Week of February 10

I am pretty sure the market will breakout soon and the direction is obvious.

Recap of last week

Last week the title of my newsletter was “With volatility comes opportunity”. And indeed it was. We took 1 single trade last week, an ES long.

We bought near the lows, and sold near the highs.

No need to sit in front of a screen all day to make lots of money. You dont need to win alot of trades, provided you are not losing much either. I would rather wait, swing big a couple times a month. The best thing about trading is you dont need to spend alot of time to make alot of money.

Next week is going to be very important. I see a range breakout in the next week or two if I had to guess. The direction will be obvious in hindsight.

Next move for markets

Up. I think the market after consolidating the last 3 months, is ready to break out and upwards. First thing to remember here, is the market is in a bull trend, it is trending upwards, and when you see consolidation in an uptrend you should expect it to resolve to the upside unless you have a good reason to believe otherwise. Right now the market is being pushed down by random Trump tweets and tariff fears, but when the rubber meets the road, its a supply and demand story, an earnings story, and a macro story and that trumps Trump tweets.

The market is consolidating for a powerful breakout I believe. All the major MAs are going up and to the right. This is a very clear bull trend and the market is innocent until proven guilty. What has been illuminating to me these past few weeks is how well supported the market has been on pullbacks (DeepSeek, North American trade war). We wrapped up another big earnings week, with mostly clean beats across the board. The only unwelcome development has been Mag 7 Capex, but that was expected by us and the market for a while now and the market has responded well with other sectors outperforming to pick up the slack.

The market has delivered broadly speaking on earnings season. The market will NOT see a significant correction unless EPS deteriorates, or we see an exogenous shock. EPS has delivered, so really the coast is clear here as no one can predict a black swan

I am sure you have noticed Mag 7 has been relatively weak this year. I hope you have all de-risked it last November when I urged everyone that the tide was shifting.

