Recap of last weeks action

I was super bullish last week after the upside breakout post-NFP. I predicted an 80% chance of a green week, with 4000 target on ES before CPI data. We had our green week, and reached approximately 4010 on ES before the CPI data release, exactly as predicted. Now this won’t happen every week, some weeks I may be wrong, but what is important to me and to my readers is that I had a PROCESS derived from a thesis generated using information the market provided to arrive at my prediction. And that I got the general direction correct, as the magnitude of the move is not as important as you don’t need to limit it, it will be what it will be. Remember you only need to limit your downside, the upside takes care of itself. I recommended specifically to take SPX 4000 calls Feb expiration, and if you took those you are up quite a hefty sum.

Now what?

I think the upside from here may be limited. But more importantly, the last few points on the upside are just not worth “chasing”. We are at a point in the market where longer time frame sellers are licking their lips ready to slap the bid. Yes the market can go up another 50-100 points before falling, but it’s too risky to stay long to get those last points. Remember, if your goal in trading is to make it a life long career you need to make risk management your top priority and watch potential downside before you look to secure potential profits. I want to be cautious here, and am expecting a bit of two-way trade. Especially with this being a shortened week due to MLK day, as well as a massive options expiration containing the Jan-20-23 LEAP options all set to expire. This is a week to tighten stops, take profit frequently and play smaller. Especially if you followed my plan last week you are up huge and its time to protect some profits.

Image A: SPY closing over the 200DMA.

Yes we got that elusive close over the 200DMA. But as you can see the SPX has popped its head over a couple times since this bear market has started and eventually found gravity and dropped back below rather quickly. So still remain on your toes and be cautious here. So we have this resistance area here at the 200DMA. We are also very quickly approaching the massive JPM short call (as apart of their collar) position at 4065 SPX which will act as resistance. This is not an educational blog so I won’t dive into the nitty gritty of gamma and options hedging. But treat 4065 as a resistance that we are getting awfully close to as this rally reaches it last legs.

Next weeks plan

The best trading analogy I ever heard was that trading was like baseball. The best hitters know which pitches not to swing at (trades NOT to take) and which pitches to take massive swings on (trades where you size UP). A key difference is as a trader you can’t strike out. You can pass on 1000 trades and just take the ones that you have the utmost confidence in. As I have grown personally as a trader I have found the best way to improve my P/L is to eliminate bad trades rather than seek to improve my edge which is notoriously much harder.

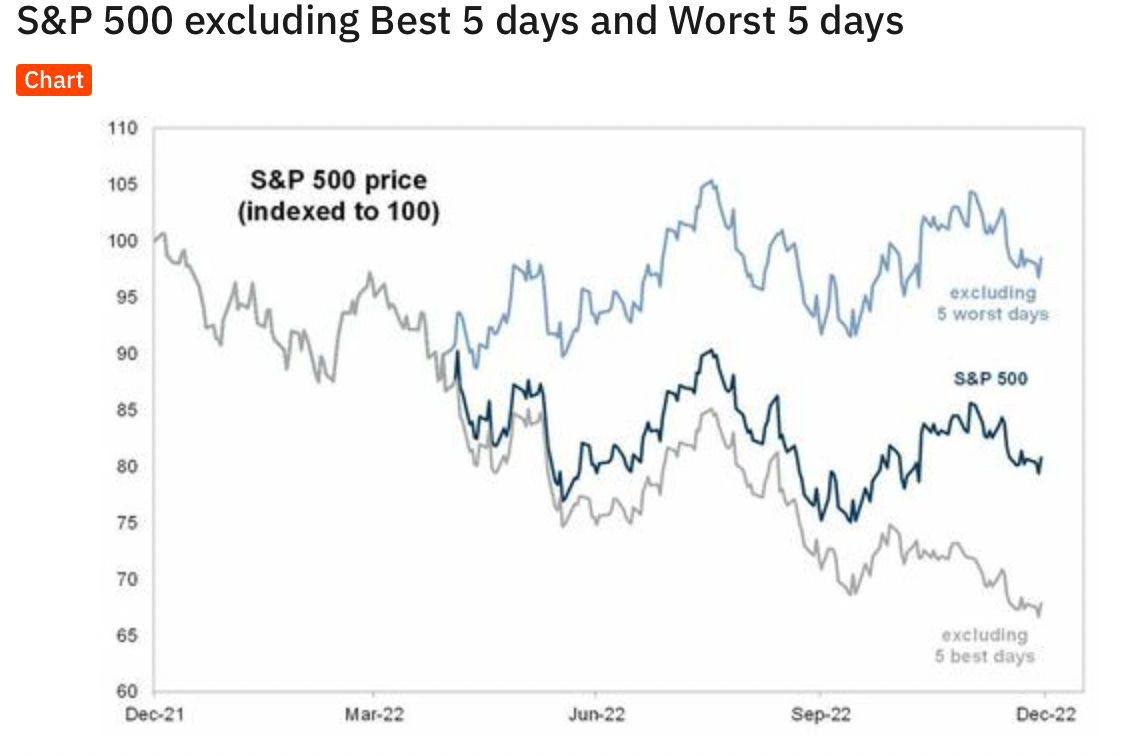

Image B: SPX performance when removing 5 best and 5 worst days.

Now imagine your own P/L if you excluded your 5 worst days. Or heck, even your 5 worst single trades. I imagine it would look very very different. So on that note, I can say this is a week where I am mainly watching and waiting. I am not going to recommend trades or a bias simple for the sake of filling up this post, id rather personally preserve financial and mental capital as I await the next fat pitch like last weeks longs which were massive wins. I have a slight downside bias but am expecting tough 2 way trading as market makers unload massive positions as options expire. It’s definitely a week to sit on your hands I think.

Levels I am watching:

I am hesitant to take any longs except for on an intraday basis. The main level I am watching this week is 4072 on ES which will be resistance. I would start building a put spread position there using a March 31 expiry with a strike 3% OTM.

Important events:

Not much in the way of market moving events except for maybe PPI on Wednesday.

Image D: Wednesday economic calendar.

I think we are past the point of inflation readings providing massive market movements, as options gamblers found out on Thursday post-CPI. I warned my readers last week to take no position pre the release and I am sure they are very happy to have done so if they listened. Just worth nothing to get flat before this release but am not expecting a change in market structure or trend based on this data point.

Happy trading and be in touch next week once we have more information. Wishing you a happy MLK day.