Recap of last week

Last week we took three trades, all three were winners. No losing trades for over a month and counting.

We said fade the inflation hysteria, and went short puts long call spreads into CPI which was a big winner.

Then on Friday morning we saw the fat pitch on the horizon and went short 5966 and 5976.

The high of the day, which was also the high of the week? 5977.50.

As of SPY AH prices, that short is already 100 points in the money. My thoughts on the credit downgrade and how that changes my view on markets below.

Next move for markets

Down. As you guys know, I set my limit sell orders at 9am Friday morning. The Moodys downgrade wasn’t until after the market close. Meaning I think this market was set for a selloff even before the news. People are now arguing is this not really news, or is this something more sinister brewing. I think even if it didn’t occur, you would have seen the markets retrace a bit here. One thing we can all agree on, this definitely isn’t good news. It comes at a pretty crucial juncture, at a specific time and price, that is frankly speaking just not good for bulls.

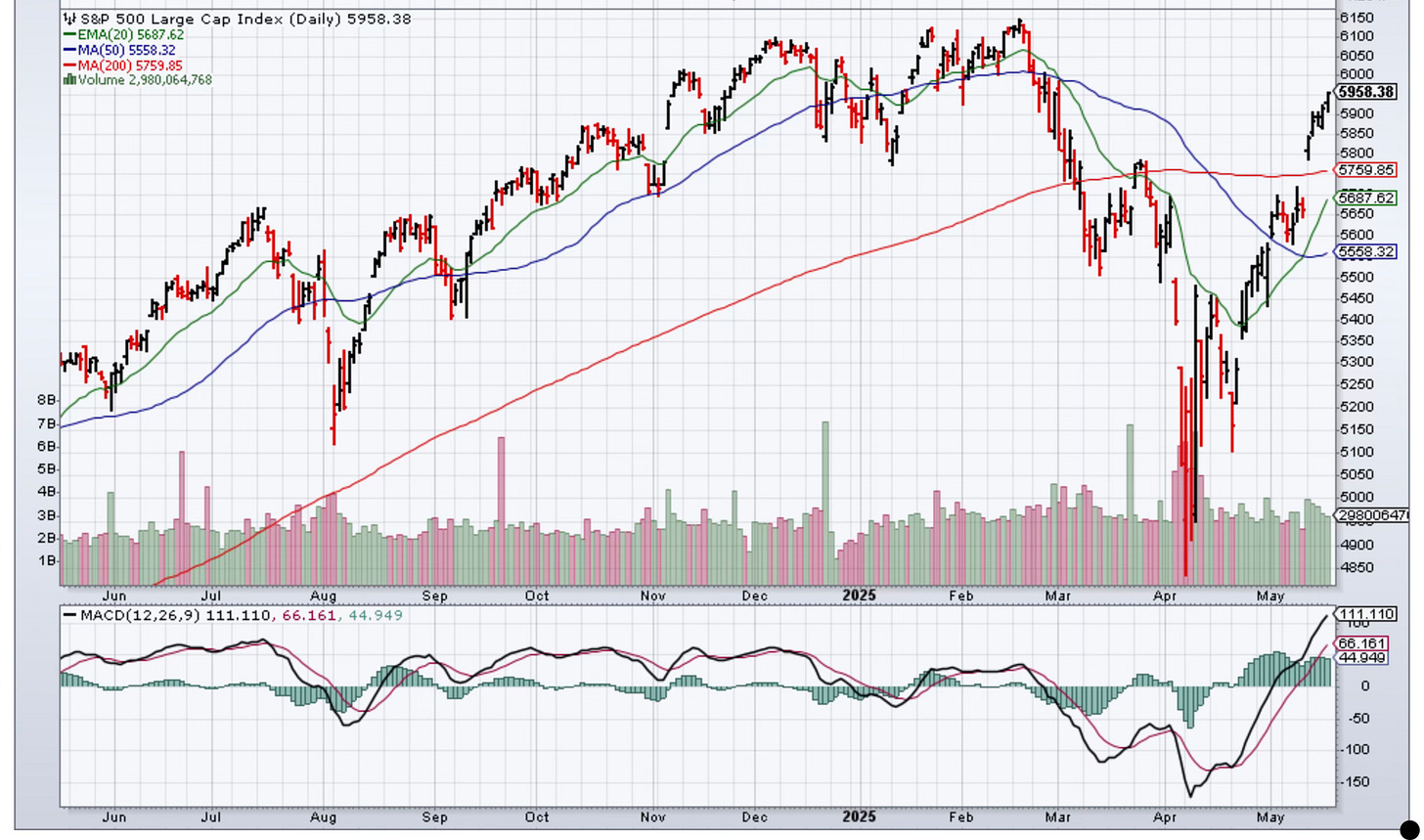

This good old fashioned tape bomb is happening at the tail end of a huge up week of the SPX. We saw many big gap ups in the recent past, including the monster weekend gap. This results in a weaker micro structure for the market, which becomes especially vulnerable given the recent news. The market is also stretched by almost every metric (RSI, MACD, deviation from xMA). When the market is stretched and overbought like this, really any catalyst can trigger a trend reversal and the news itself matters very little.

