Recap of last week

We started February extremely hot, with a huge short the day before CPI, and never let up. We closed out the month with another monster week. Banked 100+pts again on ES as well as scored on both options plays given.

Let’s start with the ES long. We bid 5068.

5068 is that blue line. Need I say more?

As usual I gave specific daily updates on entries/exits in the chat which you can see on my Twitter, I won’t waste time reposting them here.

I started my Substack as an anti-Substack of sorts. I wanted to write a publication that was the exact opposite of what the usual grifters on Twitter put out. I do not hide behind conditional, vague statements. I do not bother with the bullshit of if/then, maybe, “bulls in control”, “bears in control”, nonsense.

I will tell you. I think the market is going up. Or I think the market is going down. I won’t always be right, but you will know which way I am leaning, where I am buying, and where I am selling. There’s no ambiguity, no snake oil for sale here.

None of that “below 5080 we might test 5030”, “above 5080 bulls may make a further upside excursion”. What is that? People who are intentionally vague like that have to be to maintain a degree of plausible deniability because they have no confidence in the market calls they are making.

The market is rarely as wishy-washy. In fact I would say it is pretty damn determined on going which ever way its going, and leaves very clear signs. To those that can actually identify them, anyways.

An update on my positions below, as we look forward to another packed week headlined by Mr Powell.

Next move for markets

Up. Last week played out exactly as I expected, and I expect my price target of SPX 5170-5200 to be reached in the next week or so. We got the consolidation and small retracement which helped strengthen this current uptrend, as market found demand at lower levels.

The main chart that captured my attention this week was SMH - semiconductors. This is the undisputed leader of this rally from the October lows, as semis have been the sector of the market that has seen the immediate benefit of the ferocious AI spend corporates are unleashing. SMH put in a massive bull candle on Friday, closing on new highs, as well as at the high of the day. SPX and NQ have been following their trend for quite some time, and I don’t expect that to change anytime soon. It’s hard to be bearish when SPX just closed at ATH, and the leading sector put in such a massive bull candle like that. Of course, how can we talk about semis without talking about Nvidia.

Nvidia also opened with a gap up on Friday, I called out the May 17 800/1000 call spreads. I think it may be ready to run now as it closed over the pesky 800 resistance level, and we have two catalysts upcoming. One, the Morgan Stanley TMT conference on March 4, and the annual GTC event March 18-21 where NVDA generally announces new products and releases.

