Recap of last weeks action:

Big big week last week with lots of new information coming into the market. Lets start with a quick review.

Right off the bat on Sunday night I had a bullish bias. Sure enough we traded about 40 points higher into 4080 early on Mondays session. Market showing initiative from buyers as the test of the 200DMA brought in a lot of patient buyers. Then at around 4075 on ES 0.00%↑ I warned my followers that I had sold all my longs. I didn’t like the risk of holding into Powell, especially after a large rally.

This pretty much was the top, and market proceeded to sell off massively in a straight line from then.

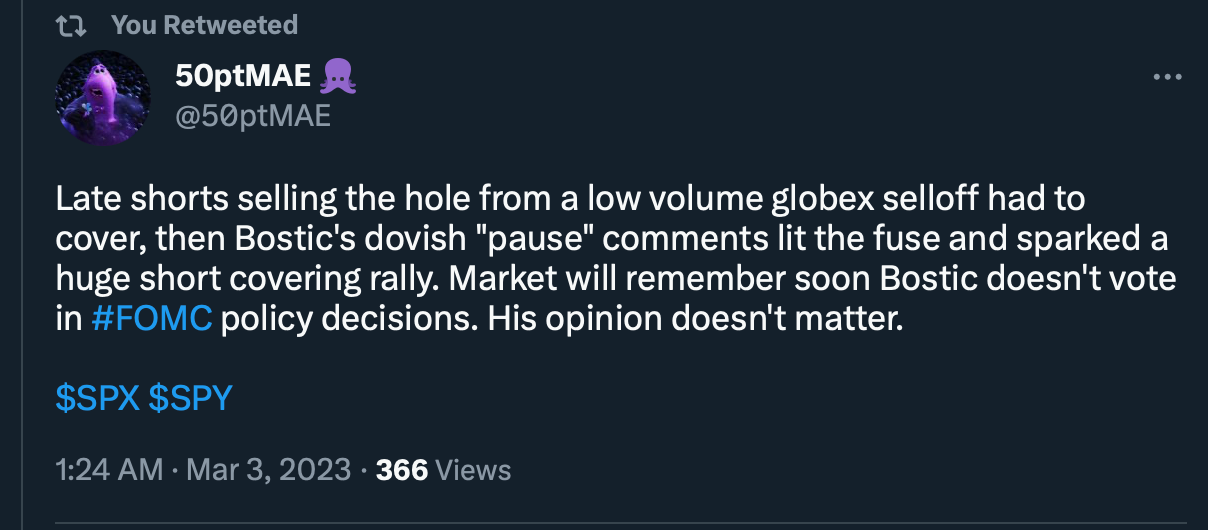

I had theorized we would see a much more hawkish Powell. After the screaming hot PCE inflation he had to come out significantly more hawkish, preaching higher for longer terminal rates and reiterated the Fed’s number one mission to crush inflation and to stay the job with a restrictive monetary policy until the job is done. After a 160 pt rally from my 3920 level, the market was prone to a large sell off as well, and Powell was just the impetus the market needed. I also warned this was not a sustainable rally, but a short-covering led one, which tends to weaken the market not strengthen it. When a short covering rally occurs, markets are losing potential future buyers (shorts that have to cover by buying futures) because they already bought. The potential buyers turn to potential sellers, which just then needs a spark for a selloff.

Lastly we had #NFP to wrap up the week. We had the big SIVB 0.00%↑ blowout which i will touch on in just a moment as well. We had traded down into 3890 on NFP and bank failure fears, when I sent this tweet.

That pretty much marked the low of the night and morning session, with the $SPX bouncing over 50 pts, trading over 3940 on ES 0.00%↑ after the print and if you took call spreads like I recommended you had a nice multibagger win to end the week.

Now this was a really tough week to trade, with Powell, big economic data (NFP), and to top it off a big tape bomb from SIVB 0.00%↑ for the cherry on top. If you were following me on Twitter you should have had a profitable week, when most people were getting blown up.

Just a reminder to my followers, as we enter the last stages of this bear market and tightening cycle, when tape bombs like the SIVB failure hit the tape, throw all your plans out the window. Huge events like that take some time to filter through the system and changes the market structure signicantly and you often need to step aside to clear your head rather than jumping into another trade or stubbornly sticking to your plan.

Next move for markets?

Down. This selloff has everything to do with the SVB failure, bringing back markets’ past trauma in the Great Financial Crisis. There is significant fear in the markets right now.

Image A: 9 day VIX curve showing extreme stress. Highest since October of 2022.

This is an ugly moment for the banking industry, having the 16th largest bank in the US essentially fail overnight. Although it may not be as bad as it seems. I am not an expert on the subject but from what I understand this is what happened. Seems as though this failure was caused by a bank run, whether intentionally or unintentionally. A lot of big venture capital players such as Peter Thiel, when they caught whiff of SVB’s liquidity issues, urged all of their startups they were backing to withdraw all of their funds. Many across the entire technology industry did the same. Customers pulled out $42B out of their collective accounts in a matter of days. This snowballed and essentially became a self fulfilling prophecy, as Silicon Valley is a small place and you had the majority of an entire industry all pull their funds out at once and make a mad dash to the exit.

