Recap of last week

Last week we smashed it.

Three trades given, all three winners. I didn’t end up taking the puts personally but they paid on Wednesday when FOMC sparked a 1.5% selloff. The USDJPY we closed out for 0.5% gain, which is fantastic given that was our hedge to long equities. When your hedge even made money that’s when you know it was a good week. The SPX calls we entered printed, along with our futures long on Friday.

The plan played out to a T, exactly as I expected. Hawkish Powell, knee jerk sell off, and then market gobbles up the new supply.

After establishing our swing longs, I became extremely bullish at 1:14PM on Thursday. Market then went on to rally 90 points in just over 24 hours.

.Oh and then on Friday morning we tripled down on our winners and added to our long calls with long futures. We got filled at around 4937, before a 60 point rally intraday.

Next move for markets

Up. SPX 5000 remains a magnet. It may hold as resistance for a couple more days but I am expecting to reach the target and most likely break through and trade even higher. My road map for the next couple of weeks, is a rally to around 5100 SPX by Feb 16.

Constructive price action for the bulls once again. SPX loves the top keltner line, and is very comfortable riding on the top band. RSI cooled down a bit thanks to Powell, looks ready to take another peak into overbought territory, which is bullish.

On FOMC, there was nothing said that truly surprised markets. Powell as expected came off super hawkish, but if you have watched and read enough FOMCs, you can tell the difference between the what the Fed is planning to do, and what the Fed is saying it plans to do. There is a distinct difference. There are the Fed’s true intentions, and there is jawboning. Powell was jawboning. If the data warrants it, or there is instability in the banking system, there will be a March cut. It doesn’t matter what he said on Jan 31. The Fed is there to support the markets, and the economy if the need arises. There is no doubt about that. The selloff was typical and easy to spot, as outlined last week. This was merely an opportunity for sophisticated market participants (like us) to get on board the rally train with a backtest of old ATH’s 4818. Obviously we didn’t hit that, but that’s how it works with huge levels, they get front ran. If markets always backtested to the exact level, that would be amazing, and we would all be rich wouldn’t we. Unfortunately, you have to get your hands dirty, and front run the levels, and take some heat to get on the train. Just how it is. Now that some big players got a chance to get long at good levels (low 4800s) I fully believe we are on the train to SPX 5000.

Now regarding Powell on 60 minutes, which will air Sunday evening. I do not expect this to be a market moving event. If it is, I expect it will be market moving to the upside. The reason for this is, primarily I dont think Powell has anything to say that will surprise markets. We know the Fed is committed to fighting inflation, we know they are data dependent. We also know if shit hits the fan like the SVB crisis they will inject liquidity. He also just came out on Wednesday FOMC and was very hawkish. What will he say on 60 minutes that wasn’t said at FOMC? 60 minutes is not the time or place to give statements on monetary policy. I rewatched the 60 minutes episode on April 2021 when Powell appeared during the COVID recovery. It’s fairly in depth, but did not move markets and didn’t reveal anything that wasn’t public knowledge already as conveyed through the FOMC. It’s kind of a FOMC lite for the average American person. You have to remember most people buy and hold S&P and bonds, most normal people don’t know who Powell is or what the FOMC is. Think of it as a FOMC lite, for regular people. If anything it might be a bullish catalyst as people are a little scarred still from Wednesday so they might have taken down exposure or shorted ahead of Sunday, and when it turns out to be a non event they will buy back, or have to cover.

On the economy side, we had a very encouraging beat from ISM manufacturing with it coming in at 50.7 (expected 50.3), we also had the blowout NFP of 353k. Showing that manufacturing in the economy was turning back up and the jobs market remains very healthy, robust, and tight. This is bullish. I don’t believe March or May start for Fed cuts really matters, and it’s clear the market agrees to. The economy is still humming along and the hard data proves it. We didn’t get retail sales this week, but in January they beat as well so manufacturing, consumer spending, jobs are all healthy and strong. This is supportive of new highs in equities.

On earnings, the expectations for Mag 7 were very high. Yet they did not disappoint. MSFT, META, and AMZN really impressed. TSLA was weak, but it’s just a car company that somehow squeaked its way into Mag 7. META in particular was stunning, with it issuing a new divy, and yet another 50B buyback. AMZN showing great progress in leaning out with very encouraging operating income and margins as well as strong AWS growth. I think those two will continue to be bid up this week which will help support the Nasdaq.

Seasonally speaking, we are in a slightly bullish period. The first half of February tends to see some strength early on but nothing to write home about. Still, it favours the bulls. I think the coast is clear to buy dips towards at least Feb OPEX, as you can see circled in red that is when things get tricky. We will cross that bridge when we come to it though.

