Recap of last month

We finally wrapped up the ugliest of Decembers. December 2024 was a true outlier, as the SPX finished down -2.5% and SPXEW was down a whopping -6.5%. For the SPXEW (RSP), that registered as the worst month since September 2022, when inflation was 9%! And the S&P in the throes of a monstrous bear market.

We had a losing month. But a winning year. We were one of the very few who really nailed the election trade, as we played for a very quick resolution when the crowd was expecting a long drawn out affair. We dumped 75% of our longs on Thanksgiving weekend and avoided most of the carnage.

The mission for me is to become a better trader every single day of my life, and I hope that for all of you as well. It’s important to reflect on our losses. Buying the dip did NOT work in December, yet I think it was arguably the right trade. Whenever you hear “the market is oversold” from someone, inevitably the next response is “the market can get even more oversold” or “the market crashes from oversold conditions”. Both of which are true. But here is the rub. You have to categorize the market into two groups, is it a bull market or bear market? In bull markets, oversold conditions do not last, and they also do not become very deep. Infamously the SPX fell about 50% peak to trough during the GFC. If you said, you only want to buy the market when it is MAX oversold (call it -50%), you could be waiting decades (if you’re lucky) or realistically you might die before we experienced another GFC event. So most of the time, if you are buying dips in a bull market you have to dip your toe in during oversold conditions, knowing the fact that yes it can get even more oversold. You must balance the risks.

So if I am losing money on buying the dip because we got an extreme outlier, bear market type action in the middle of the bull market, you kind of just have to shrug and laugh it off. The bottom line is this.

You either buy oversold, knowing it can get more oversold (we did this). Most of the time you make money in a bull market, sometimes you lose (December 2024)

You only buy MAX oversold, and you avoid a ton of risk but also a ton of profit. The problem here is you get extremely few signals, it could be years or decades between MAX oversold type signals. You probably make alot of money but only once every few years/decades/lifetimes.

Long term readers know my view. As a trader, just focus on taking good setups with favourable risk:reward ratios and just execute over and over again. You may experience losing days, weeks, even months. But if you keep executing like an emotionless machine you are guaranteed to make money over the long run, barring some severe cognitive bias. You must act like a casino. If you are playing blackjack in Vegas, you might very well be in the black for the day, the weekend, or even in the month. You know damn well, if you are in the casino for an entire year you are virtually guaranteed to lose all your money. In this case, be the casino. When the market gets oversold, you buy it. Use indicators that are based on hard data. Most of the times you will make money. Occasionally the bottom will fall out and you will lose money. Laugh it off and keep on playing that setup over and over again because you know its virtually impossible to lose in the LONG RUN with an edge, although in the short run anything can happen.

Next move for markets

Up. I think that the most bullish scenario for markets is playing out. In October 2024, we saw extreme greed and bullishness. Everyone was on the same side of the boat. Now we are seeing that wall of worry come back. Fear. Extreme fear. Apprehension. This is when markets perform the best, when people are doubting it. This is not some mumbo jumbo, it’s because when people get bearish they short the market and create future buyers/demand. Typically people overestimate negative outcomes and underestimate positive ones. I didn’t read that in a fortune cookie, that is an actual scientific fact. There are many studies on the subject. But I digress.