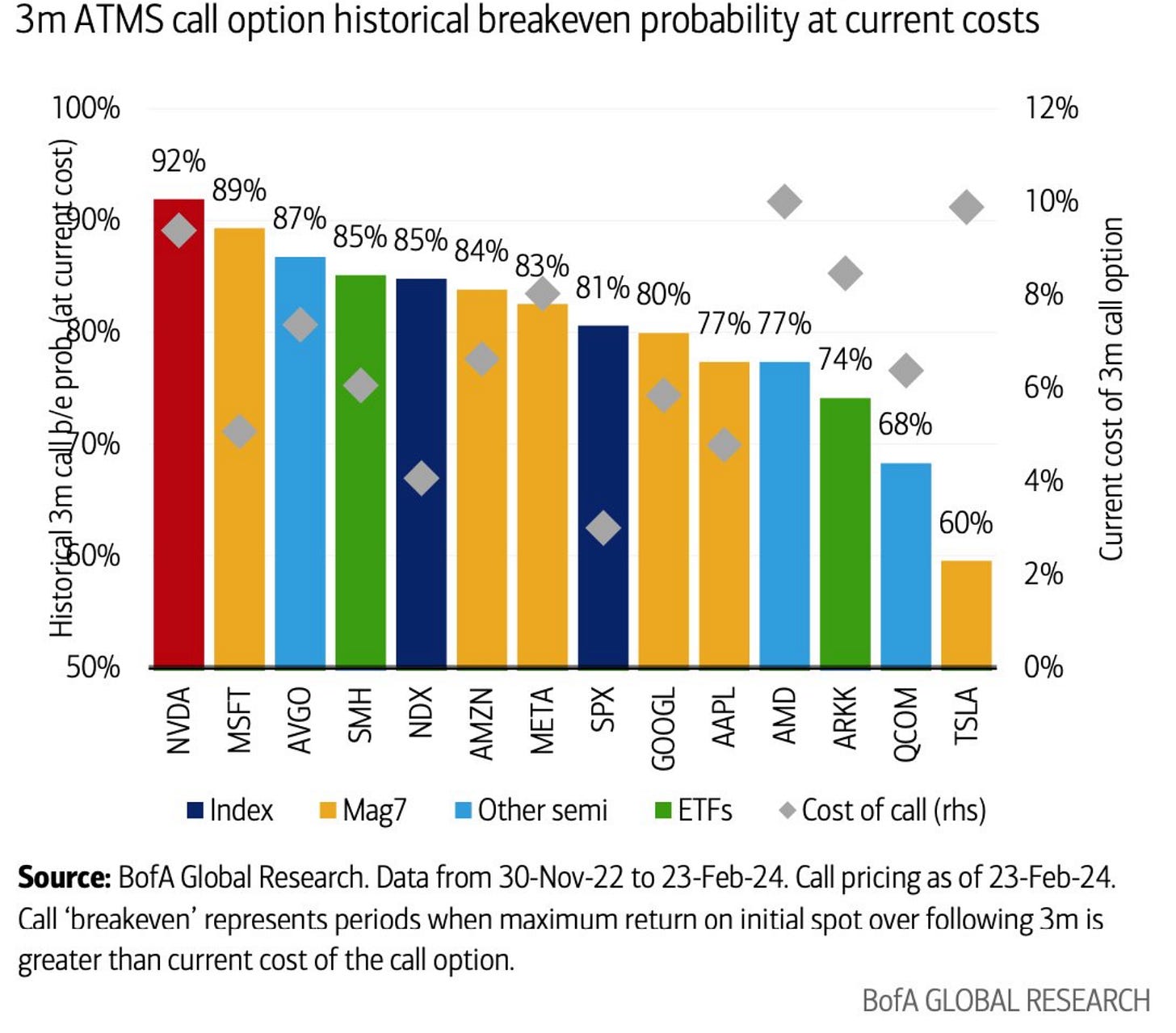

BofA has come out with this great chart showing you how easy it has been to make money buying calls on NVDA. I think Friday was a great entry too, and with SPX making new highs this trade is looking really good to me right now. Again, when the market gives out easy points, like buying calls on NVDA or buying 5068 last week, I am all over that. I love that. There are no brownie points for taking hard trades. Trading is about making as much money as possible. Plain and simple. Your P/L is everything. So when you identify an easy trade, don’t be shy about it.

Generally these conferences are bullish as the speakers are all there to announce exciting new developments and tout all the benefits of the major changes their technology will bring. It has much less risk of downside as an earnings call might have for instance, as there are no material financial disclosures. It is also worth mentioning there will be many other companies presenting at this conference so its quite bullish the broad market I would say.