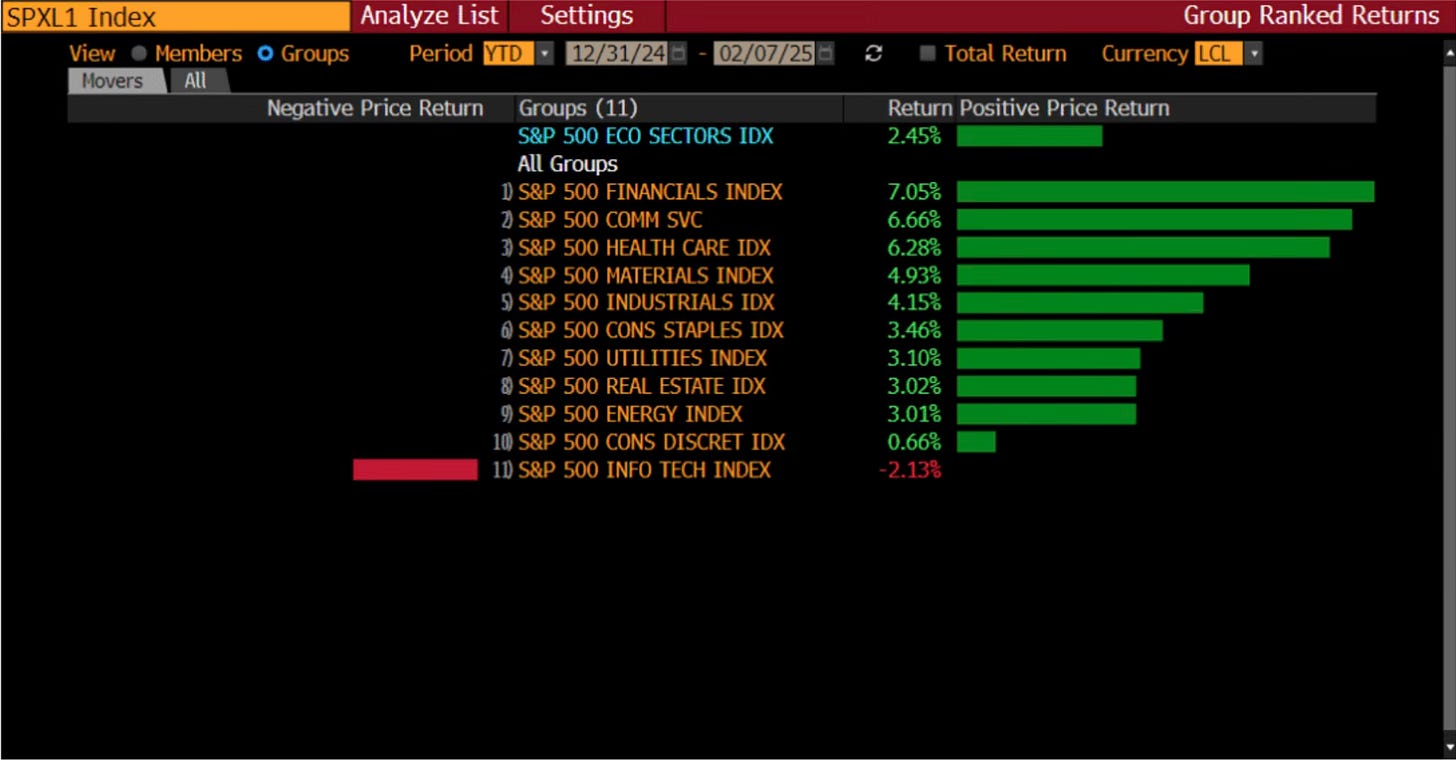

So what’s holding the market up? Literally everything else. If I held a gun to your head and said “does the market break up or down” while showing you this chart what would you say? The answer is obvious. Upwards. Ten out of eleven sectors are green, and the one sector that is red is tech which comprises the best business in the world that are just digesting recent Capex guidance, not because they are experiencing slowing growth or dominance.

This market is extremely strong beneath the hood, and I would say it is much more bullish now than it was in December, when the SPX was the same price but breadth was horrible and it was being held up by only the Mag 7.

But wait, there’s more.

We are seeing the early signs that the tide is shifting in Tech/Mag 7. Hedge funds are often the fastest horses out of the gate, and if you closely monitor their flows they often get the jump on trends right before they start. They are often the smart money in the market.

They bought tech stocks every single day this week. They are both covering shorts and adding new longs. This was a significant buying event going back multiple years. This is also extremely important as if you have been following my posts every week this is a distinct change of character from them compared to most of January where they were net sellers almost every single week.

So you have an extremely strong market with 10/11 sectors in the SPX being solidly in the green so far YTD, now you can start to see the tide shifting in tech as well, all whilst we are trading in a range that goes back 3 months. This all points to an upside breakout for the SPX, towards 6300 or so in my view.

Now of course we can’t ignore the main event for this week, CPI. As usual I will alert if I see a good trade opportunity before the event, as there are times when it makes sense to bet on a hotter/cooler print, especially if implied volatility is relatively low. We will have to see how things are looking on Tuesday. But I believe that this will most likely be a bullish event for a couple reasons.

First and foremost, what’s the trend for CPI? It’s cooling and on a downtrend. Out of the last five prints, four came in as expected and one came in cooler than expected. Even if the print on Wednesday is hot, that does not change the TREND of inflation. Just like if SPX has one down day after 5 up days, it doesn’t mean the price structure is now bearish. Common sense maybe, but alot of people are straight up delusional about inflation.

Of the last three February CPI prints, all three came in hotter than expected, and all three came in 0.2% ABOVE headline estimates. Why does February matter? Because it’s the CPI report for the month of January, which happens to be the first month of the year. Alot of companies choose to enact bigger price changes on the beginning of the calendar year. Self explanatory. This is known among experienced market participants, so in a sense the market has an excuse to ignore a possible hotter print.

