Week of March 10

Once the crowd capitulates and gives up, the market will stage a breathtaking rally

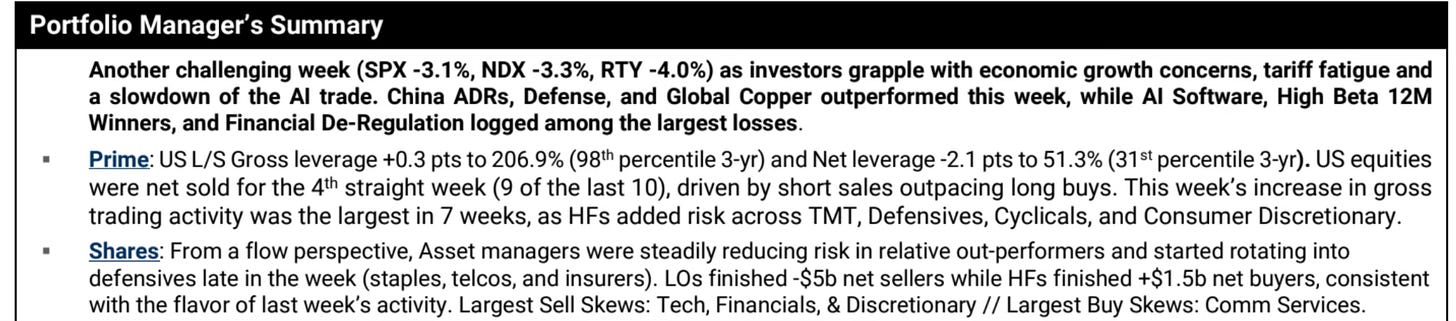

Recap of last week

The pain continues.

The Nasdaq is now off to its worst start since 2022, when it plunged into a deep bear market. Hedge fund leveraged cratered again to 51.3% net exposure which is in the 31st percentile on a 3 year look back. LOs continue to puke equities although notably HFs after large net selling since the turn of the year, finished slight net buyers this week.

It is absolute blood in the streets for hedge funds right now. Pretty much all major hedge funds were crowded into the same momo trade (read: Mag 7) and of course as we all know Mag 7 is collectively down about 15% off the December highs.

You have stalwarts like Citadel, Millennium, Jane street with their Harvard and MIT PhDs just getting steamrolled all month. This month wiped out alot of traders and alot of funds.

Time to the hell out of the market or buy the dip?

Next move for markets

Up. This is not the time to capitulate. Market has a way of finding its way to the place where it hurts the most people. We are deep into that point right now. It really is a game of inches. If you hold on to your longs a fraction of time longer than the next guy it could be the difference between making a ton of money and getting completely wiped out. Right now we are all going through it. Unless you are net short all the time (in which case you probably have a very small portfolio) you are probably long stocks in some way shape or form and are getting hit. The market dips on average -10% in any given year, and in each case there are very good reasons why investors are selling, but most of the time the market does end up recovering to new highs. Alternatively, the market could keep on plunging and we see our 3rd bear market in 5 years.

Fortunately, I dont think we need to answer that question yet, as contrary to what many people believe the strongest rallies and uptrends (though short lived) occur in bear markets. I believe that whether we see new highs, or a bear market, the market will bounce very fast and hard, and soon.

As I stated the past couple of weeks, I have soured on the risk/reward of US equities. It is not about predicting a bear market, but more about weighing the probabilities of a big up year in stocks, vs a big down year. And also evaluating how your capital will be treated if deployed elsewhere. Namely international stocks and/or bonds. To be clear, I will be making big changes in my portfolio to shift away from US equities. But not now. I do not think this is a good time to exit. If you sell your US stocks/options right now, you would be doing what they call “buy high, sell low”. If we want to make money, we must do the opposite. Why doesn’t everyone buy low sell high, then? Because every time the opportunity arises, there is an endless supply of fear, uncertainty and doubt echoing from every corner of the world telling you why you shouldn't but the dip. You must fight the temptation of succumbing to the FUD, and I am here to show you why the market is likely to bounce, backed by hard data.

