**Quick housekeeping note, will no longer be opening up my previous plans to free subscribers. I have the free trial enabled (1 week) for people unsure of the value they are getting. Also, all my current subscribers will never be affected by future price hikes (provided they don’t resubscribe) as they will be grandfathered in at the old price. This blog is just a hobby for me, trading is my passion and my bread & butter, I only ever wanted a couple hundred subscribers and as I approach that number the blog will become more exclusive.**

Recap of last weeks action:

Last weeks plan was absolutely spot on. We sold off during the Sunday Asian/European session, about 80 points, before a massive 170 pt bounce into the FOMC meeting.

I also mentioned that I would become short biased post-FOMC and that was also the right call. It didn’t reach my target price to get short, but if you followed that plan you should not have been long at least!

Now reviewing last weeks “Trade Ideas”. 3 trades given, 2 big winners, 1 neutral.

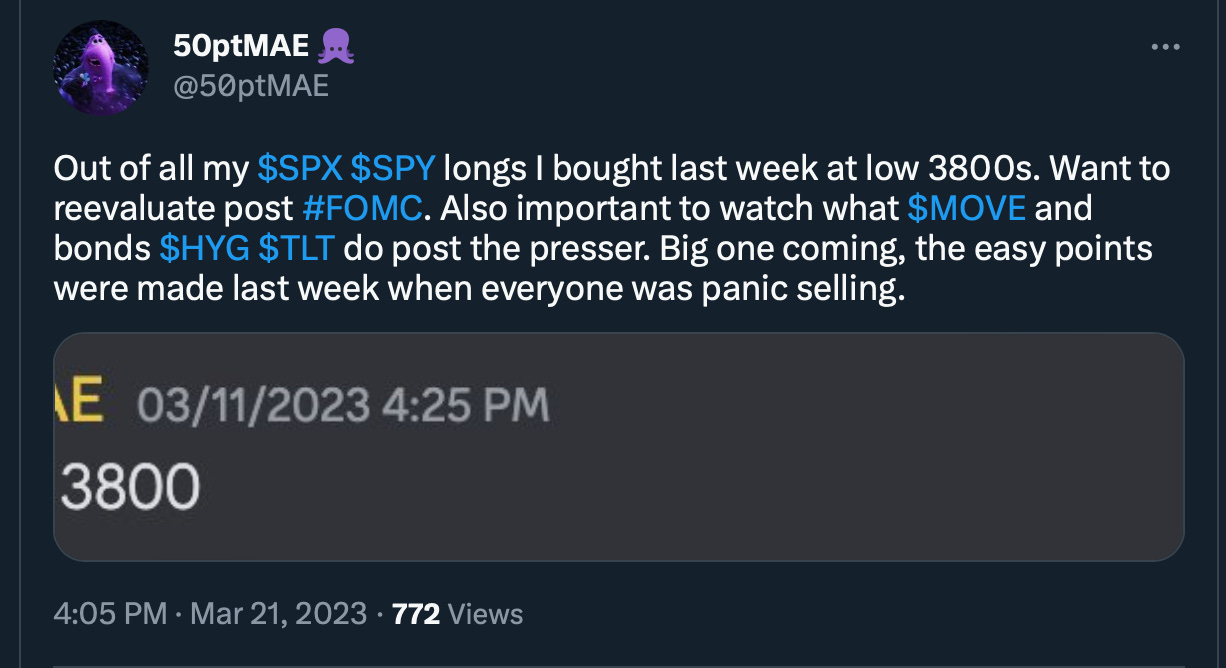

Low on SPX was about 3860 during the overnight session. We touched about 4020 on Wednesday. You can never catch the entirety of the whole move but if you can consistently bag about 30-70% that is still a massive winner. Calls were extremely profitable too as the move happened in an extremely short period of time so no major theta decay occurred. I also warned in my weekly post that after FOMC I would become short biased. I even tweeted about it to really drive the point home. What followed shortly after was a 100+ pt drop.

Nothing to report here. I am still long XLF and it is just hanging out at these levels.

Another massive winner. OXY rallied from 58.50 from Monday open to 60.60 on Tuesday morning. About a 3.5% move in 24 hours. Hopefully you took profit on Wednesday when I warned. You should never let a green options trade go red. I am ok with sometimes having a long stock position oscillate from green/red but with options never. They are too inherently volatile with the mechanics of delta/gamma/theta affecting it dynamically so I take profit when I can and set stops in profit. It takes years to really fully grasp the nuances of option trading which is why I dont recommend them often to new traders and only suggest taking them if you know how to acitvely manage the trade.

Next move for markets?