Week of December 4

Do we breakout to YTD highs?

Recap of last week:

After 4 straight winning weeks in November, it looked like the streak was over this week, but we managed to finish strong Friday and ended the week once again extremely profitable.

To start off with SPX of course, as of last Friday’s close (Nov 24) of 4559, the market traded down into 4541 with no MAE early Tuesday morning.

Nice solid base hit winner to start the week. 20 points with no MAE. Doesn’t seem like much but you have to remember that the VIX is mid 12s, the entire WEEKLY range was only 60 points or so, and it’s December. No one really is trading. I thought this would be a bigger winner, but to be honest Waller’s comments caught myself and alot of people off guard I think.

If you didn’t move your stops in profit, there was another chance to get out at the double bottom before Powell spoke on Friday. Overall, it was a choppy and extremely boring range bound week on SPX. You either made a small profit or small loss. Anyways that’s not where the action was this week.

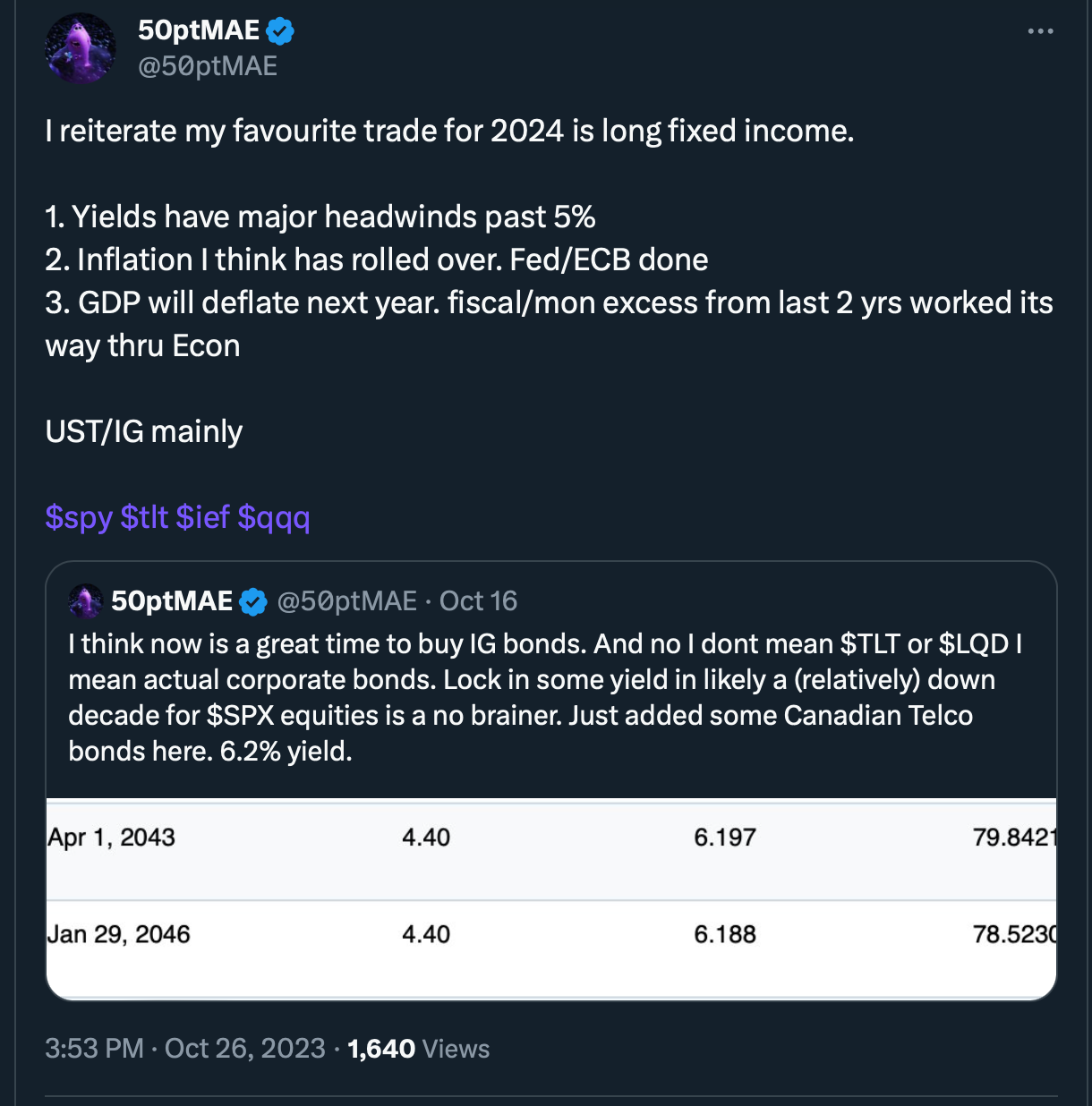

Bonds screamed higher once again this week, closing up over 3%.