I will begin with hedge funds. Hedge funds were very OW Mag 7 and through this whole ordeal have been liquidating and puking their exposure non stop as their models did not predict the possibility of a 15% drawdown in mega cap names in only a couple of months. Simple explanation of gross/nets/LS ratio is gross is total exposure to the market (Shorts AND longs), net is (net long exposure), and L/S ratio is long exposure divided by short exposure. As you can see they are up to their gills in gross, but it is not coming from net long exposure so in other words they are heavily net short this market. Their L/S ratio is shockingly in the 0th percentile. Yes you can go lower from here, but it doesnt take a genius to figure out where the asymmetry lies. Hedge funds have very rarely been less long than they are now. They have much more room to buy here, than to sell further. They have been a big source of liquidation and capitulation throughout this whole mess, and simply put once you sell your longs, you cannot sell them again unless you want to double or triple down on your shorts I guess. I think if you summed up this section would be, do you really think they are going to press gross exposure further past the 99th percentile and reduce longs past the 0th percentile? They are already at extremes on either end here. I think the bet here is on some mean reversion, and the flows last week point to that as well, as they have turned net buyers last week.

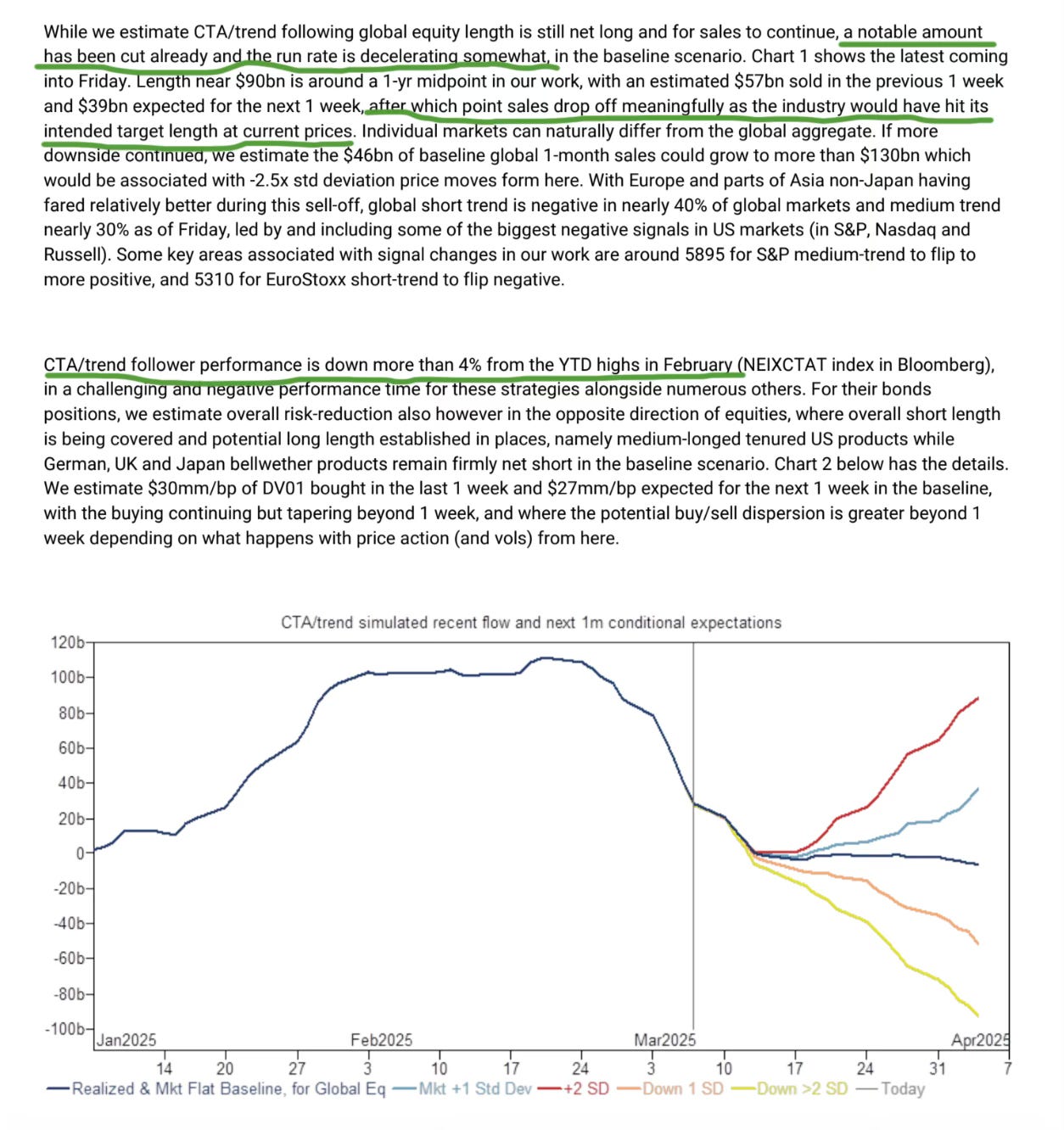

Alongside the HFs blowing up in February, we have CTAs adding to the liquidation. GS has CTAs as an aggregate down 4% from its YTD highs in February. They were a key catalyst in sparking such a rapid selloff in the indexes. However the worst of the flow is over, and this is a really key cohort to watch because they are constantly toggling in between buying and selling. Everything they sold here recently, they WILL have to buy back higher if we can reclaim some key CTA triggers. This is important because alot of buyers are willingly stepping out of the market right now due to any number of things (Trump, tariffs, growth scares etc) while this is a group that is purely a