Now the fallout. A lot of startups and mid sized companies (such as $ROKU, ETSY 0.00%↑ ) had signicant amounts of capital tied up in SVB. These companies may not be able to make payroll in some cases. This freezing of liquidity may adversely affect business operations in some cases. This is an evolving scenario at this point and will take some time for the market to digest.

With that being said, I don’t want to get too beared up. On one hand, this is the 16th largest bank in the US, on the other hand this is the 16th largest bank in the US. This is not JPMorgan, this is not BofA, this is not Lehman Brothers. This is some of the markets past trauma coming back to haunt it. Policymakers and the Federal Reserve overhauled the entire banking industry after 2008, significantly increasing reserve requirements and capping the massive leverage that was used among many other things. That is beyond the scope of this blog. The Fed has put all the big banks under stress testing for this exact environment of 5-6% rates. The big banks are not a systemic risk as they were in 2008. And you are starting to see some of this reflected in the price action here.

Image B: JPM 0.00%↑ green on a day when almost everything is selling off.

What we will likely see in the immediate future is more pressure on the smaller, more regional banks which I will use KRE 0.00%↑ as a proxy and they will move to safer mega institutions such as JPMorgan. At first, in early stages of panic you see implied correlations all move to 1. As the emotional selling subsides, you will see market start to pick winners and losers. This move ultimately strengthens the big banks which have the biggest weight in the S&P which is what we are focused on here.

To sum up, I do think this is a dip to buy. There may be another leg down or two, some more bodies to float to the surface. The key here is this bank failure was largely caused or ignited by exogenous factors. Which was a coordinated bank run by big VC and tech players in the Silicon Valley community. You can debate the motivations if you want but it doesn’t really matter why it happened just that it did. The JPMorgans, Citibanks, BofA’s are just not vulnerable to this scenario, and to reiterate, this failure of SVB ultimately makes the big boys even stronger.

Let’s not forget S&P 500 is a cap weighted index. If you take my thesis to be true, that this is isolated to primarily smaller more regional banks, they cannot cause a much larger swoon in the $SPX than what already occurred. So in the short-medium term I am looking to buy the dip here. In the longer term, trouble is brewing though. Cracks are starting to show underneath the surface, as we see the effects of higher rates starting to ripple through the real economy. Monetary policy moves with a significant lag, a reminder that just 1 year ago, Fed Funds rate was at 0! Crazy to think now we are knocking on 5-6%. To that point, I must share this amazing chart from BofA.

Image C: Every Fed tightening cycle leads to something breaking.

The most dangerous phrase in markets. “This time it’s different”. This is the fastest tightening cycle in HISTORY. So I doubt this time will be any different.

Image D: Fastest tightening cycle in history.

There is a lot of pressure building in the system now, and with inflation not really abating I think we are headed for a hard landing. Although unfortunately we can’t trade macro, we have to trade price. I think there may be a major credit event that ultimately marks the end of this bear market, as it will spur the Fed to stop tightening out of necessity. But I don’t think this is it. I will look to enter longs soon.

Image E: Volatility of $VIX is something I watch for short term bottoms. As people buy $VIX calls to hedge, that invokes a natural reflexivity in markets, supporting any further downside.

Image F: XLF 0.00%↑ financials sector due for a bounce here. Super extended past all MAs, multiple SD (standard deviation) move. JPM 0.00%↑ maybe leading the pack here?

On CPI day:

To be honest there’s not really much to write here. If the number is hotter than expected that’s bearish and if cooler then that’s bullish. We all know that. Just a reminder to risk off your short term trades here before the date of course. A reminder that a large unexpected move to either side you may need to step aside and let things shake out a bit. PCE was much hotter than expected so I would be very cautious here as well. But I would never recommend shorting before the event. The market makers jack up the vol on options so you need a much larger than expected move to really profit. There’s too much risk, for a medium sized reward which doesn’t work for me. The risk is undefined which is a dealbreaker for me to enter a trade. Will be updated more on Twitter this week as this is an especially dynamic week to trade so the situation is very fluid.

Trade ideas:

I want to accumulate longs between 3750/3800. Either $SPY, QQQ 0.00%↑ or the leveraged counterparts such as SPXL 0.00%↑ and $TQQQ.

I want to long XLF 0.00%↑ at around 31-32. As mentioned above, I think there will be winners of this fallout, as capital flees to the safer more secure megabanks with much more assets and liquidity.

Lastly, please remember this is a developing, dynamic situation. If more news hits the tape be ready to adjust/pivot on the fly and change your thesis if necessary. For more frequent updates and smaller day trades I mainly post on Twitter.

Until next week, happy trading!