Recap of last week

Another winning week.

To start the week off, we got long into CPI with SPY calls. That was the only 1% move of the entire week. I think the important part to really take from this is we actually have a system regarding trading these events. There were plenty of people who got long into the event, but there is a difference between having a feeling, or going off a hunch, compared to utilizing a consistent and rigorous process that is based on data. If you are trading of hunches and your competitors are trading off data, you are destined to lose. Pretty simple.

That same day, we got leveraged long NVDA at 10:17 AM. NVDA went on to have a monster 7% up day. The week was already made by Tuesday.

For good measure, we finished the week off with a short Thursday evening. Friday was the biggest down day of the entire week, down 65 bps. You don’t see me flip flopping, giving a hundred different scenarios. I do not hide behind ambiguity.

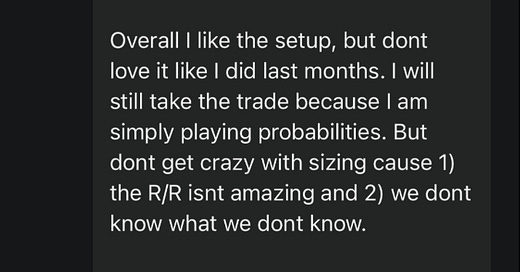

We closed out all of our shorts at ES 5175 from our entry around 5220. NVDA GTC is Monday and we all know what happened last time market sold off into the day Jensen was speaking. Is this time different?

Keep reading with a 7-day free trial

Subscribe to $SPX Trading Bible to keep reading this post and get 7 days of free access to the full post archives.