Recap of last week

Last week was tricky for many, and was emblematic of what separates the good traders from the great ones. Alot of “good” traders I know where fading the SPX playing mean reversion because of its extreme overbought nature. But the move was play for overbought to get even more overbought as the traders brave enough to long a 2SD move at the end of last week got paid. Traders playing the mean reversion last week got blown up.

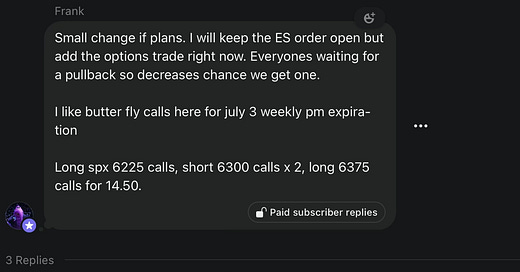

We took just one trade last week, and was a big winner. Considering the overheated market momentum, we chose to use options as our preferred vehicle. Our risk was defined as when market is stretched in that manner it can selloff rather aggressively. We also knew the market was close to a crescendo and wouldn’t have the juice to trade over 6300 so we went with call flys, that ended up settling for 54.00+. Our week started on Sunday night and with our well chosen strikes we just rode that winner all week. We had no losing trades.

And so we now approach the July 9th tariff deadline. Are traders too complacent on the taco trade?

Next move for markets

Down. I think these last two weeks pulled alot of the July seasonality forward, and drew everyone into one side of the boat so to speak, so in the immediate short term (2-5 days) I favour more of a risk off environment. Right now we are in many ways seeing a mirror image of early April. TACO is now the consensus, SPX is at 23+ PE, over 70+ RSI so it wouldn’t take much to shake the tree a bit. That’s what I expect to happen. But don’t lose sight of the main narrative, this is still a bullish market and I expect any tariff related swoon here will be bought.

Ill keep this short and sweet. That is a crystal clear breakout with nothing but blue skies above. We took about 8 months to break out of 6100 SPX. That is a long, long time. It should be equally strong of a support. If we lose that quickly, then that is a warning sign and things will get ugly fast. Until then, its a buy the dip market.