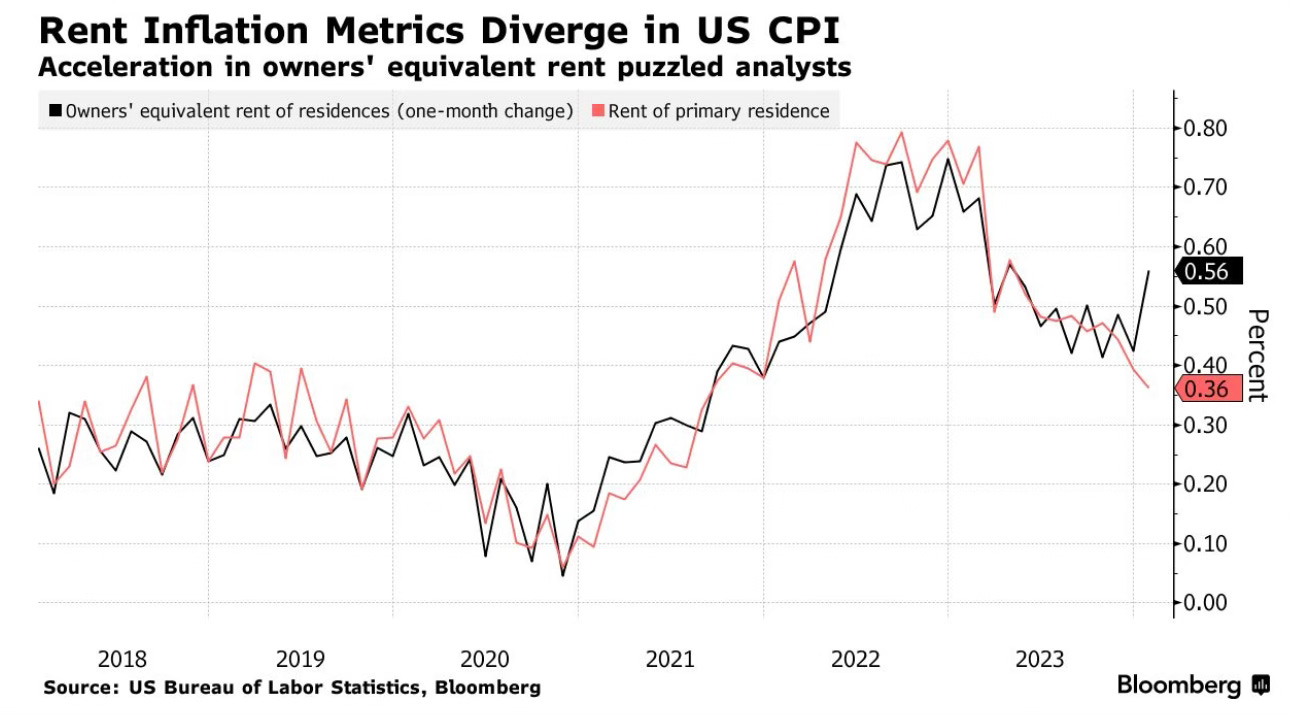

Last week we also got some welcome news about inflation. The last two CPI prints were quite rough, so I think everyone breathed a sign of relief at PCE coming in as expected. But maybe more notable, was this email the BLS sent out regarding the past January (released in Feb) CPI print. They alluded to the fact that a large reason for the upside surprise was due to a new calculation of OER.

The quote is from Bloomberg. That alleviates some concerns about the resurgence of inflation, as bulls naturally think the print was an outlier due to the weighting increase. I think it also alludes to the fact that the weighting could possible by adjusted again in the future, and possibly taking away some significance of a more inflationary component of the CPI.

I think this update sent out by the BLS, as well as the as-expectations PCE will be a boost to near term bullish flows and sentiment. At least until the March 12 CPI which will provide more clarity on the trajectory of near-term inflation. That is the major risk we have upcoming, but it isn’t for another 10 days. So plenty of time for SPX to log another 1 or 2 all time highs.

Another major market development I want to draw your attention to is Christopher Waller’s comments on Friday. Waller hinted heavily as the Fed injecting additional liquidity into the financial system, in a move that could be interpreted as a cousin to QE (quantitative easing).

Essentially, he is floating the idea that the Fed will start to lean more towards buying more shorter-dated Treasuries. Coincidentally (not really), the Treasury and Yellen have been materially increasing issuance on the shorter-dated bills to help the market digest the recent slate massive issuance during the Biden administration.

This is yet another whisper into the market’s ear, that the Fed has got your back. It’s now a well documented Pavlovian response for markets, when the Fed implies it will support the market, we rally. Waller is also known as being a very credible voice within the Fed, and he is not sensationalist in his comments. Not too dovish, not too hawkish. The market listens when he talks.

Although it certainly doesn’t feel like it, February is generally a bearish month for equities. Having such immense strength during weak seasonality is always a tell-tale sign of a strong uptrend. Seasonals in March especially in the first half are nothing to write home about, but just exiting the back of of February will be a nice removal of some bearish overhang. Markets also had quite a large amount of equities for sale as part of funds rebalancing their 60/40 type portfolios. That is all done now.

On the systematics side, market participants are very long. However that is not a bearish signal in and of itself. We have seen in recent history, such as 2021, that there can be even broader participation. Worth having a look at.

So to sum up, my intermediate bullish view and price target of SPX 5170-5200 has not changed and only grown stronger since I adopted it last week. The market further confirmed this with a close at new highs on Friday. The overall inflation picture looked a bit rosier last week as PCE merely met expectations after solid beats on CPI/PPI the previous weeks. BLS also alleviated some concerns, highlighting potential overweighting in a particularly inflationary segment of the CPI basket. Governor Waller stoked the bullish flames with comments alluding to future liquidity injections synergizing nicely with the latest Treasury funding policies. We have the strongest sector in the market, SMH and the AI basket leading the way again with a huge bullish candle on Friday. NVDA closed at new highs, with a big technology conference upcoming on March 4 where we will all hear about how great and life changing AI will be. Last but certainly not least, SPX closed at new all time highs which usually portends further gains.

Trade Ideas

Still long 50% of my SPX 5100 calls.

Still long full position of NVDA May 17 800/1000 call spreads.

Will look to enter again on ES, will update in the chat.

Haha no I meant I won’t bother reposting all the winning trades cause you can see them all on Twitter