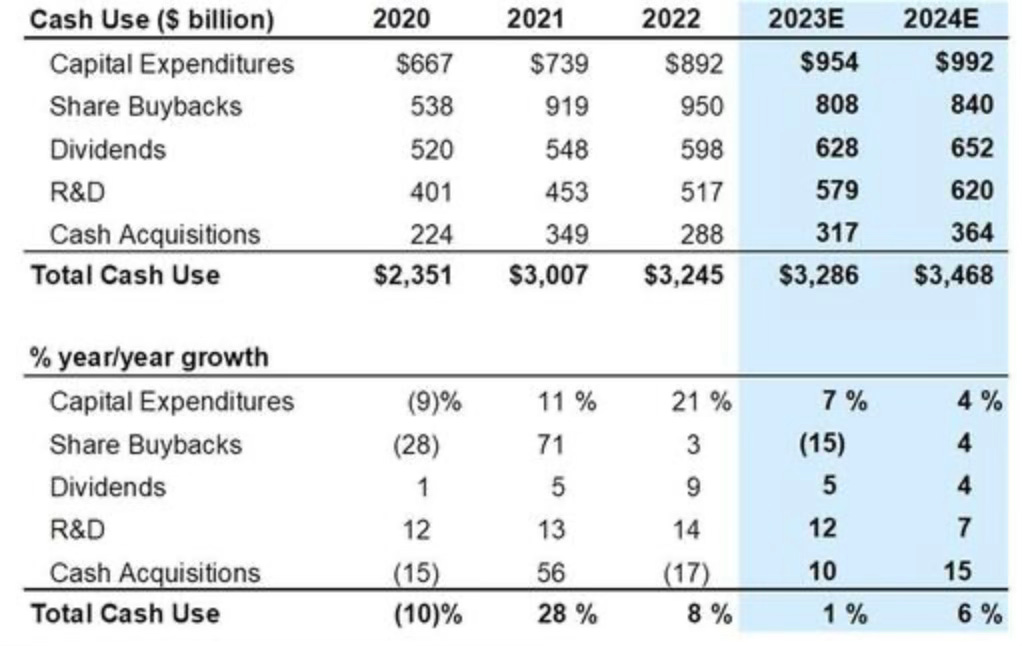

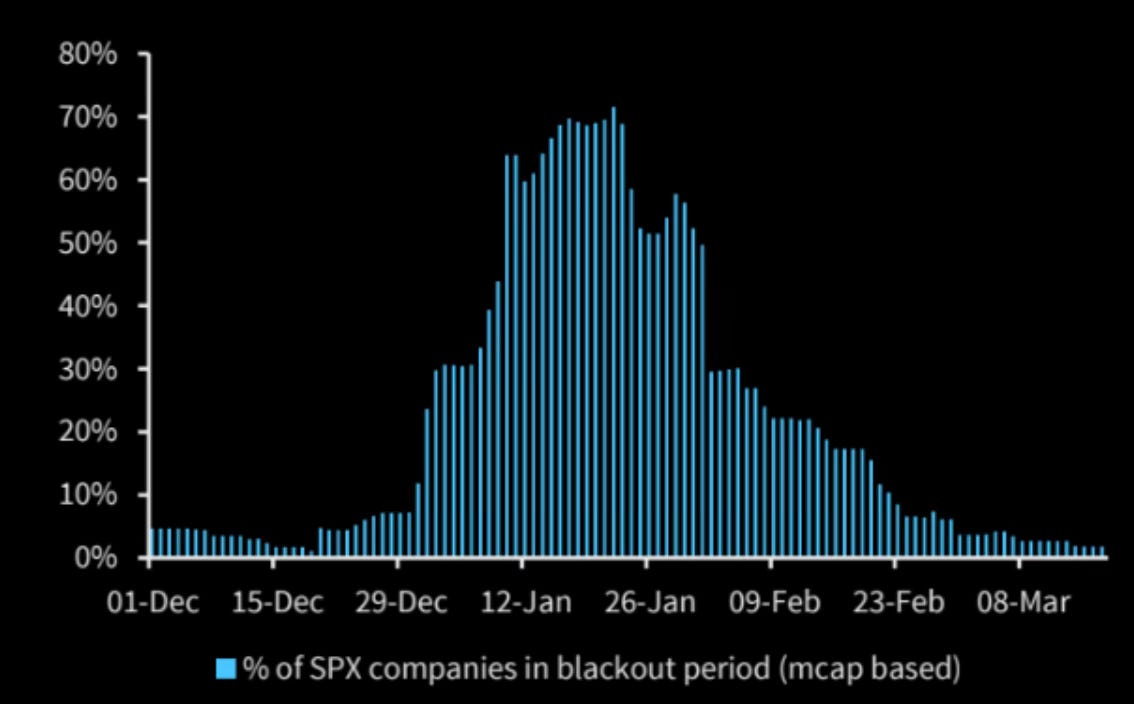

Very important to note, we have now for the most part exited the peak of the corporate buyback window. Buybacks were a pivotal part of the EOY rally last year as I have touched on, and they will be back with a vengeance now until March or so. GS has 2024 authorizations at 840B, so call it 210B a quarter as a crude estimate. These are algos, unloading their billion dollar clips at VWAP, day in and day out for a month plus. These machines aren’t getting emotional, they aren’t drawing dot-com comparisons, they aren’t scared about no AI bubble, they are just lifting offers with billions of dollars day in and day out.

