With the huge gamma rolloff post the massive January 20 2023 OPEX on Friday, markets will be able to move more freely. Just in time for the beginning of a much anticipated earnings season in which traders look for clues of a material earnings slowdown to validate the recession thesis. My thoughts on the next move below.

Recap of last weeks action

Quick recap here, I wasn’t expecting any big directional moves last week due to the gamma effects of the multi trillion dollars worth of options expiring as well as the massive upward move the NFP range break of the multi week balance area. This turned out to be a good call. This blog is not just about macro and markets but I want to really focus in how to succeed as a consistently profitable trader. You will see and hear from many super intelligent and knowledgable traders on the internet, but you would be surprised at how many simply don’t make any money from markets. The biggest edge a retail trader has is he/she doesn’t have to trade everyday. There are no performance reviews, no benchmarks to beat, no redemptions, no one to answer to. This is priceless in markets. If you have to really think hard about which trade to take, here’s the answer: don’t take any and sit on your hands. Wait for a big fucking fat pitch to swing on and lever the fuck up. Then go back to waiting, and watching. When I began my journey as a trader one thing really stuck out to me. I imagine my P&L if I simply took my top 5-10 trades a month and the results were staggering. I am sure many of you have done the same. The best way to improve your P&L substantially is by eliminating bad trades NOT taking more good ones. Why is that? Because true alpha is so hard to come by. It is much easier to make more money by losing less basically. There simply aren’t that many “fat pitches” and everyone and their mother are looking for them all day long. So just stop striking out (taking bad trades) as often.

Image A: Drawdown chart. What you need to get back to breakeven.

Take a good look at that chart and save it as your desktop background or something. It will be the secret to your success (or failure) as a trader. Plain and simple. I am urging you to focus more on eliminating bad trades than finding more good ones. It will make more of a difference in your P&L.

Now what?

Key change in the markets last week as we sold off into 3900 area on the back of a weak retail sales print. This is a key change in the characteristics of the market as the market is now in “bad news is bad news” mode or moving into it. It fears to Fed has already tightened too much and the effects have yet to be felt throughout the system. Data like these is a leading indicator of possible and likely economic slowdown which many fear will reverberate through corporate earnings. Which is ultimately what the S&P 500 trades on. Short term it is about liquidity. Long term it is about corporate earnings. Important to remember.

Image B: Upcoming earnings releases this week.

The 2022 bear market was all about multiple compression. This is not a Finance 101 textbook so I won’t get into the details but essentially stocks traded for a very long time on TINA (there is no other alternative). In this rising rate environment interest rates for bonds and other highly liquid investments are now offering a much more competitive return 4-5% with very little to no risk (US treasuries). Which is competing (and winning) for $ inflows from stocks (high risk with an uncertain next decade due to inflation and growth concerns). And as interest rates rise, the cost of borrowing money rises, which hurts high growth companies the most, which tend to be technology focused, which is what the Nasdaq is mainly comprised of, and the S&P is heavily overweight technology.

The 2023 bear thesis is basically centred around earnings compression. For the S&P to break its ~3500 lows, either US 10 yr yields have to make a significant new high, or there needs to be a significant slowdown in corporate earnings. The former is more unlikely at this point, as bonds are very closely linked to inflation. As the market is pricing in that the peak in inflation is already in, that coincided with the peak in bond yields.

Image C: TLT is a bond ETF that holds 20+ year T bonds. As the price of TLT goes lower, the 10 yr yield rises, which puts pressure on technology stocks as the price of borrowing money for future growth becomes more expensive.

So if we assume and agree with the market that the inflation peak is in, and that the bottom for TLT is in, then the main bear thesis is a material earnings slowdown. And here we are at the beginning of earnings season.

Next move for markets?

Up. Here’s why. The main story so far this year is the divergence between the fear of the impending recession and the reality (data) not yet reflecting this scenario. Markets have been front-running a recession for sometime now. You’ve seen it plastered all over the headlines. But on the other hand the data is just not reflecting that yet. The labour market is secularly tight, the consumer is still very strong, travel/leisure is absolutely booming. So I think the next move here for markets is a short-term move up, to possible test the December highs on ESH2023 of about 4180 post the CPI print. If we get there that may be a good spot to sell into. People will position and hedge for a material earnings slowdown that IMO we will simply not see yet. We kick off the season with Microsoft, as well as another look into the consumer with reports from Visa, Mastercard, and AMEX. I am bullish here as we cooled off a bit last week and we had an important backtest of the 3800/3900 balance range breakout and we could not break it.

