Recap of last week

Last week we took three trades, 2 x Calls, 1 x short puts. We hit all three trades.

We were quick on the draw and well prepared last week to buy the dip. We got long on Monday, early on in the week. The SPX finished green or unchanged at the worst for each and every single day this week.

We added to our longs on Tuesday, as we knew the short term positioning meant a buy the rip situation was in play. As short term shorts were caught off guard by the velocity of the move. We finished the week 3/3, and we had no losing trades.

SPX looking very bullish, things are looking overbought now. Are we buying new highs here?

Next move for markets

Up. I prefer buying the dip of course, but sometimes the right trade is buying the rip. Last week was very significant in terms of price action. The pre Deep Seek all time high, was finally broken. This 6100 levels in fact has been giving bulls headaches since December 2024. This is an 8 month break out of resistance, so that is alot of potential energy stored and in fact if this is a true breakout, the upside is going to be a hell of a lot more than the 30 points we got so far.

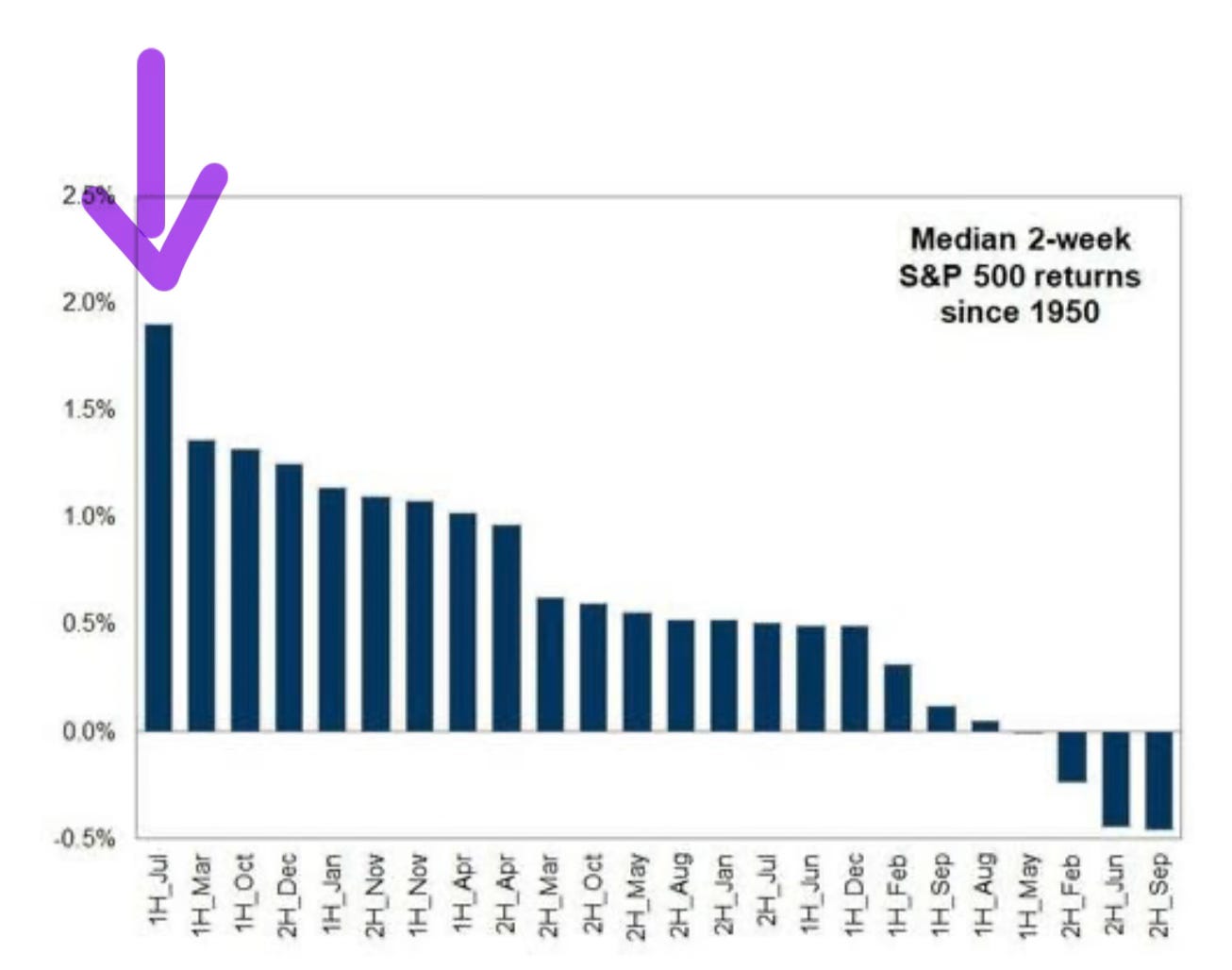

This daily and weekly close above previous all time highs also occurs on significant volume. Especially considering we are sort of in the dog days of Summer here. If I had to guess at this point, we could be seeing 6500-6600 this Summer, though not all at once! And of course we are entering July, a very well documented mega bullish seasonal period of the year. I will be going into detail on that.

