Recap of last week

Extremely happy with our performance last week. A reminder here to not confuse the best outcomes with the best decisions. It was NOT our most profitable week, but our trading process and thesis was as good as it has ever been. We started the year with our eye on the ball and very in tune with the market.

While everyone was calling for the Santa rally, and huge inflows to start off the beginning of the year, I called for a correction in SPX. Thats exactly what we got as the index was down 1.79% this week. Fed fund futures also corrected as I predicted, removing about a hike or so from the fun year projects. The dollar also spiked about 1.03%, and the 10 year yield was up about 17 points. So I wasn’t exactly stingy last week with 5 separate predictions.

SPX down - Check

Fed funds futures too optimistic - Check

Dollar spike - Check

Yields spike - Check

Mag 7/tech outflow - Check

Im not going into the week looking to just be right or make money. Thats not enough. I want to be right for the right reasons. I want to make money because my thesis is right, not for getting lucky. Thats important. You can’t make a career out of getting lucky.

Here was the recommended trade basket of course.

SPX +86 points

EURUSD +111 pips

USDJPY +361 pips

Gold -1%

Some of these trades filled, some didn’t. Some I felt like scrapping, like the USDJPY. First week of the year, I think the most important part is dont start the year in a massive hole. Psychologically it’s important. And I want to encourage and remind people that I give trade ideas as a nice bonus, but you should be taking the most value from my analysis, and ideally you craft your own trades and expressions. If you took what I said above in my summary paragraph, that yields and dollar would spike and spx would correct, you can express that in a million ways. I will give some sample alternatives here.

Instead of short SPX you can do QQQ put spreads

Instead of short EURUSD, you can long USDCNH

Instead of long USDJPY you can short /ZN futures

My trades are always suggestions, but I want to encourage people to adapt my views to their own trading styles and not be too locked in or rigid on X trade idea. It’s the general themes that are important, that you should take away from the weekly read. After that you should choose the best way to express that view using the trading style that fits best with your own personality and risk management framework. Like if you always do options spreads and I recommend ES futures, do your spreads. If I say I think a correction in SPX is coming, and I am short at XX.YY price, you dont need to wait for XX.YY if you think XX.YZ is a great entry.

Of course we capped off the week with an impromptu trade that I gave Thursday at NY close. My indicators were showing short term fast money was a bit crowded on the short side and was pretty certain barring a 3+SD beat that the market would rally on the print. Thats exactly what we got as this was good for about 40 points on ES or so. Gave the exact entry, the stop, and even the take profit.

Hopefully you read my alert before the market sold off again during lunch hour.

One last note. I am always going to try and alert you guys when I exit, but I encourage you guys to actively manage your own trades. There will be times when I am not at my desk, times when I am sleeping, times when I straight up have a bad exit myself. Never let a good sized winner go red. As a general rule, take profit along the way, and always leave a couple runners to be stopped out at entry for those big winners.

