Recap of last weeks action:

I was long biased last week. Finished the week with a small loss. Last week was shaping up to be pretty uneventful until the Fitch credit downgrade of the US government. That’s a tape bomb if I have ever seen one. The last downgrade was 12 years ago in 2011 during the debt ceiling crisis. These type of things you can never predict. Biden could have a heart attack, China could invade Taiwan, there could be a new pandemic etc etc. One thing you have to be OK with if you are to pursue trading long-term is to expect the unexpected. Again, you can only judge your process and not the results. Looking back I wouldn’t have done anything differently, my uncle doesn’t work at Fitch so no way of knowing that was coming.

But at least we didn’t take any major losses. The news dropped Tuesday PM, and we closed below my first support 4530 the next day. So I mostly derisked by then, and you should have too. Took a small loss. I’m ok with that. Small loss, great. Small win, great. Big win, amazing. Big loss however is unacceptable.

This is the good news however, in a bull market there are always retracements. Although we took a paper cut this week, this new volatility usually means there will be an opportunity to buy the dip soon.

Next move for markets?

Down. Now, to reiterate what I said earlier on my Twitter, the downgrade by Fitch is almost meaningless. At the end of the day there is no alternative to US treasuries. In the sense of, an asset that is relatively high yielding, (4-5%) for most maturities, and as close to risk-free as you can get on this planet. Yes there is a risk that aliens invade tomorrow and eradicate the USA, but other than that you can virtually guarantee you get your money back and your yield. If the US isn’t paying their treasury holders, the world is likely in utter chaos so no point even worrying about it. So the AAA to AA+ is really just semantics. No multi billion dollar pension fund is selling their US treasuries to buy Japanese bonds that yield 0.6% or German bunds or whatever. This move also doesn’t cause any forced selling, AA+ is still an extremely high credit rating and US government debt is still seen as the “gold standard”. No one would trade their US treasuries for another countries bonds, period.

What caused this selloff then? This was just an excuse for the market to selloff, and retrace a bit. The reason we got such a big reaction is this rally has been quite extended, positioning rather lopsided and this just frankly caught alot of people with their pants down. This flushed alot of upside positioning out, alot of late longs were liquidated, and the gap down destroyed alot of OI in calls which ripped SPX away from the 4600 gamma magnet. A look at the technicals here.

Image A: Technical damage incurred.

SPX had its worst week since March, the first 1% selloff in 2 months, and closed for the first time below the 21EMA since May. Noted. The gap down below the 8EMA, then the close below, then the test from underneath and rejection to close below the 21EMA on the Friday is pretty weak. I am also paying attention to the lack of the ability to rally on Friday after the NFP print as well. What a stock doesn’t do often says alot. 4 down days to end the week was giving 2022 vibes. Here’s the deal, the market has rallied alot this year, Nasdaq was up almost 40% in 7 months. I don’t think anyone is rushing to buy the dip just yet, especially in a weaker month for flows and poor seasonality.

Part of the reason for the selloff was the weak AAPL earnings as well, y/y revenues were down in almost every segment. Apple will always be the bellwether for consumer discretionary and they didn’t have any encouraging things to say. Another reason for weakness is some front-running of the upcoming CPI print.

