Recap of last weeks action:

Subpar earnings results with all the major tech companies reporting. The big tech titans (apple, Microsoft, google, etc) all with relative disappointing reports, but pretty much all of them trading up after their prints. This was obvious to me and you can read my previous posts on this. We have been talking about recession for months now, no one is selling on the day of the print because we learned no new information. As for the Fed, I often don’t trade the day or even the week because it’s an algo dominated disaster. The liquidity is too low and the market whipsaw both ways and takes all of your stops. Or if you don’t use stops you blow your account instead. But as I correctly predicted market has remained bullish and traded up and climbed this “wall of worry” of a hawkish Fed and earnings slowdown. ES traded briefly above 4200 even but closing the week about 60 pts lower. So where to now.

Next move for markets?

Down. Although the medium term trend is now up (consecutive opens and closes above 200DMA is a key factor) I think in the short term we are due for a retracement. Likely 4000-4100 area is where we might see bulls step in for a possible break of 4200. I do have long term views on the market, and I think there is a good chance we test and break the Oct lows, that is very dependent on data we have not seen yet. For that to happen we would need to see inflation materially reaccelerate or the job market showing signs of cracking and significant unemployment. Two things that are very possible even likely, but we can’t anticipate those with our trades just yet.

4200 is a major resistance, and we tried it twice last week, failing to break. The index is very overbought by many measures, well above all its moving averages and at the top of its keltner channel and Bollinger bands.

Image A: SPY looking very overbought here.

Now here you have the market being stretched to the upside, some mean reversion is very likely. With S&P being in a longterm downtrend, major resistance at 4200, and a seasonally weak period coming up, it is a no brainer for me to enter into some long term puts here. I am talking June, September, or even Jan 2024 expirations. Depends on your risk tolerance and position sizing. Very unlikely the S&P breaks 4200 before CPI on Valentines day here, and we likely see some profit taking and risk off before the huge event. Feb CPI of January data will be interesting as many companies wait for the new year to raise prices. So we will see what that day brings.