Next move for markets

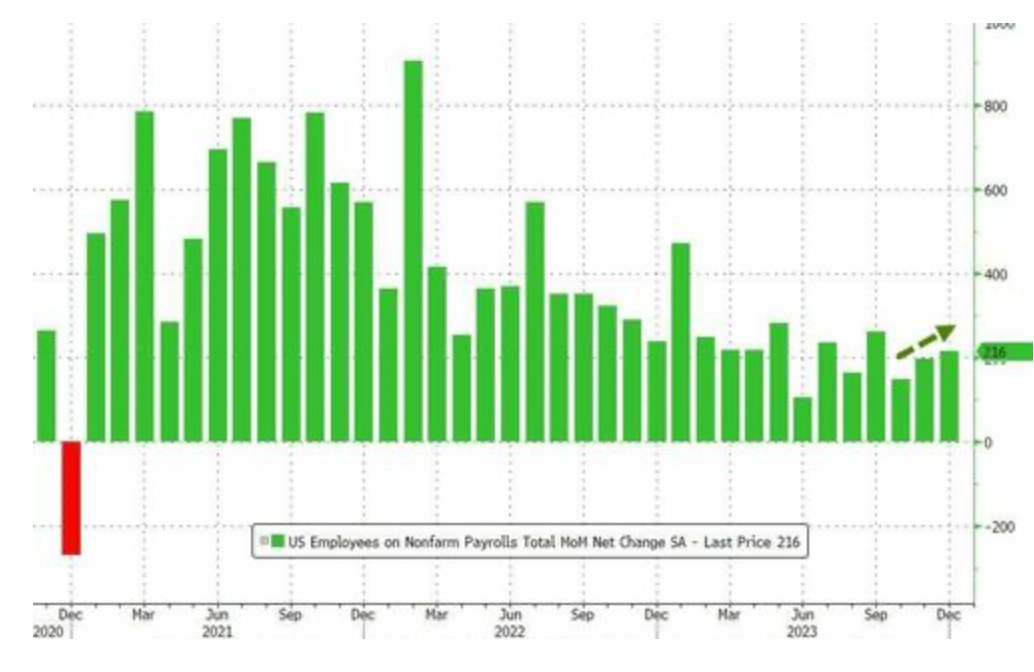

Up. The market had really quite a rough first week of the year. I think the short term pain is over and we are in for a bounce before the main event of January, CPI. I like that low of ~4702 made on Friday morning right after the print. The NFP print came in slightly hot at 216k vs 175k expectations, and notable AHE also beat at 0.4% vs 0.3% expectations.

I think alot of traders are trading an old narrative here. The narrative that a hot jobs market will spur the Fed to hike again and stay higher or longer. As they say skate to where the puck is going not where it’s already been. I think we are past that point. The focus now is on a soft landing, in an election year. I also want to remind people it is 2024 now, it’s been a year and a half or so now since Powell’s infamous “There will be pain” speech. Inflation is not 9%, it’s 3%. If you believe in the long and variable lags theory, which I do, it’s probably headed even lower. The Fed is getting more and more worried about a recession. The bar to hike is on the moon right now. I think realistically speaking NFP is not meaningfully changing the Fed’s dot plot or interest rate trajectory at this point. That’s ultimately what gave me the conviction to buy the dip on Friday.

Our usual look at technicals here. We were riding that top keltner for all of November and December here, not exactly surprising considering seasonal strength and the chase factor. Zooming out here is nice, as you are reminded we were in a mega strong uptrend here and looks like we just had a healthy pullback. Quite the contrast with the doom and gloom you see all over Twitter. I didn’t really see and feel bearish about last week, there was some fluff in the market that needed to be worked out, that doesn’t change things for me fundamentally. Instead we got confirmation once again the jobs market is very healthy, and therefore the US consumer which is everything. Later this week we get the other important piece of the equation, which is CPI. Overall from a technical standpoint nothing really remarkable. We remain in an uptrend, and right now we have tested and so far held the 20D EMA.

Now given the past couple of months between CPI and PCE, we have seen a very strong trend of disinflation. That trend looks set to continue but all eyes on Thursday for the actual confirmation. Another reason I lean towards a rally this week as alot of fast money jumped in short last week, and now staring down the barrel of the BLS. Last report shorts were obliterated so I am sure there will be a cover bid as we trade up and into the print. Once bitten, twice shy. I think with a cool CPI, we likely trade through 4800.

To support my thesis here of a short cover driven bid into the CPI print, we have this chart from Citibank. You can see a general trend of weaker performance between NFP-CPI in 2022, and as inflation began and continued on a sustained downtrend from late 2022 to present day, this period of about a week every month has been quite strong. When inflation prints were coming in blazing hot, markets would see a broad degrossing of risk. The most recent 6 months or so, have been quite robust and alot of this is due to shorts covering and getting flat and/or long before the print.