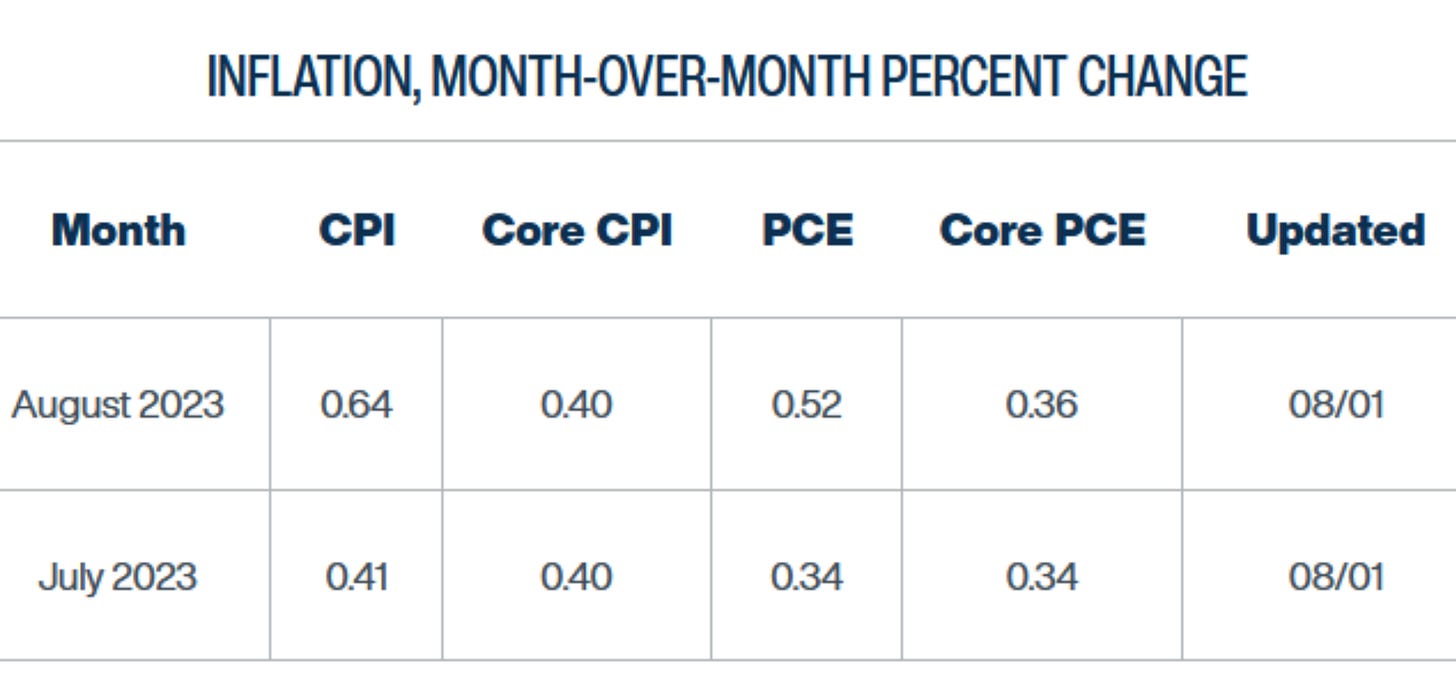

Image B: Cleveland CPI revising upwards on Aug 1.

Whispers of hot CPI print are circulating, primarily due to the oil and gasoline rally we have witnessed as of late. Apart of being part of the crucial energy costs component, energy is a key contributor to inflation in other areas such as food, plastics, shelter. A hot print if we get one, also comes at an inopportune time, right before Jackson Hole. Recall last year the market sold off from 4300 into the ultimate bear market lows of 3500 starting with Powell’s mega hawkish Jackson Hole speech. No doubt that is on the market’s mind.

Image C: BofA posits a strong correlation between diesel and CPI.