Trade Ideas

I don’t like to gamble on earnings as the implied move historically almost always exceeds the realized move. So in essence the person or computer selling the options wins and you lose. But because of the heavy weight of the tech giants in the indices you can play earnings through simply the index.

I like Feb 17 SPX 4000 calls. My ideal entry is around the 3950 area. My stop is a break below the 3900 low made last Thursday 1/19.

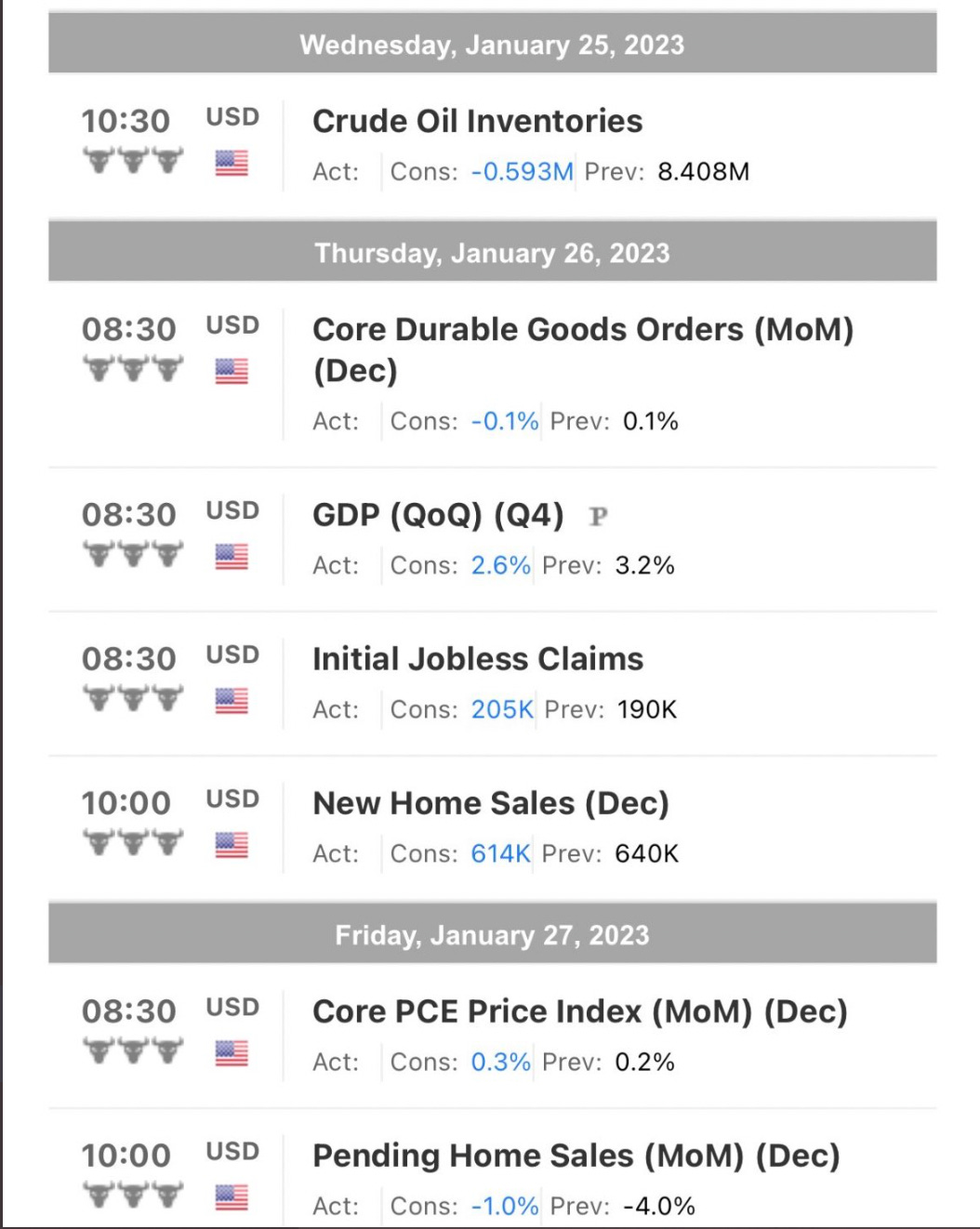

Economic Calendar

Image D: This weeks important events to watch.

The main event to watch this week is GDP (QoQ). As we approach FOMC another hot print could reaffirm the Fed’s mission in continuing to tighten which means higher for longer. Going into Thursday I may look at shorts on a shorter term timeframe to hedge against my long options position.

Happy trading! See you guys next week.