In this upcoming week, of relatively little catalysts, being that FOMC and NFP are behind us and CPI isn’t until next week. These indiscriminate flows such as buybacks really matter.

As I mentioned earlier, I don’t believe 60 minutes is anything to be concerned about, this week will be a chase for 5000 SPX, a chase for META AMZN and MSFT. Probably people chasing NVDA for their upcoming earnings which I am sure will be a doozy. I can’t really think of anything to knock bulls off their momentum here, FOMC and QRA was a real risk to markets and that’s all done and dusted for now.

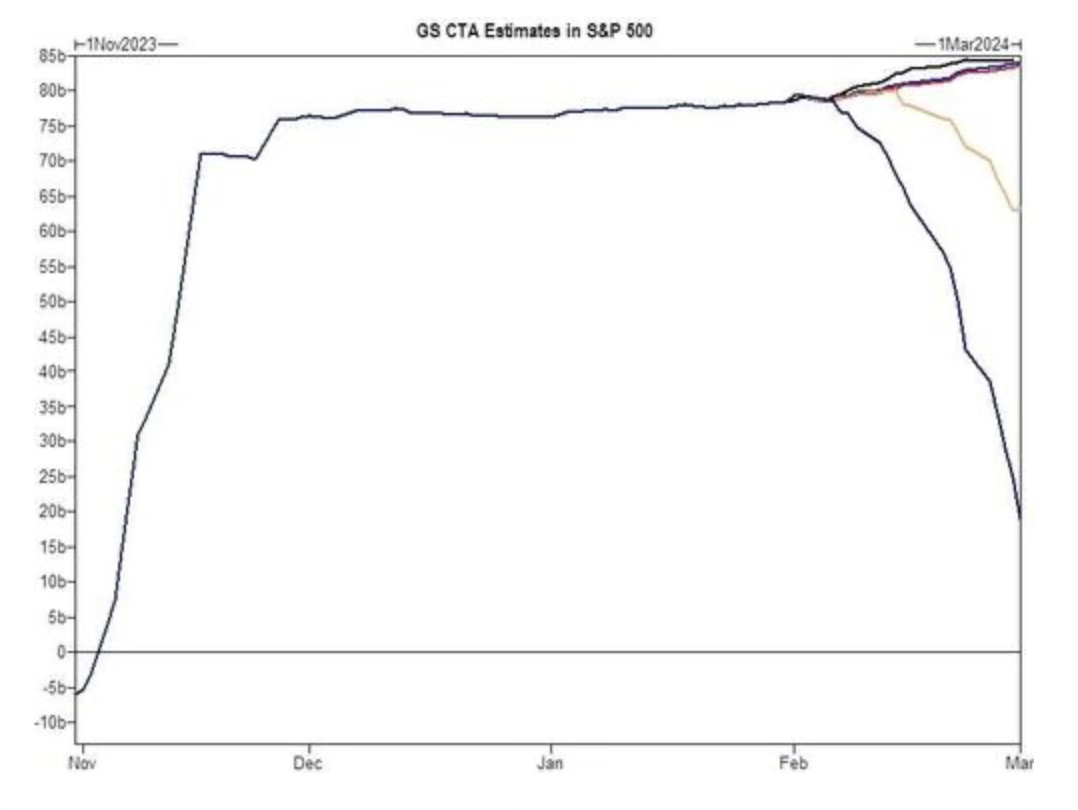

On the systematics side, the picture remains the same broadly. Huge flows to sell if we sold off from here, but basically a non factor unless you anticipated SPX to lose 200 points from here.

To sum up, last week I believe was a healthy consolidation and pullback to previous ATHs in the form of a backtest. Many smart market participants used it as an opportunity to jump on the long bus as we target 5000 SPX. FOMC was as expected, Powell echoed recent Fed speakers such as Waller, as well as Lagarde and Bailey from the ECB and BoE. The bottom line is this for all the Central Banks, they are committed to fighting inflation, see cuts down the line in 2024, but between the lines they will all ease at the drop of a hat if financial stability or orderly function of markets is in question. ISM, NFP continue to signal a very strong economy. There is a dearth of big catalysts this week so expect the current uptrend to continue, led by the Mag 7 as they come off huge quarterly earnings reports. Corporate buybacks are also back and will serve as a huge tailwind for markets. The coast is clear to buy the dip, and remain long biased.

Trade Ideas:

We continue to hold our 5000 March 15 SPX calls.

I would love to build a swing futures position to target 5100 SPX. I am hoping for an entry Sunday/Monday. I will leave bids at 4966, 4961, and 4955 on ES.

Seems like we got all our entries...Where’s a good SL for you?