Recap of last week:

We were bullish last week, and market rewarded us again.

When you start becoming more and more experienced with trading SPX, you realize the old adage of buy dips and sell rips does not apply in many situations. There are times when the best trade is to buy the rip, and sell the dip. It was not an easy decision to go long last week at 78 RSI, but after a thorough and detailed analysis I decided it was the right move and market did indeed move in our favour. I think mean reversion is the #1 cause of all blowups. In true bull markets, and strong price action, the market will not dip to your perfect ideal entry and will just keep ripping without you if you dont just hold your nose and jump in.

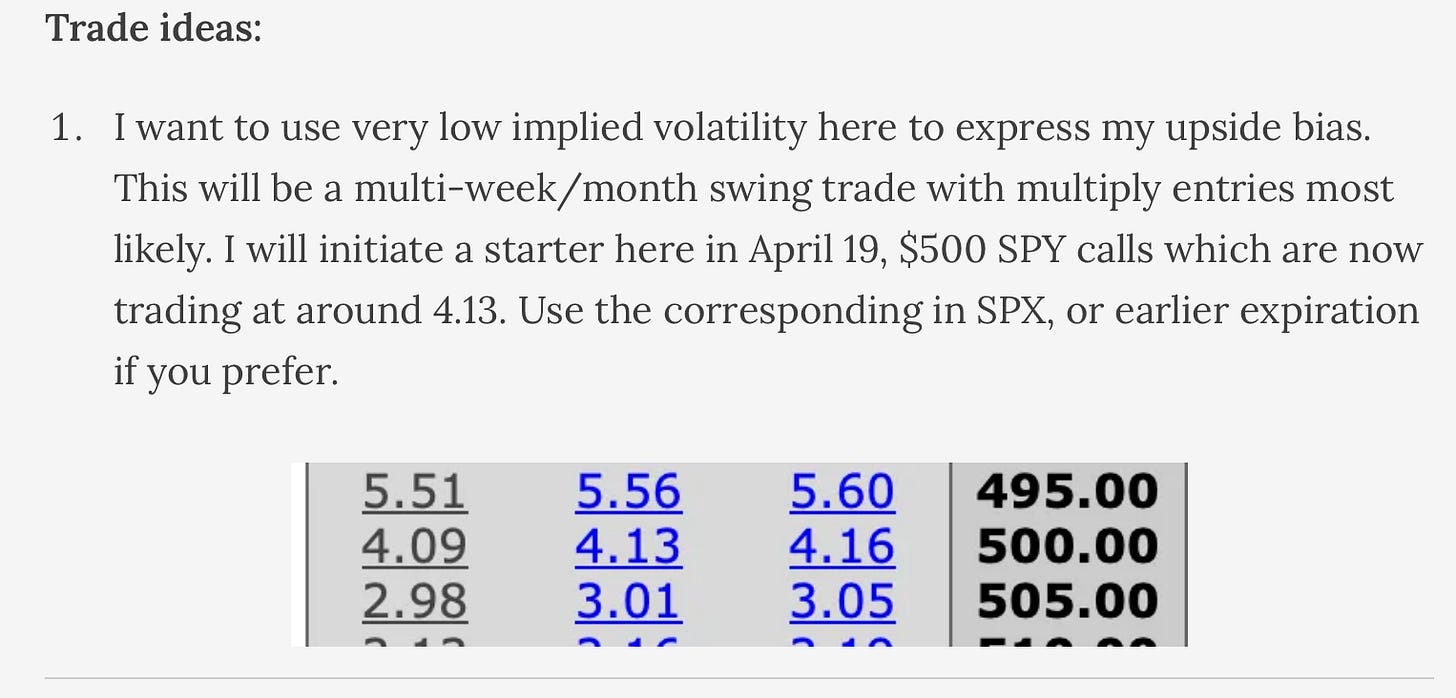

We took these $500 April calls, so 4 month calls, quite safe in terms of time to expiration, and they finished the week at 5.29. So solid 20-30% gain. No one is making or breaking their year here in the last couple of weeks, but as always we focus on just executing our process over and over again and the money just naturally follows. An update on the trade below of course.

Next move for markets?