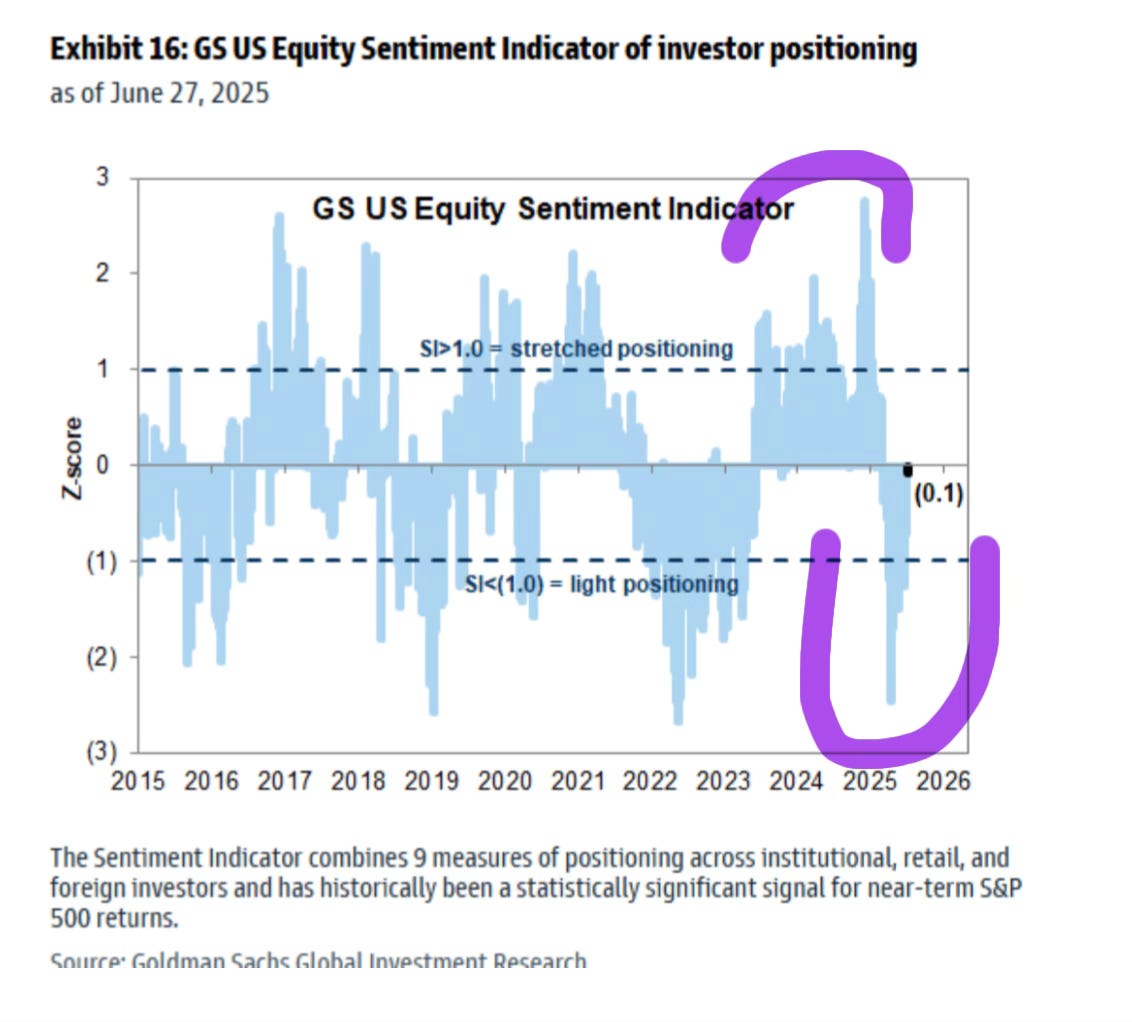

If you look over all my posts this year, you will see one clear theme emerge through almost all of them. Bombed out positioning. It is no longer bombed out per say, but it remains somewhat depressed. Everyone was all-in for most of 2023 and 2024, and that is not the case today. As I often say, if youre looking for a market top, it typically happens one of two ways. Markets can either experience a negative catalyst (such as bad earnings or economic data) or it can also collapse under the weight of its own euphoria. NFP just came in blistering hot, again. Earnings season (1Q) was very strong. So that leaves us to the second option, are market participants euphoric, or positioned overly bullish? No. I still see that as maybe a couple of months away.

Funding spreads echo my thesis. This is essentially the cost of leverage, how much interest it costs to hold S&P futures contracts. The level is still quite depressed. In fact look how much lower it was compared to the last time SPX was at 6100. Secondly, look at the recent surge off the bottom. Professional investors are buying the highs here, as they have no other choice. That may prove to be a problem in the future, but not as of yet.

Back to seasonality. In previous years its been totally normal to see a bit of a give back post July 4 week, and then see another leg up. The historical return for July 1-15 is 2.43%. That would put SPX at 6337. That squares with my thinking that if we got a bit of a pullback this week it would most likely be buyable for another leg higher. Although, it is just an average, meaning we could undershoot or overshoot that return, the takeaway here is the 1H of July is a seasonally bullish period and that should colour all of your trading decisions in the near future.

Time for a good old fashioned gap fill? This chart should remind you of the SPX funding spreads. Although spot is at new highs, positioning is most definitely not. Add this cohort to the underexposed camp. Over stretched positioning is often necessary to see a meaningful top, and we are nowhere close. I would like to see systematics closer to being fully invested before I begin to start thinking of a more sustained equity correction (over 5%).

When or where might these funds start buying again. In the next month or so. GS estimates about +95bn buy flow in global equities in the next month in 1 flat tape. Right in the dead heat of Summer. During that aforementioned July seasonality.

Lastly, maybe the most important chart of the week is we have earnings season upon us in the next couple of weeks. Consensus EPS estimates are only 4% after registering a 12% handle last quarter. Thats a low bar. This train will keep chugging as long as corporate America keeps on delivering. No quarter for bears unless NFP cracks or EPS cracks.

To sum up, in the very short term (<1 week) market looks overheated and a bit overexposed into an unknown event (July 9th tariff deadline). Would expect more of a risk-off tape early on into that week. If we were to get say a 50-100 point pullback, I think we could lean back into long SPX to play another leg higher into 6300-6400 SPX for the mid/back half of July here. I dont think this uptrend is over and I think people are a bit too early here calling for any sort of significant correction yet.

Trade Ideas

Will alert in the chat as usual. But looking to re engage long when the time is right.