The way the news dropped (After market close) was just savage. The is very little liquidity at that time of day, and I am sure many big traders and money managers were already at happy hour on their 4th beer at that time on Friday. I was just coming back from the golf course and actually had no idea the downgrade happened until about 6pm ET. The point is here, when that news dropped there was no way to effectively hedge. You couldnt buy SPY puts, or VIX calls, or even hedge via futures. As you can see above, P/C ratio was at YTD lows. The crowd is loaded to the gills with calls. Another thing that is important is this is coming in the middle of the month. You tend to see hedgers active closer to the beginning of the month as that is when the big economic prints come (NFP, ISM, CPI) and the middle/end of the month is alot more quiet in terms of economic data. So this news comes right when the crowd is most vulnerable and broadly speaking swimming naked.

Now onto the credit downgrade. Bulls (who are in short term calls) are saying it doesn’t matter obviously. I can see their reasoning, Moodys is simply falling into line with the S&P/Fitch earlier downgrades. But the bond market is saying something different. We are hanging around the 5% level, which has been major support in the past. If you look at the picture above, these are huge levels. And if you look closely on the X axis, this chart goes back 20 years. It is not a YTD chart. These are 20 year highs in yields. This has been really concerning to be honest. Considering CPI and PPI came in stone cold. Again. And yet yields are in the danger zone. Its trading 101, when a resistance/support gets tested more than once, it becomes weaker with each test. We are also not seeing strong rejections near 5% but something closer to acceptance. Its widely accepted that the economic data is not yet showing the effects of the tariffs yet. So when inflation is missing across the board and yet yields look like they are about to blow out, what happens if we get a couple hot prints? It will get ugly fast.

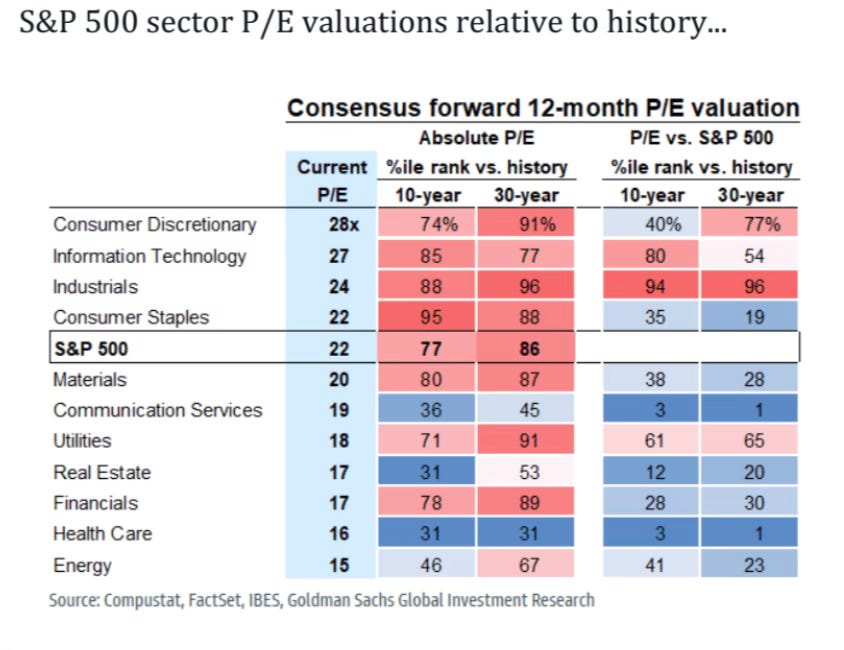

The Moody’s downgrade also happens just as Trump is trying to push his “Big beautiful bill” through Congress. The bill, unsurprisingly, extends the TJCA and adds things like no tax on tips as he promised in his campaign. All said, the bill is set to add another 3-4 trillion to the deficit in the coming years. If the bill isn’t passed or its delayed, stocks will revolt. The tax cuts rolling off would decimate corporate margins just as they have to deal with the reality of tariffs. If the bill is passed, bonds revolt. Because its more reckless fiscal spending, importantly, with no end in sight. Biden spent like recklessly, and Trump looks to be doing the same. That is one true bipartisan thing it seems, spend with literally no regard to the deficit. Its really difficult to see how things are going to change in the near future. And so the Moodys downgrade is really a wake up call, again. Now, how long until the S&P/Fitch downgrade US credit again? All these things are happening at the tail end of a 20% rally off the lows in the S&P, all the while it sports an extremely rich 22x P/E. You can see my apprehensiveness for taking on risk at this point.

Right now, you are paying an extremely rich valuation for equities. Period. Then you must account for the fact that, in the BEST case scenario, the effects of the tariffs will be UNKNOWN. Thats the best case scenario. The worst case is recession and inflation roaring back. You also have the treasuries market flashing code red and near very very dangerous levels. 22x PE when everything is copacetic and there are no immediate risks on the horizon is already rich on its own. Given all these known unknowns (tariffs, bond market stress), and the short term very overbought nature of the markets, I am biased short for now.