I have screamed from the mountaintops non-stop in October how much I loved long bonds. No doubt I have annoyed many people. The people who are not annoyed, aren’t because they are making a fuck ton of money with me. There was basically no action in SPX this week, but we had yet another monster week because of our long bond positioning last month and letting our winner ride.

But we weren’t done yet. The last trade of our weekly basket here was an FX trade. I always love to hear from my followers and many have expressed the desire for more trades and discussion around other asset classes, how they pertain to equities and also in and of themselves. That will be one of my key main focuses as I enter the new year.

We got short EURJPY, a trade in which I will cover in detail below. I even had a horrible entry here in the short term, im sure many of you were filled close to 163. Regardless, after that short lived squeeze this pair dumped 1.58% to finish off the week.

All in all, an amazing week. We were long bonds in large size (+3.13%), short EURJPY (-1.58%), and short SPX (+0.87%). Two out of three trades hit, and even the SPX short was a winner if you closed the trade on Tuesday. At worst it was a small loss more than offset by the other two winners.

Now post-Powell and knocking on the door of YTD highs, where to next?

Next move for markets?

Down. I think the main course this week is Non-Farm Payrolls. Until then expecting more of the same of last week, which is a range trade between 4540 - 4600 SPX. As you should know by now you never anticipate the range break, we are just under YTD highs right now at 4594, I think 4600 is conquerable but it would have to be on the back of a cooperative goldilocks NFP print and STIR (short term interest rates) pricing.

What jumps out at me is the extremely strong uptrend of course. Makes me hesitant to outright short SPX, but we had success last week shorting it within a basket of other trades. First I want to flip the question around and ask do you want to long here? RSI at 73.44 and where it peaked in late July and June. Way above the top keltner channel. 8EMA converging with the top keltner channel. Just a hair under YTD highs. Longing here is not even remotely appealing. So I think we take a pass on any longs for now, and if it squeezes up for no reason I am happy to miss those points. R/R is just unappealing here.

Regarding last weeks trades, I wanted to expound a bit on that selection. To begin with, knowing where we are on the calendar year is important. We are in the early days of December, volume and general activity in the market is pitiful as expected. Especially in up years in the SPX, when you start approaching year end you have people locking in gains. I love discovering real world reasons for market behaviour that cannot be explained or have nothing to do with what the SPX ostensibly moves on which is corporate earnings/EPS. For example, the fact that extremely large amounts of money, hundreds of billions are managed by institutions, which are then led by individual people at the top of the organizational structure. A single person, is ultimately in charge of these funds. That person, the CIO or CEO usually, is mainly motivated by incentives.

Another beautiful quote by the amazing Charlie Munger, may he rest in peace. So in a hypothetical scenario, but one that is very realistic and one that reflects actual reality for alot of fund managers today, right now, is that they are up on the year, or beating the benchmark in the SPX. They invariably are on a compensation plan tied to their fund performance, and say for example you are up 25% or 30% on the year and SPX is up only 20%. What many of them do is lock in gains by either converting to US treasuries to lock in their profits or many just jump back into the index. It’s always a game of indexing to the benchmark. If you are already beating the SPX, say your alpha (abnormal rate of return to the benchmark of S&P 500) is +10% and it’s December 3, your incentive to take on additional risk is very very low. Because your job is already safe, you probably have hit additional tiers of compensation as outlined by your Board of Directors, you are just fine and dandy doing nothing for the rest of the year. Essentially it’s the finance version of being up 3 touchdowns late in the fourth quarter. You hand the ball off to your RB non-stop to grind out 3 yards a carry while you run out the clock. So part of the reason why volumes die down and trading ranges collapse is because alot of winners exit the market. The die is cast so to speak for many, no one is making or breaking their year in late November or December.

So knowing this, you kind of have to adjust your trading methods here. It’s why I was so adamant about swinging for the fences and leveraging up for the EOY rally in October, because it’s slim pickings now. Many traders opt to switch to a money market fund such as MINT 0.00%↑ and take an extended holiday. Theres nothing wrong with that, and I think it’s a great choice for many. Me personally, I usually choose to trade, you just have to be more open to other opportunities besides the S&P. Also, you have to contend with the fact that volatility is extremely low this time of year, you need to be fast to take profits, and not hold too long hoping for multi baggers. The market simply aint moving that much. The fact that we barely moved 60 points the entire week on the back of some bombshell comments from Waller and to a lesser extent Powell was telling.