systematic/trend following strategy who will buy come hell or high water if certain price triggers are breached. If you have ever wondering, “who is going to buy the SPX when it’s at 99%tile valuation” or something of that nature, here’s your culprit. These guys buy based on price and momentum and literally nothing else comes into play for them. If Trump says he wants to send the SPX to 1000 bucks again, CTAs dont care and would buy anyways if they meet their trigger.

Now there is still significant supply over the next 1 week, so it could be another rocky week of trading, but as they say bottoming is a moment in markets so in my opinion you dont want to get too cute and try to time your exact entry based on CTA sell flows as we could easily be hundreds of points off the lows when they flip back to buy. Typically smart money front runs the end of the systematic supply by buying a bit before the flows flip to buy.

Back to our trusty vol panic index. Historically when this index reaches 9+, it has been a dynamite time to buy stocks. Is this time different? I doubt it. Last time we reached this high of a level was August 5. Did it feel like the world was ending at that time? Hell yes. Was it a good time to buy stocks. 1000%.

Everyone is panicking right now, that’s the data showing it right there. Now do you want to do what everyone else is doing (panic selling) or do you want to be contrarian and buy stocks. Nows your chance. No one said it was going to be easy.

Here we take another look at the vol market. We remain in backwardation, which historically was a great time to buy stocks. When spot VIX is trading higher than VX futures on a 3 month basis it reveals an overall rich premium to downside protection meaning market participants are over hedged and underexposed to deltas. In August, we rallied a stunning 20% off the lows made that day, and in December post FOMC we rallied about 5% off the lows. However I would say more important than that, is when we got above a 1.0 ratio the low was in within a couple of days. The vol markets had a lot of trouble remaining that rich in the front end of the curve. That deflating led to a hedge unwind and gross up of deltas.