The whisper for inflation is generally higher. This expounds on my earlier point, people are delusional about inflation. I dont want to get too off topic on why, but as you can see below your political affiliations apparently decide on how much you pay for daily necessities. There is an opportunity here. People are expecting high inflation, but the data does not reflect that assumption, and it showing something different. People are overly fearful about inflation, yet the data has not really given us a reason to worry just yet. You can sell that fear.

Ultimately what does this mean. In the event of an inline, or cooler print, I think the market sees a large and very powerful rally. In the event it comes in hotter, the market will drop initially but it may be bought up fast. The market has kind of a hall pass for a hotter print because its February, and also because the last five reports have been inline so just by the law of mathematics and statistics, there is such a thing called variance. Thats why the trend is important. And again, the trend is cooling inflation.

Now beyond CPI and earnings which we just discussed, what will drive the market these next few weeks? The focus again returns to systematic players, namely corporate buybacks and vol control/CTAs. McElligott from Nomura again highlights the target Vol funds who are forced to buy as vol gets crushed post events (or Tweets) and also the long gamma environment which will further support stocks.

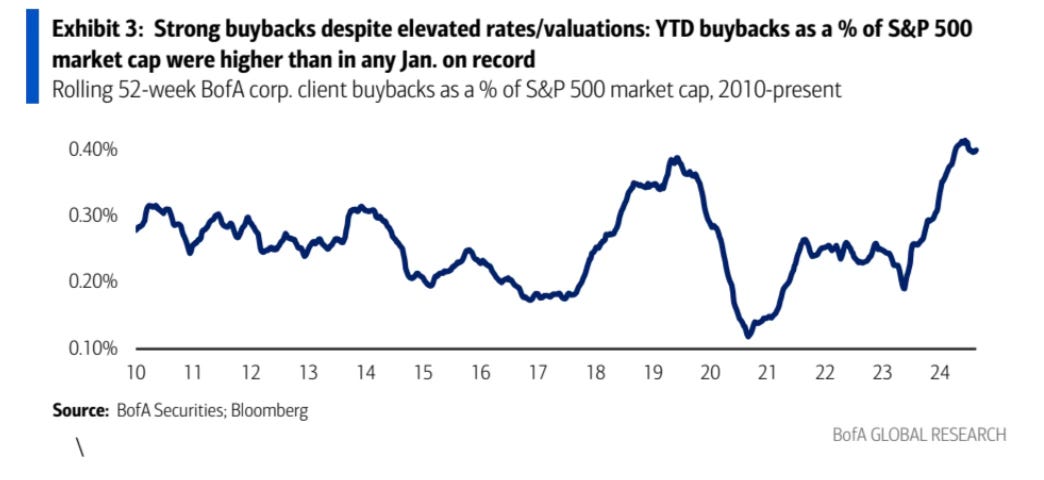

I am sure you are tired of being inundated by perma Bears screaming to the skies about how overvalued the market is. Oh and it is. The market is overvalued as fuck. You can cry about it, or you can accept the circumstances as they are and try to make money regardless. I choose option 2.

I would remind everyone that corporates are the biggest buyers of equities. And this BofA chart shows us that companies are not shy about buying stocks with the SPX at 22x PE. They dont care about your feelings. They dont care that your favorite bearish furu thinks rates are going to 7% or that the market will crash this year. They are buying stocks. Trillions of it, in fact. Ignore this at your own peril.

You guys know I have been bullish bonds for a while. Since October 2023 with yields at 5.1% for my long time followers. That has not changed. Here is Hartnett on bonds, written more eloquently that I can manage. But I believe he is right 100%. I see rates falling towards 4% and that will be supportive of stocks. Both from an ERP standpoint and less pressure on debt heavy companies. There is alot of excitement now regarding DOGE. Never bet against Elon, whether you like him as a person or not. He is a very determined and capable man and it seems like he is hell bent on cutting government spending, which will be a huge relief to bonds. This is another reason I am bullish for this week, I believe buyers will step in to buy bonds on a hot CPI so any damage to the trend will be relatively muted.