Back to my basket of trades of long bonds, short EURJPY and short SPX. I liked this selection of trades because I thought the chance I hit 2 or 3 of them was very high. And of course most importantly, I thought the chance I took a large loss on these trades was very low. I want to try and dissect them for you and help walk you through my thought process. The idea behind a basket is a selection of low risk high return trades that are uncorrelated. Ray Dalio’s Bridgewater did not invent this ideology or portfolio construction but is one of the most famous for this. Ray discovered a long time ago that when people thought they had a diversified portfolio they were were often mistaken. Some people consider diversification a basket of different stocks, often times all within the same sector. Some people think a basket of different stocks in different sectors is diversified. Some people think a basket of stocks from different countries is diversified. Some people think a basket of stocks and bonds is diversified. Ray’s realization was that none of these were true. He suggested a basket of trades ranging from equities to bonds to agricultural products, ranging from Emerging markets to developed markets, and across different currencies. I agree with this take and it is genius in its simplicity. A sample portfolio might look like this. 20% SPX ETF, 20% Emerging market bonds, 20% commodities, 20% Chinese high yield, 10% Canadian REITs, 10% cash in Euro or Yen. Thats a totally random portfolio but you can see how each individual position has the making of possibly large winner, but are largely uncorrelated. You have exposure to USD, EUR, CNH, fixed income, equities, EM and DM, cash and commodities, and real estate. Thats true diversification. People buying XLK XLY XLE XLC and think they are diversified are living in a dreamland.

To circle back to last weeks trades. My SPX short was predicated on technicals, largely relating to the AI basket and technology, it was also long duration through SPX technology weighting. So I like to work backwards, and think if I put on X trade, how do I get fucked on it? My SPX short would get fucked if the Fed (Waller and Powell) came out dovish in their remarks. They could talk down FCI and short term yields. Funny enough which is what happened.

But then I am already long bonds, and in larger size than my SPX short. So I was hedged, as my long bonds trade appreciated much more than my equity short. I also liked the asymmetry to this trade because the market’s calculus in this case when evaluating dovish Powell/Waller is they see the underlying impetus for easing monetary policy as a sign of an imminent hard landing. Otherwise why else lean dovish when we are still a ways away from 2% inflation. In a hard landing scenario bonds appreciate considerably as corporate earnings slow and margins compress. So my long bonds position would appreciate in two ways, both from FCI loosening and any signs of the Fed members alluding to a hard landing.

The last trade of the basket was short Euro against a long Japanese Yen position. This was similar to my long bonds trade, where the Euro would have sold off on any dovish remarks by the Fed. Reason for this is ECB moves pretty much lockstep with the Fed, and futures rates pricing pretty much mirrors what the Fed will do. So in the case where they lean dovish, and they did, the Euro would sell off from more cuts being priced in on the ECB curve and sooner as well. The Yen also appreciates in this scenario as it is often a safe haven during harder economic times. The reason for this is beyond the scope of this blog, but Japanese households hold a very significant amount of wealth, which they tend to invest overseas in higher yielding currencies or markets such as the USA in good economic times. When the macro dark clouds are forming, they tend to buy back yen and repatriate those funds.

So, 3 trade basket.

SPX short (risk is dovish Fed, but positions 2 and 3 will benefit instead)

Long bonds (risk is hawkish Fed, but close to 0% chance that happens due to deteriorating economic data AND disinflationary trends)

EURJPY short (risk is hawkish Fed once again)

So when putting on these trades ultimately I saw very little chance for me to get fucked. SPX was running out of gas, especially in technology so I thought the chance of me getting squeezed was very small. I thought the only way SPX would rally without tech is on dovish comment. But if we got dovish comments (and we did) my bond long and EURJPY short would both print. Which is what happened.

Now moving on to the next week, because my base case here is more boring rangebound trading until NFP I still want to remain in all 3 positions here, because nothing has changed really. Tactically, I dont want to keep eating these theta checks so I will switch from a SPX put position and short some TQQQ instead.

Systematics wise, they have moved from heavy short in late October to now modestly long. There is asymmetry to the downside, but in a flat tape they are pretty quiet in the background. Dont expect their market impact to be anything major this week without a catalyst to trigger a break until NFP.

Waller’s comments in particular this week were very eye opening. He is historically a more hawkish member of the committee, and his reticence to remain jawboning in a time where the battle against inflation is not over smells to me like a fear they have gone too far too fast. I think the market sniffed that out too, which is why bonds rallied so hard this week. I do think monetary policy is a super tanker and it moves with long and variable lags, and by the time they start easing it the damage will have already been done. As I mentioned before, if a recession was coming, they could start cutting today and it would already to be too late. On that note I leave you with a final chart. The ERP, aka earnings risk premium or the price you are getting paid to withstand the volatility in equities over buying treasury bonds. 3.2%, what do you think?

To sum up, likely more rangebound action until NFP. We remain short equities but switch to a different instrument for tactical reasons. We remain long bonds. We remain short EURJPY.

Trade ideas:

Sell short shares of TQQQ, now trading 44.44. Stop loss a close above 4600 SPX.

Thanks for the update - what about retards like me who did not get long bonds nor short EURJPY - still a good idea to take a stab at shorting?

I still have the SPX Jan put, stop loss for me is D1 close 4600, is that still valid?