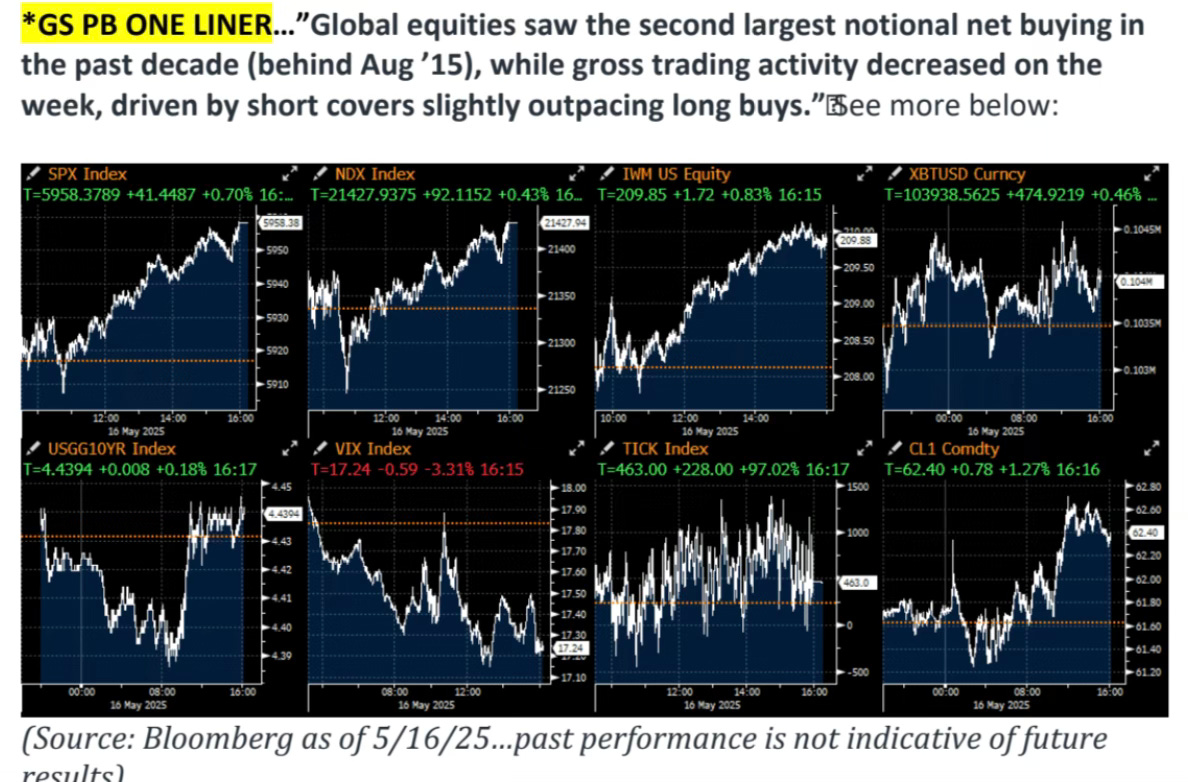

It just so happens this tape bomb comes on the heels of one of the biggest short coverings, FOMO events we have seen in a decade. Just as bears couldnt take any more pain, and tapped out, we start to see the beginning of an actual pullback. The market tends to rally after all bulls have given up, and tends to selloff after all bears have given up. Just how it works. There are alot of new longs that were stopped-in recently, and are now long at unfavorable prices. If the market turns quickly all these people will be underwater fast, and are prone to panic selling. This is on top of a very weak market structure with alot of low volume gaps and such that may mean market has trouble finding adequate support in the near term.

A look at hedge fund PB data tells an interesting story. If you have been following along every week you know HFs have been stubbornly staying out of what they deem a “bear market rally”, until last week. They couldnt take the pain anymore and covered their shorts. They got stopped in. Largest net buying since December 2021, four years ago. Interestingly enough right before the market topped and went into a bear market. One thing to monitor is gross leverage is dangerously high. They are susceptible to a quick de-gross if things get volatile. It would truly be a shame if the market finally turned back down just as hedge funds bought back into the market after staying out for months.

Everyone who wanted no piece of the market in the low 5000s, suddenly loves stocks at 5900. Buyers long at unfavourable prices + weak market structure = elevated selloff risk.

Everyone hates puts again. NDX p/c skew at YTD lows. Getting into rare territory. I mean why buy puts when the market will never go down again, right?

To sum up, I lean bearish this week. I was bearish and short ES before the Moodys downgrade, that happening was just a nice bonus. The market was/is overbought by almost every metric. The structure below is very weak, filled with many gaps. The deviation from the 20DMA is close to 6%. The credit downgrade tape bomb happens after hours when badly positioned bulls have no way to hedge their long exposure. The last 200 points is composed largely of FOMOers who got stopped in and will be running over each other to see who can panic sell the fastest. No one has any puts on, and have hedged their calls with more calls. Short term the positioning is very stretched, and at 22x PE with the tariff uncertainty persisting and the bond market in the danger zone there is very little fundamentals supporting this FOMO rally at this current time and price. There will be better opportunities to buy.

Trade Ideas.

Remain short from 5970s in ES.