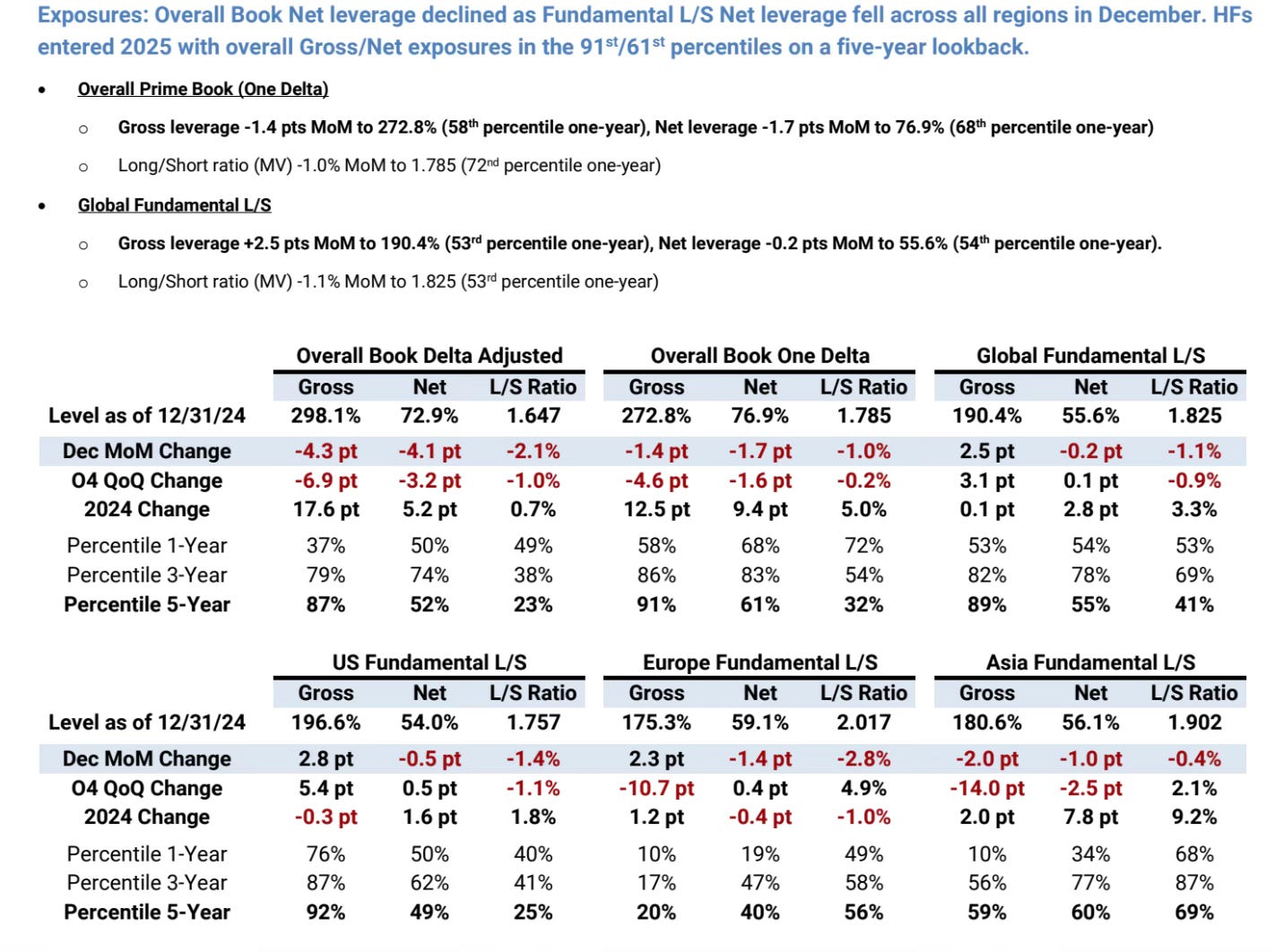

To circle back to December 2024, it was truly a month randomly plucked out of the last bear market and inserted into the 2024 bull market. Performance across the street was abysmal, as it was a true multi SD event to see that sort of selling. Hedge funds got hit hard as well as long onlies. Hedge funds reduced exposure by significant amounts across the board as the risk shockwave reverberated through the market.