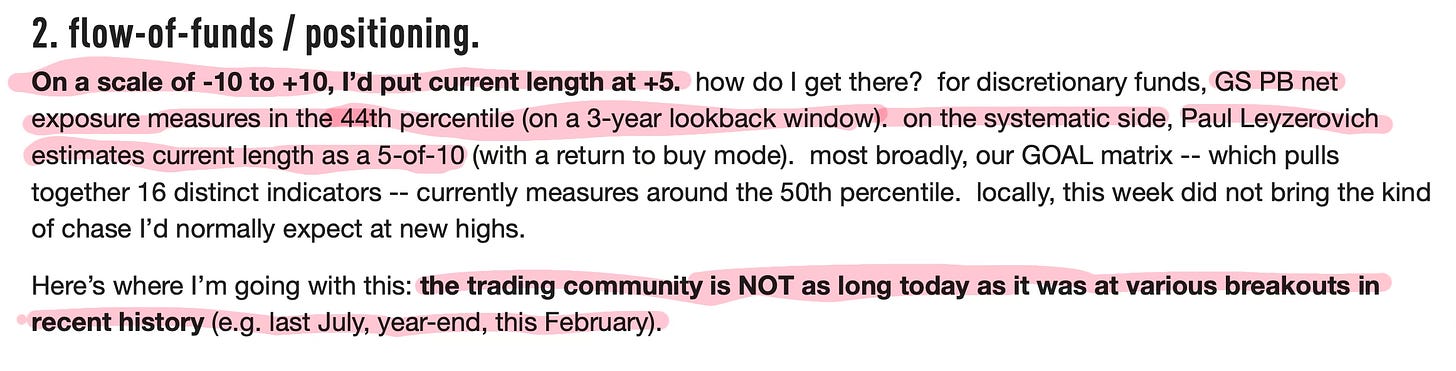

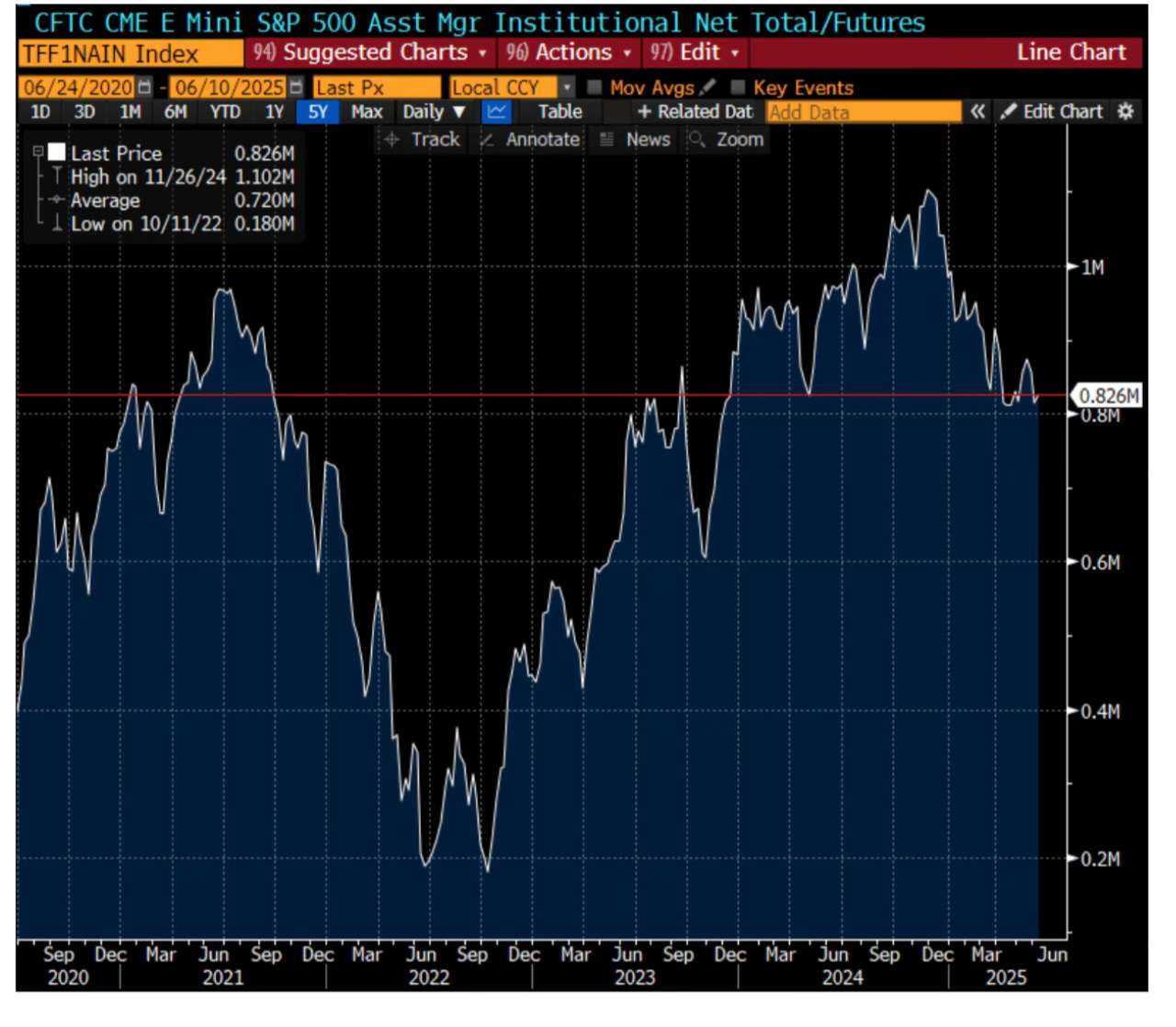

Very important. This is a very different market than February 2025, and December 2024. Although price was pretty much exactly where we are now, the positioning was starkly different. Everyone was all in the pool in Feb/Dec, and arguably that is why we failed to break out. Now we have officially closed at ATH prices, and a very large amount of investors are sitting on the outside looking in. Positioning is not low per se, but for a market at new all time highs it is low. These metrics were all in the 90th percentile if you only go back a few months. In the end, the crowd’s perma bear disease is our opportunity. We have traded through and are at prices now, where each tick upwards will bring a wave of stop ins. At a certain point, at a certain price (any price above 6100s) fund managers who elected to stay in cash will have no choice to buy the highs. Their careers depend on it.