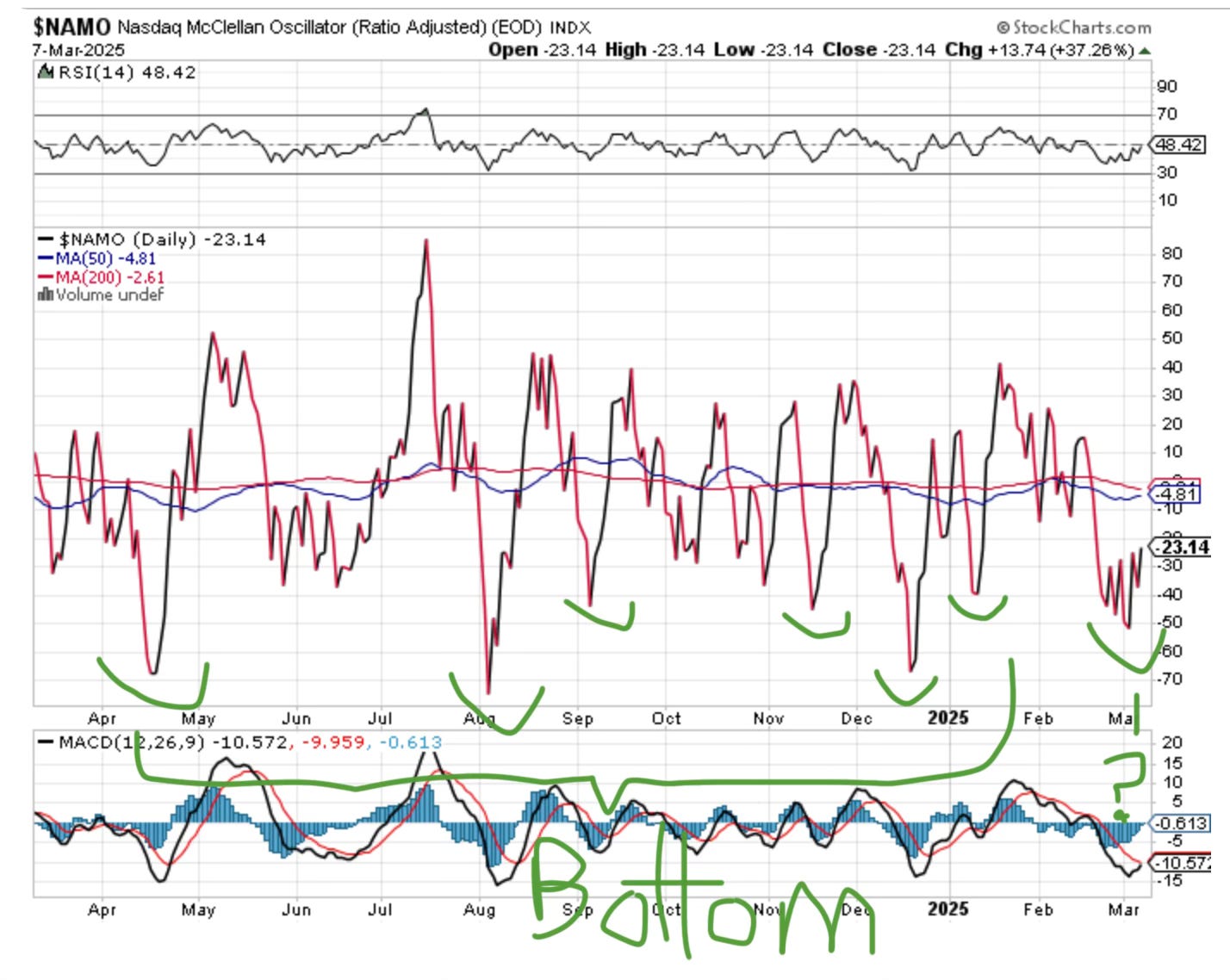

Recall last week I posted this chart of the Nasdaq McClellan oscillator. Last week it was about -50, and now it is sitting at -23. This is very encouraging. Very often you see breadth bottom first BEFORE the index. That is what you want to see. In ever case I pointed out where NAMO got below -40, it signalled a bottom in the last year. In every single case. See for yourself. Now we have seen breadth bounce big off the lows, despite making a new low in the index on Friday. That is a positive divergence. It means the mega cap techs led the last plunge lower.

As I alerted in the chat last week, MAGS (Mag 7 etf) has printed a Demark 9 buy. This is in confluence with a test and support of the 200MA. As well as nearing oversold RSI, an area where it frequently bounced. You are also starting to see MACD converge and begin to curl up. It doens’t take a rocket scientist to figure out you would rather lean long here than press shorts. These are after all the best quality companies in the entire world. Expecting them to crash into oblivion would be quite stupid, wouldn’t you agree?

So if Mag 7 is very clearly close to bottoming or already bottomed, and breadth has already turned up that is really quite encouraging for the weakest index of the year (NDX), as they will drive the SPX from here.

Of course, now market participants are getting worried about a growth scare. Is there more to that? As of now I dont think so, markets were expecting an apocalyptic payrolls number and it came in really quite strong. Another clue we have to look at is the credit markets. The bid in corporate credit remains extremely robust and its telling us the equity selloff is overdone. As you can see these two are very tightly correlated as they are both priced of corporate health and earnings, but equities tend to overshoot and undershoot. I am betting this is an undershoot here and equities will bounce back up to converge with CDX HY.

Last but not least, here GS has tracked for us the overall put option volumes and this graphic really illustrates the level of panic hedging, historically at levels which has marked major bottoms.

We are in never seen before territory of put volumes. The past week has seen levels surpassing the Yen carry trade collapse, the SVB banking crisis, 9% CPI, and the 0%-5.25% Fed hiking cycle. At this point market has absorbed these huge body blows and people have puked like crazy. Dont be a victim of extrapolation bias, thinking recent events will extrapolate indefinitely into the future.

To sum up, this has been a widespread industry liquidation in equity markets. Hedge funds, CTAs, vol control funds have all puked up massive gains and in many cases had their worst month since the 2022 bear market. There is widespread fear and outright panic in vol markets. We are at a point where the market should be finding an imminent bottom, if not already made. If you want to be a contrarian this is it. The crowd is selling, buying extremely expensive panic crash protection, and is extremely bearish equities. Hedge funds and systematics have already liquidated to a large degree, they cannot liquidate their holdings twice, although they can buy back what they sold.

If making money in the stock market was easy, everyone would do it. It is definitely not easy to buy here, on the contrary lately I have been buying it makes my stomach turn. But I know without a doubt it is the right thing to do. We will see if I am right in a month or two.

Trade Ideas

I am holding all of my longs, just entered new SPX calls for April at the end of last week. I have re entered Mag 7 after selling it all in November

There is still some CTA supply to work its way through the market this week, I am ready and willing to add to this position again closer to FOMC if it remains weak. Will alert in the chat if so.