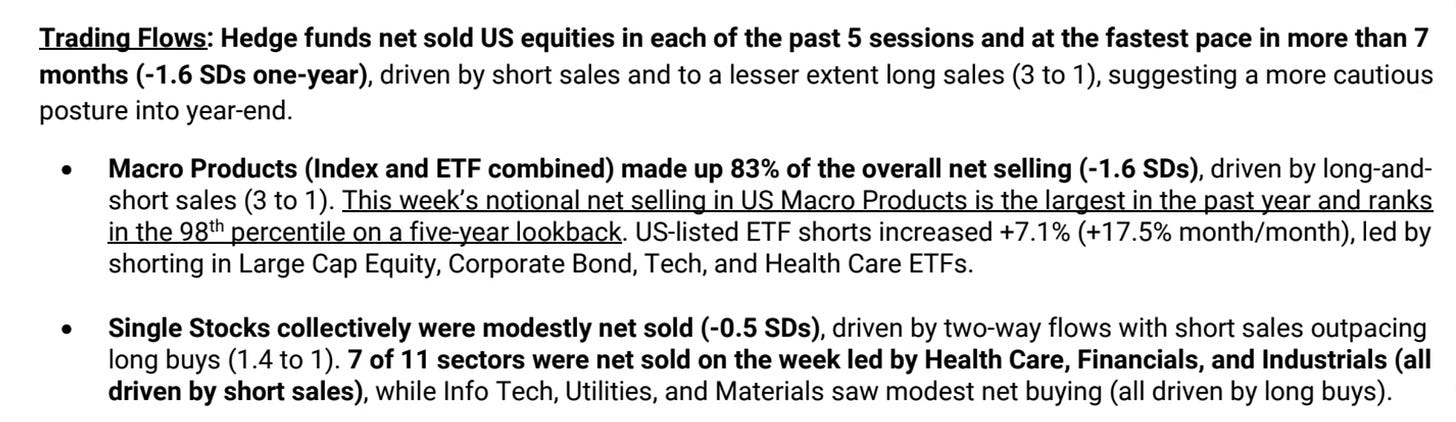

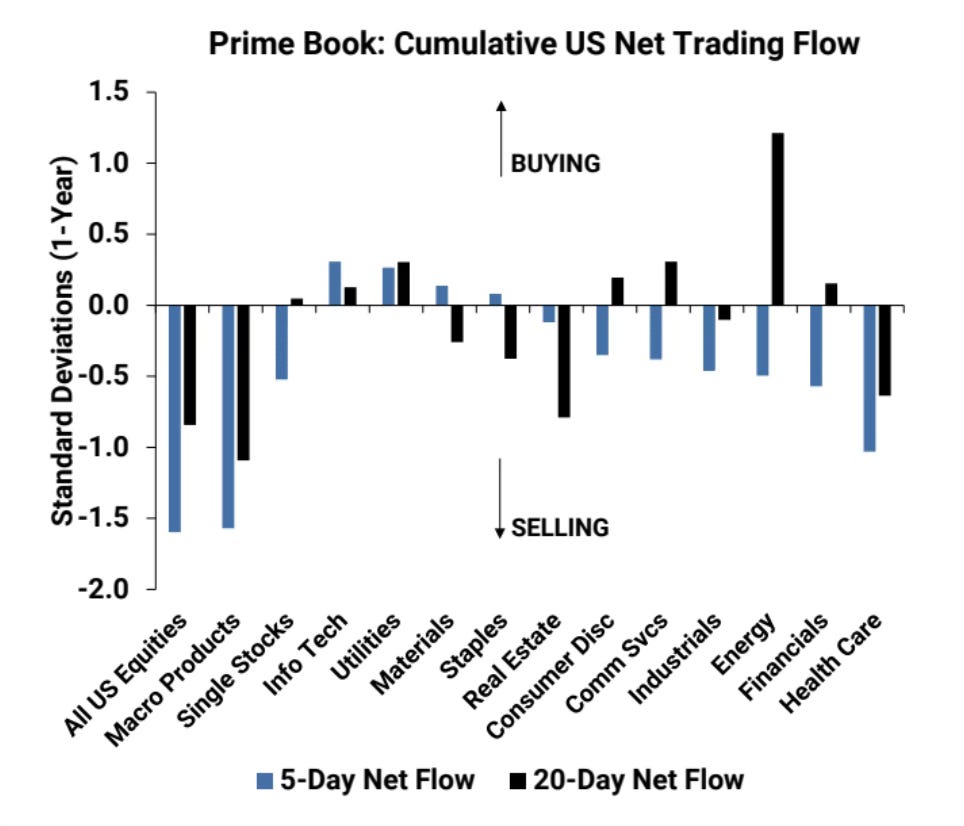

Hedge funds not only degrossed in a significant manner but added to their net shorts largely through macro products. There is fear in the air. You can smell it and now im showing it to you on the tape. Interestingly enough, the last time short flow was this heavy was Feb 2021, when Biden had just been elected. It’s quite natural to see some major skittishness when a new President is inaugurated. There are alot of question marks and unknowns about policy. Markets hate that. But as I said earlier, people are too focused on these obscure negative outcomes and not enough on the multitude of positive ones that will likely materialize.