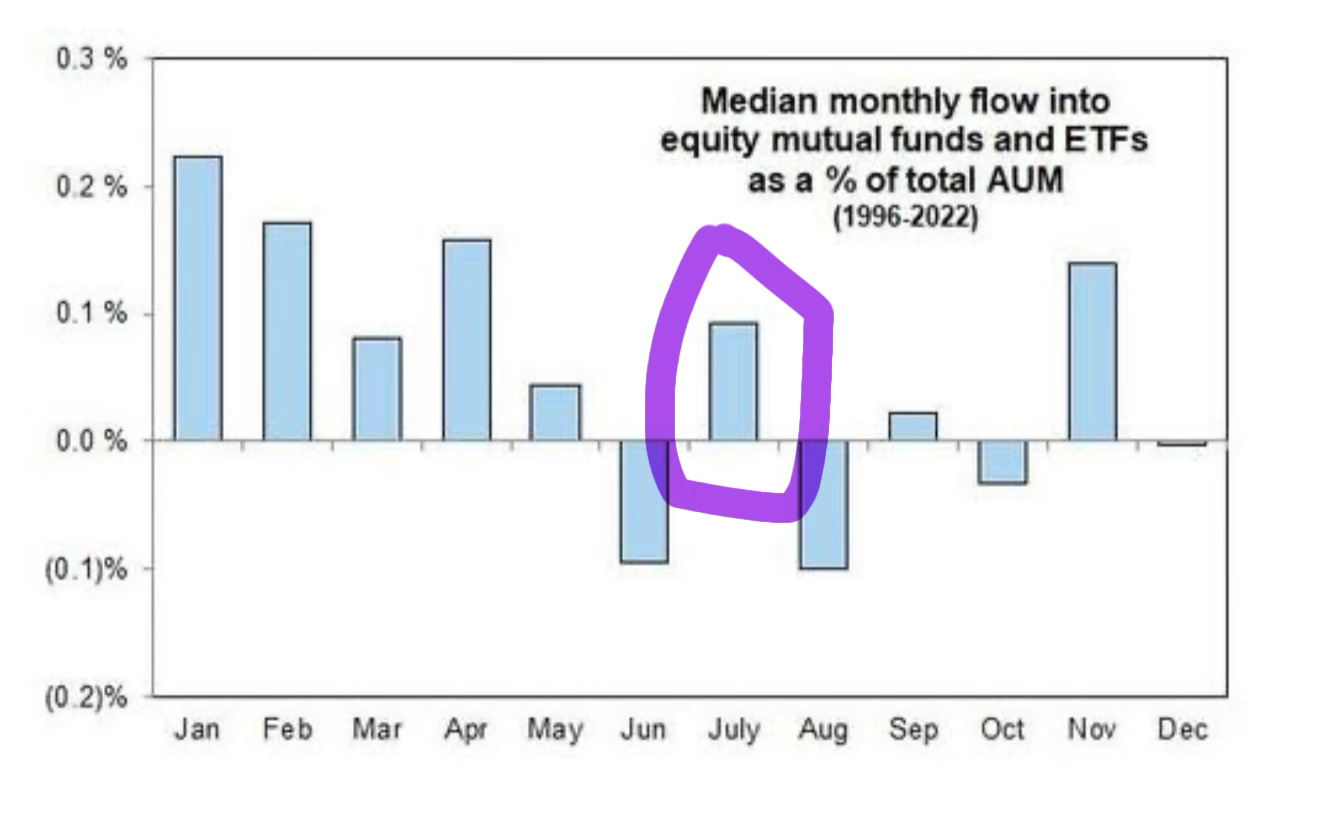

Early July seasonality is the strongest positive flows we see in the entire year. This is primarily due to two factors. One, it is the beginning of the 2H of the year. When stocks go up (most years), this encourages people to invest more and this is a common point for funds to deploy new capital. Two, this is of course July 4th weekend and alot of the big fish are on holiday in Nantucket or the Hamptons BBQing and drinking beer. Bezos of course is getting married again this week in Italy. Everyone is OOO (out of office) right now, the last thing anyone managing a big book wants to be doing is chained to their desk in a tall Manhattan skyscraper managing a giant short position.

1h July officially is the most bullish 2-week period of the entire year. You also have to put it in context of the recent technical breakout of an 8 month resistance, and you have a very bullish setup I think.

Big time inflows come in right at the beginning of the new month/quarter/half of the year. Whats the most powerful force in the stock market? Probably FOMO. There will be FOMO this week as the market just made new highs. The AI train is running at full steam too.

Circling back to positioning for a bit, although SPX has staged a torrid rally off the lows, long is not a crowded trade right now. Believe it or not. The past couple of times we were knocking on the door of 6100, everyone was leveraged long and that was a big reason we couldnt break through. That is not the case right now. The market will go higher and higher until those sitting on the sidelines have no choice but to buy. That is how it works.

