Recap of last weeks action:

We crushed it last week.

The market opened at 4190 SPX, where we loaded puts, and proceeded to sell down to 85 pts in only 2 days with a massive volatility spike.

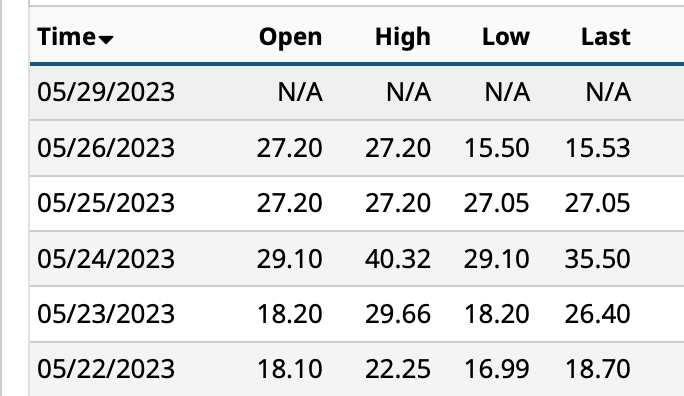

If you bought puts at NY market open, they were 18.10. They soared to 40.32 a mere 2 days later for over a 200% return, on monthly puts. This was the only trade I recommended. I am not someone who will recommend 10 different trades a week, throwing shit at the wall and seeing what sticks. If you do that you are bound to see massive winners, as long with massive losers. I am like a sniper, I am waiting, watching, for hours and hours before I pull the trigger. For me a high hit rate is important, minimizing losses, minimizing tilt, swinging only on the fat pitches. I wont bombard you with a million trades, only really high quality ones, with high success ratios and asymmetric rewards to the upside. I preach this all the time, the fastest, most efficient way to take your P/L to the next level, is not to find a better edge, or bigger winners, but simply eliminating dumb trades that kill your profit, and put you on tilt.

One trade idea, 100% hit rate, 200% return. No bullshit.

Mid-week, I turned bullish after NVDA earnings. The market proceeded to rally 100 points from my tweet, with almost 0 drawdown.

No flip flop bullshit, no 100 different trades, no bear under XX bull under XX Fugazi. Just crystal clear bias, that is right most of the time. That’s what I try and offer my followers. Onto next week now.

Next move for markets?