Hedge funds net sold US stocks every single day last week. They are cautious and they are fearful. You might wonder why this is not outright bearish, if in fact HFs are smart money? Its simple. Hedge funds do not target total returns, they target medium returns with low volatility. They would rather miss the ripper, and instead gain 1% a month on low realized vol. Rich people are focused on staying rich. If you are trying to build wealth, in my opinion you should accept more volatility for increased total returns. A stellar year for a hedge fund would be +10% total return. If that’s what you’re aiming for you can play on the sidelines too. If you want to do 20%, 30%, or 40% you got to be playing offence.

Have I said yet that people are afraid, they’re apprehensive, they’re cautious. It’s almost like there is a wall, and it’s made up of peoples’ worries. General rule of thumb, when the premium in vol markets to hedge is high, some bad “things” are already priced in. So typically you want to fade that because the world can only end once. But according to the vol panic index, proprietary from GS, the world ended 10 times in the last 2 years. Most people fear the worst, but the worst almost never comes to fruition. How many times have you read the phrase, “WW3 is coming” or “WW3 is here”. A thousand times, a million times? Yet it still aint here. Right now people fear big bad tariffs, 1970s style stagflation, this that and the other. What if it’s better than feared? 7000 SPX.

They are selling absolutely everything over the past couple of weeks. The world better explode in 2 weeks or my guess is these guys will be covering their shorts.

More on fear. They are not casually buying a couple puts and tossing them into the cart haphazardly, they are reaching for them out of desperation and paying a rich premium to do so. Skew is in the 87th percentile. Was I in a coma or something? What’s supposed to happen in the next couple of months to warrant this downside fear. Is it Mr Trump taking office? It’s not like he was president in 2016 and the economy was absolutely magnificent and the stock market boomed or anything. Oh wait, that’s exactly what happened. At the same time, no one is buying the right tail? This setup in put/call skew is eerily similar to Sep/Oct 2024, as investors bid up downside while the market ran away to the upside.

The super smart guys at Nomura and GS both agree vol looks expensive here. The main fear here is definitely tariffs. But Trump has talked a very big game here, I dont think there is any real benefit to hitting your trading partners with your Trump card (no pun intended) right off the bat. There is no benefit to that. What do I mean by that? Say as a football coach, you have a secret play that works 80% of the time to score a touchdown. Trump hitting everyone with his most severe tariffs would be like that couch using his secret play on Game 1 of the regular season in the first quarter. Its stupid. It doesn’t benefit him or the US. Why not save that secret play for 4th and Goal in the Super Bowl. Its The Art of the Deal here, and he is going to threaten the worst case scenario to get what he wants, but if you go super extreme and do what your opponents worst fear is on Day 1, what negotiating power do you have left?

Alot of bad news is priced in here. A more pure way of looking at this is EURUSD or USDCAD. These FX pairs are typically range bound and both have blown out of their respective resistance/supports. Either you’re short vol here or you’re long it. I’ll short it. If you want to long it you’re basically saying these tariffs are going to be huge and devastating and completely surprise the market even though he has been talking about them for years now.

To sum up, I like the market to make new highs here in January. There is nothing more bullish than a wall of worry to climb. Institutions got spooked in December and have sold quite a lot for a 1M time period, and hedge funds quickly turned to a more defensive position and shorted broadly across all sectors and macro products. Volatility and SKEW have exploded quietly and at this richness, the market would have to realize the worst case scenario or close to it for us to continue lower, in my opinion. What does this mean, in real terms? We would have to see a big beat in NFP, CPI, and for Trump to implement huge Day 1 Tariffs for the market to realize what is implied right now. I dont think that will happen. 6150-6200 SPX is my target by end of January.

Trade Ideas.

Still long the XLF February calls, might add if I see a good opportunity.

Will alert an ES entry this week or SPX calls on a pullback to support.