Bullishness peaked right after the election in November and December of last year. We are not in euphoria yet, not even close. I think we need to go higher, before we go lower.

I am saving the best for last today. You might have noticed the putrid daily ranges in the ES as of late. We are at YTD lows in realized vol. This will bring, if nothing changes in the next few weeks, a staggering amount of systematic demand from vol targeting funds to the tune of +100B. We talk big numbers all the time, but this is bigger than big. In the dead heat of summer (low volumes), this flow will leave a gigantic footprint. This screams Summer melt up.

To sum up, the bulls are in the most seasonally bullish period of the entire year. The SPX just closed at new all time highs, pushing comfortable past the 6100 level, which has been resistance for almost 8 months. We have closed above the DeepSeek high, the December FOMC high, the election high. Lets not overcomplicate what should be very simple. I am very bullish here and think this rally will extend even further. My target this week is around 6300 on ES.

Trade Ideas

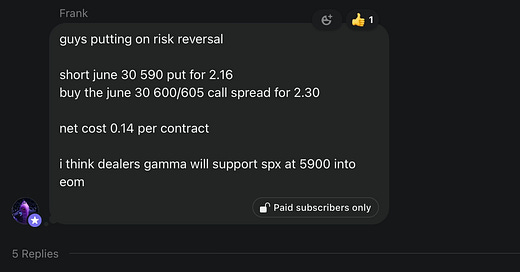

As I stated recently, June 30 brings a very large pension rebalance (90th percentile equities to sell) and that may create a liquidity event and some opportunity to buy the dip. I will look to enter some new longs here in ES Sunday into Monday. If I fail to get a fill I will just buy the close.