Recap of last week

Last edition of my weekly plan, I called out my timezone for an intermediate bottom for Monday-Wednesday.

The market bottomed on September 11 as we all know.

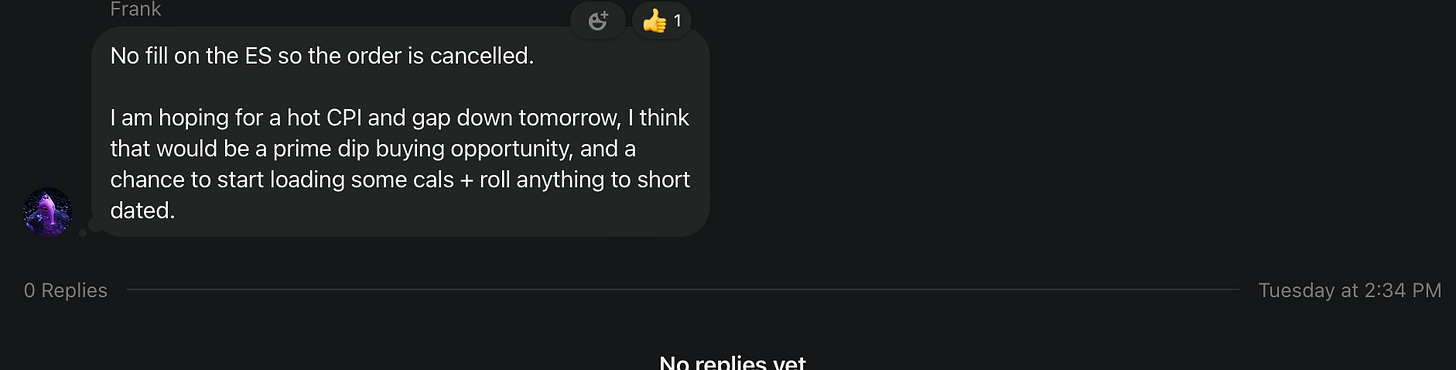

On top of that my CPI indicators worked again, as they have all year. After 5 consecutive misses, my proprietary signals alluded to a hot print. That was indeed the case and once again we had the jump on the market.

I also said if CPI came in hot (like I predicted it would) it would be a prime dip buying opportunity.

Last but certainly not least, when CPI did come in hot as we predicted, and the market did sell off as we predicted, I sent out a live update while the market was puking violently, at around 5420 ES that it was indeed time to buy.

Nothing in hindsight, no wishy-washy maybe market goes up maybe market does down bullshit. I said CPI dippy, then buy the dip and market go rippy.

Those calls closed at 14.52. If you bought a 0DTE when I sent the alert they were 50 baggers.

Great week for us and we are completely dialled in as we enter the most important and volatile part of the year. We had a buy signal the DAY the market bottomed in April, the DAY the market bottomed in August as well so although a great week this is nothing new for us. Next week is massive as Powell looms very large with an option to go 25bps or 50bps to being this highly anticipated cutting cycle.

Next move for markets