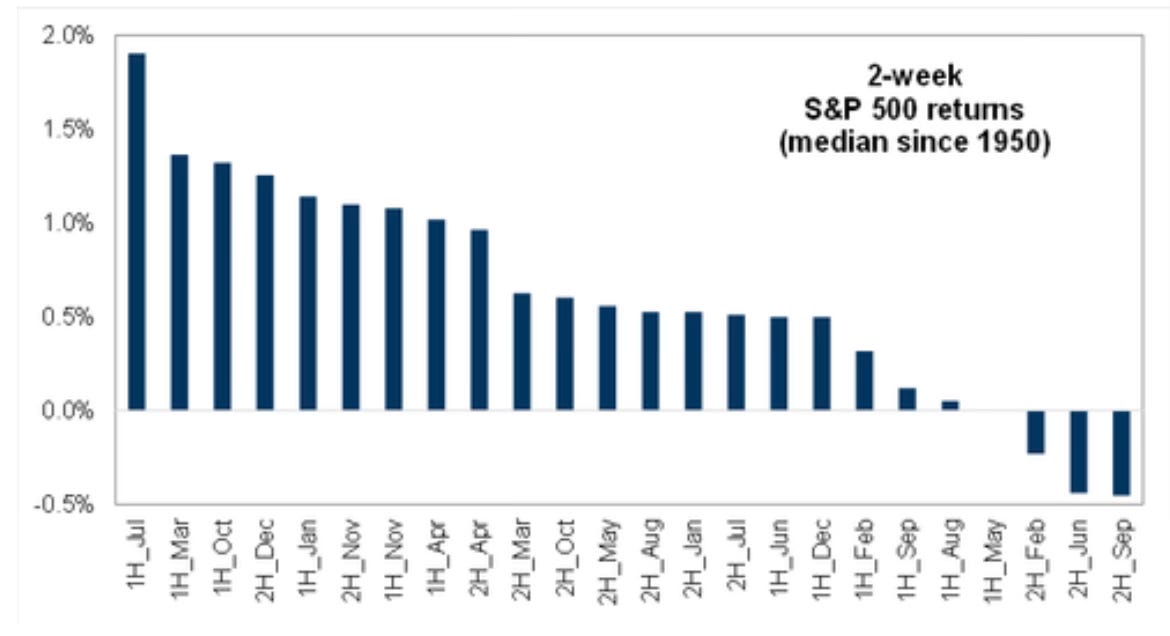

Seasonality wise, we are still in a rather strong period here. We are “underperforming” seasonality here if you will, as January is still a big month for inflows.

January is the 2nd best month for median returns, coming in at just a hair over 1.5% and most of that return does come in 1H. So let’s see if the market can stage a bit of a comeback this week. I am betting it does.

On the systematics side CTAs are at or close to max long here. There is once again a big downside convexity present here, but barring an outright disastrous CPI print, they wont be much of a factor this week.

To sum up here, I think we made a good low around 4700 on ESH24 on Friday. The NFP indicated a very strong and healthy job market, which as more people will go on to realize is now a good thing. The Fed’s more focused on soft landing rather than imitating Volcker at this stage of the economic (and election!) cycle. I am thinking shorts here will want to cover sooner rather than later and we could see a small rally early-mid week. Despite a very weak first week, we remain in a very seasonally bullish period, in a very bullish month. Those are just facts. Last but not least we managed to snag a great entry on Friday and we can ride those longs into this week, and if CPI is on our side here we could take those lots into all time highs and beyond.

SPX Trade Ideas

Hold our ES/MES runners long. Move your stop up to a daily close below 4720 ESH. We already took some profit Friday on the rally, so I want to be clear for these. No more TP, let them ride. Let them be stopped out, or let them ride through the whole week. I think still a very good chance we make new ATHs here in January.

Alternatively, you can do some call spreads here. SPX Jan 12 4750/4800 for around 7.90 looks good here.