Another factor that has piqued my interest lately is the retail army coming back in a big way. GS has pointed out that the cohort has been extremely active, and recording buy side imbalances that register as the largest in history, this year. This is further supportive of markets as retail (and now hedge funds) are very active in the market buying the dip.

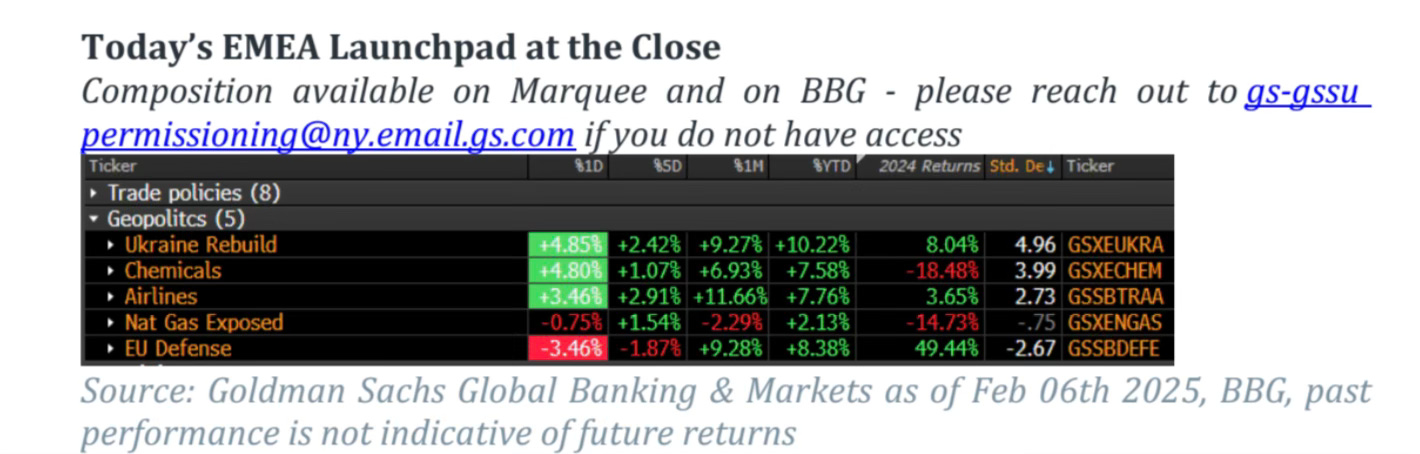

Last but not least, some geo politics. The market always knows before anyone else about what will happen in the future.

GS has an Ukraine Rebuild basket, and it is getting steady bids this year, while EU defense is getting dumped. It seems to me smart money is sniffing out an imminent Ukraine peace deal. 2025 we have come to know as a a year Trump tweets crash Sunday night futures, but I think this is something to have on your radar as a potential white swan event. This is also a reason why I believe that the DAX (German S&P500) is up almost 9% YTD. More likely than not they will arrive to a peace deal and the news will drop at an ungodly hour and the SPX will likely gap up while we are all sleeping. This is another impetus for lower inflation as Ukraine and Russia are both big exporters of crucial commodities like oil and wheat.

To sum up, I believe the market will break this 5900-6100 range to the upside in the next 1 or 2 weeks. As befits a 3 month long consolidation, it will likely be a powerful and fast breakout, with no time to jump in once it gets going. CPI could likely be hot again, but for reasons stated above the market seems poised to shrug it off as the underlying trend of cooling inflation is apparent to level headed market participants. Post earnings season, the attention returns to buybacks and systematic players. The extreme strength of the broad market coupled with fast money (hedge funds and retail) jumping in to buy the dip on technology stocks should fuel the next leg up.

Trade Ideas

Still long the March SPX call spreads. In the event of a CPI gap down, I would likely use that opportunity to double my position as I believe in an upside breakout

Similar to above, I may use a CPI dip to add TLT exposure via calls (already have it in my retirement portfolio)

Depending on market positioning into CPI, I may decide to buy a short term hedge and if I do so will alert in the chat.