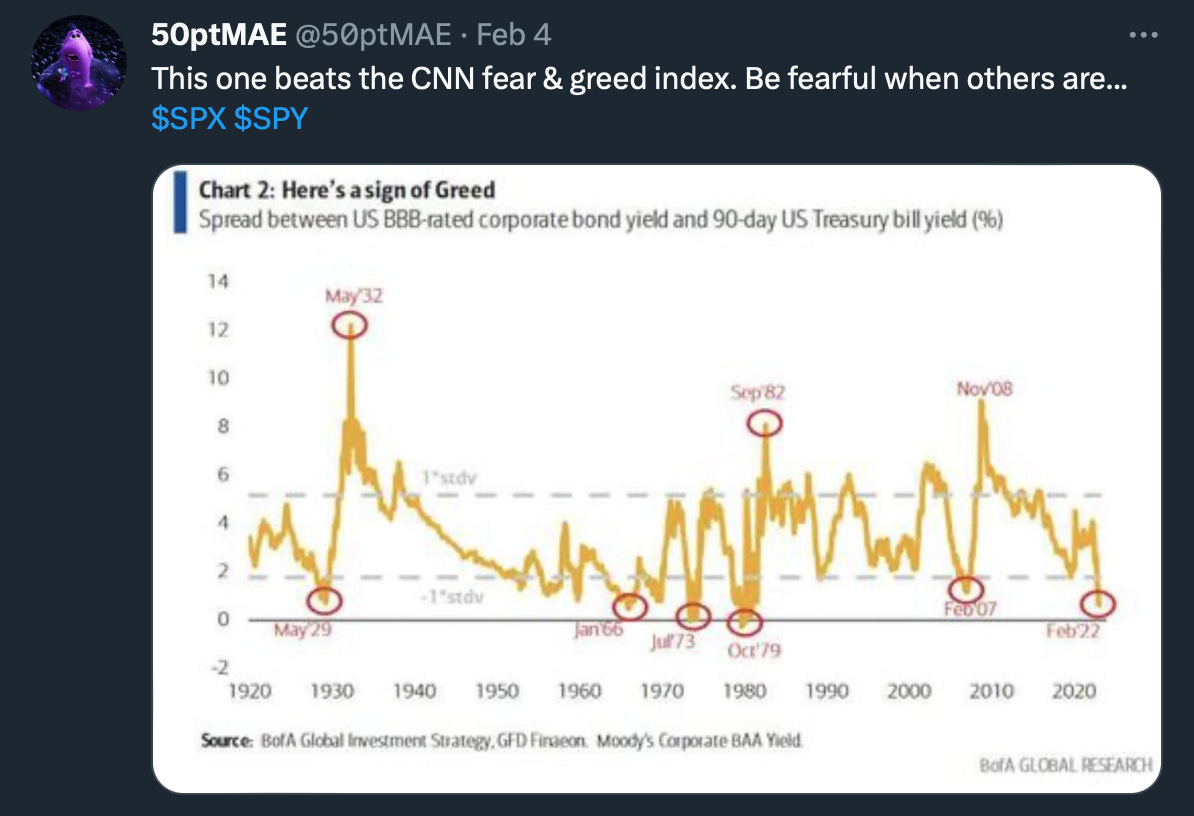

Image B: Spread between corporate bond yields and risk-free US treasuries.

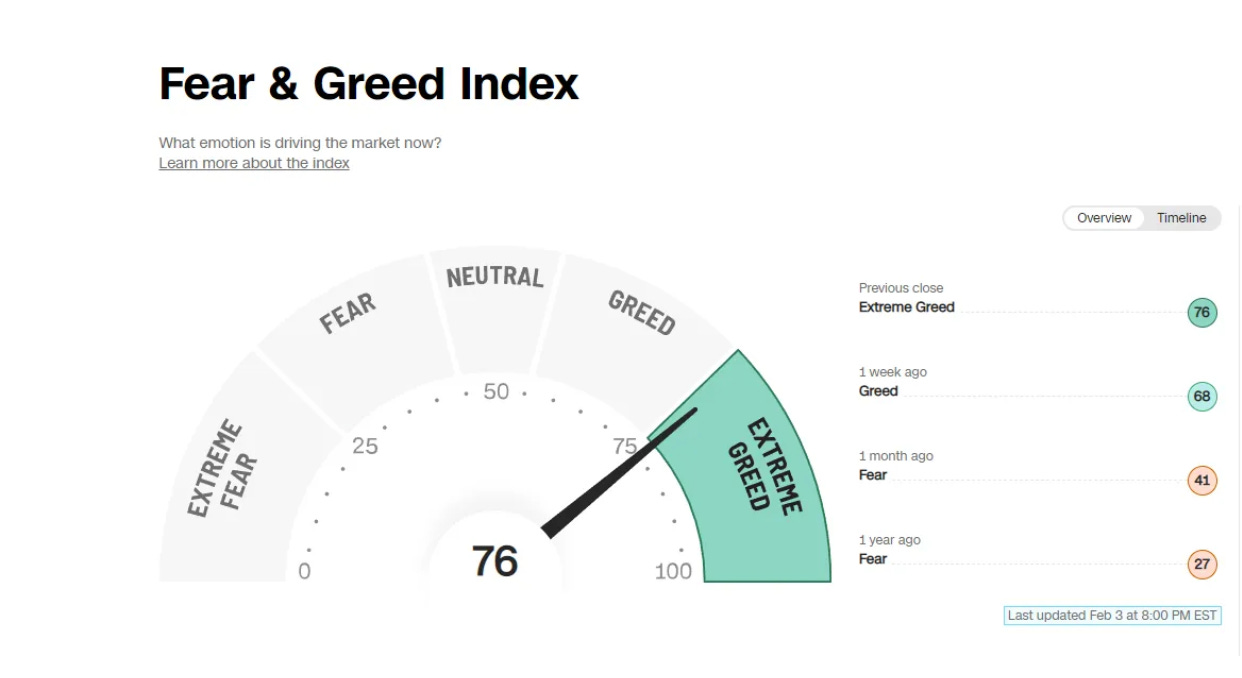

Image C: CNN fear and greed index.

It is time to be fearful now that others are greedy. If you have been following me the last couple of weeks you are long from MUCH lower. It’s time to take profits. I took all my longs off. And am net short via long dated options. A retracement is very highly likely, and this even has the potential to be a multi-month top which is data dependent but seasonality also lends to this theory. Recall the COVID crash happened after February OPEX.

Image D: Seasonality of S&P 500.

With weak seasonality, extreme overbought conditions/technicals, and a soft landing + dovish fed priced in, things feel a little too euphoric to me. Time to look for shorts as the easy points on the upside are gone. We also have Powell speaking on Tuesday.

Image E: Powell with Rubinstein discussion.

We will reevaluate next week.