Recap of last weeks action:

Massive winner last week.

I gave one single trade. Told you to size up. These went to $13 on Wednesday. You had to hold less than 2 trading days (market was closed on Monday). Huge win.

Now what. When to buy the dip?

Next move for markets?

Down. I don’t think this retracement if done just yet. But I do think we are in a bull market, we are headed to new highs, not old lows. So the question is simply when do we buy the dip. I think we will retrace to test 4000 again at some point this year, but I doubt it comes during these summer doldrums. If you have not been living under a rock as of late, you will have noticed VIX getting smashed pretty much day in and day out. No it is not manipulated, its smart traders and firms front running a slow, lighter volume summer season in a new bull market. We also have 4th of July fast approaching, which is historically very bullish, coming off one of the best starts to the year in history. So being too bearish here is not smart. That said, I think we have some room below to trap some bears before yet another leg up. I am looking to buy the dip around 4300-4320 SPX, ideally we reach those levels early in the week.

Image A: Technicals cooling off a bit here.

SPX started to feel gravity again last week, as we were extremely overbought. Still we are hugging the top upper bound of the keltner channel, which is a sign of strength. Ideally, I am looking for a test of the 21EMA or 20SMA which sits around $430 SPY more or less where I would love to go long, for a push towards new year highs into July which is usually a bullish month. So try and exercise some patience here into month end. VIX is low, so don’t expect a 2% down day like we had in 2022 many times. Slow grind and bleed most likely. I am not shorting here actively, mainly biding my time and looking for my ideal long entry.

Image C: Funds need to rebalance heavily as we approach end of Q2.

One headwind for equities here that will weigh on them is the Q2 fund rebalance. 60/40 still dominates most major funds, so in the event that equities outperform (like they did this year), many entities will have to sell out of equities to purchase bonds. That will be a drag on SPX this next couple of days, as funds look to do this spread out over a couple of days, as well as many traders front-running these predictable flows.

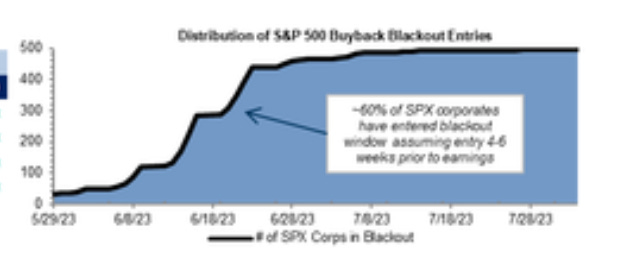

We are also in the middle of peak buyback blackout window, in 2023 corporates authorized an almost record amount, and were one of the top buyers of equities. As we approach earnings season upcoming, that bid will be gone for a couple of weeks.

Image D: Buyback blackout window.

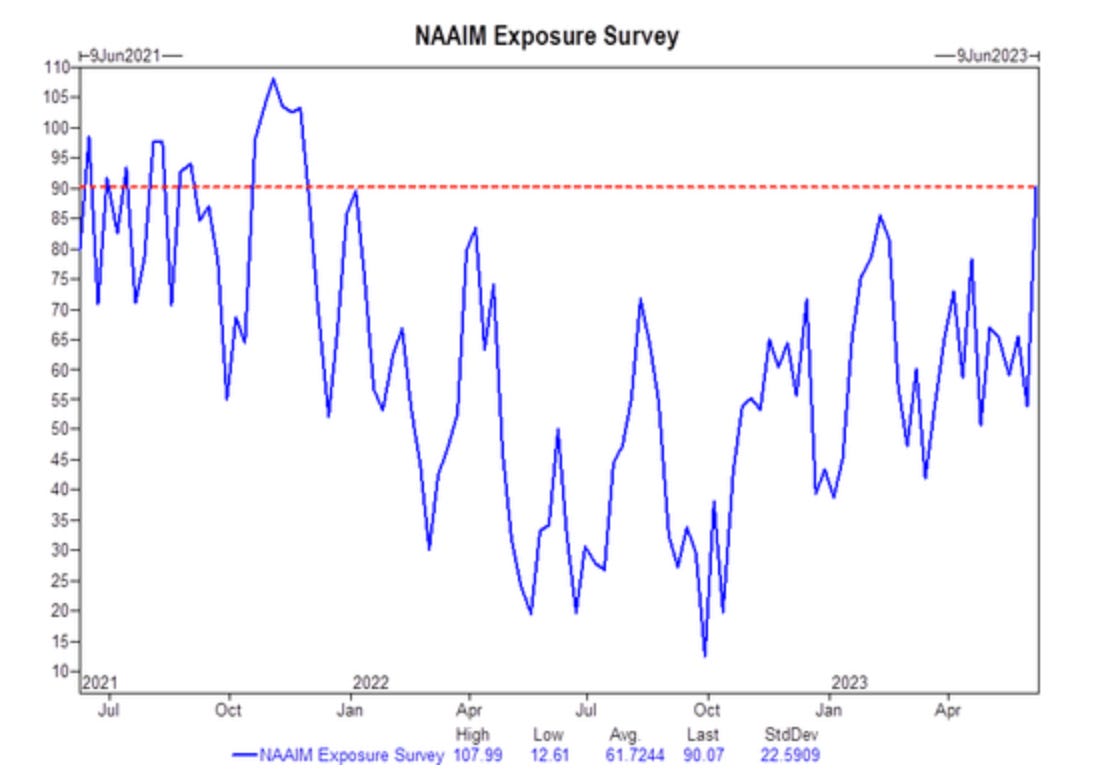

On the sentiment and positioning side, for many months these served as a gigantic tailwind for markets, as the contrarian side profited handsomely, as many too afraid to go long missed a massive rally. As we approach closer to the end of this year long rally, these tailwinds flip and reverse to headwinds. Bullish is the new consensus, and although I believe this to be the correct bias, even in raging bull markets you often get corrections of 5-10% semi regularly, which is expected and totally healthy.

Image E: Positioning is stretched, bulls getting crowded.

Image F: Asset managers most exposed to equities since Jan 2022.

Almost everyone has flipped long, everyone who will be “stopped in” has already been stopped in. Systematics across the board, from CTA to risk parity to Vol Control has bought heavily, and are very close to max long.

Image H: Systematics are very long and exposed to equities.

To sum up, this is a bull market. But even in bull markets we see corrections. We have not made a swing top just yet, I think 4300 may serve as a good entry point to ride that last gasp before a more significant retrace. I am looking to enter at 4300 for a run towards 4500 before perhaps another risk off event.

Trade ideas:

Long SPX 4400 calls July 21 at 4300/4320 SPX.