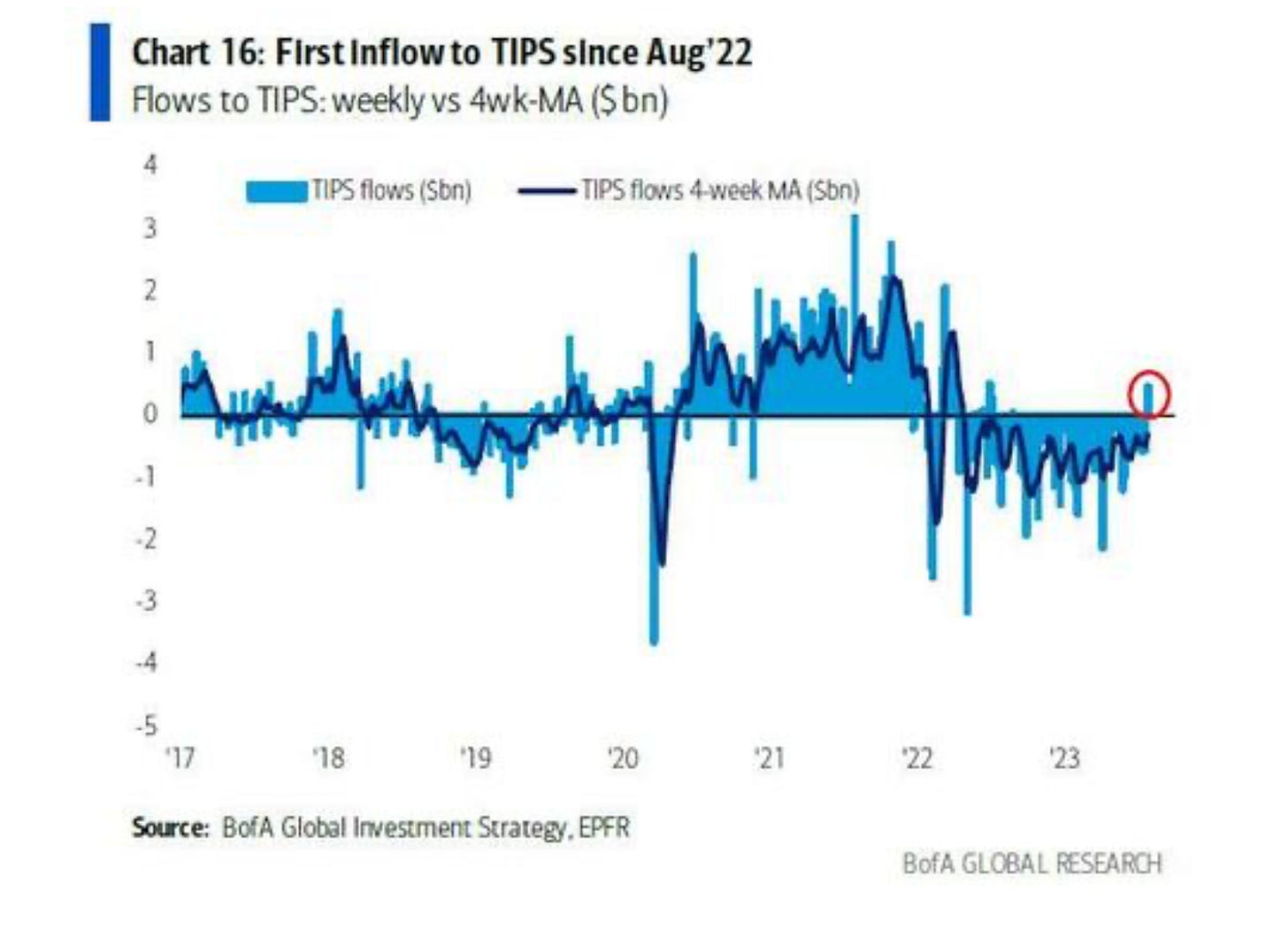

What also been worrying markets and the bond market is the resurgence of inflows to TIPs, inflation protected treasuries.

Image D: Investors buy TIPs when worried about inflation.

So we have a mega hot rally that needs a pullback, the Fitch downgrade, subpar earnings from the most important company in the world, front-running of a hotter CPI print, risk off before Jackson Hole, and lastly weak seasonal with net outflows during August.

Image D: The flow of funds picture is usually negative in August. Tailwind turned headwind.

Lastly, what has been a major boost to the market earlier in the year has been sentiment and positioning. That is no longer the case. As of earlier this week, everyone was super bullish and generally overextended to the upside.

Image E: Bullish is not unique here.

Of course CTA’s remain max long as shown below. Another big incremental seller this past week was vol control. They have regrossed this year in a huge way as we grinded down to 13 VIX.

As the VIX spiked last Tuesday, and remained elevated, they had many billions of equities for the market to absorb as well. They are in the astounding 99th percentile of exposure, referencing the past 10 years. Generally speaking, they are quick to sell when volatility spikes, but for them to re-add exposure they need to see volatility decline for longer time frame, usually it takes 1-3 months for a vol spike to fall out of their dataset and to achieve the same net exposure as they once had pre-event.

Image F: CTAs have alot to sell, but market not quite yet at those levels.

Goldman has the key SPX CTA levels at 4444, 4260 (most important), 4240. We are still aways away. But that said, below some key levels, and/or if volatility spike we likely see a huge downside move. But I dont think that comes unless we are below 4250 on SPX.

To sum up, last week was very bearish, no two ways about it. Market is in a shaky spot as it is extremely vulnerable to a large sell off below 4250. But at the same time, we closed last week down 4 days in a row. We are due for a bounce soon. I don’t want to short when we can bounce so soon, but I dont think the selling is necessarily done yet. There is a big market event coming up on Aug 10 where many will look to see if we see inflation rear its ugly head again. I think benefit of the doubt goes to the bulls, but too risky to buy at these levels. I think we sit on our hands here for a while, and wait for post-CPI print to re evaluate the inflation picture and see how that changes the Fed Fund futures pre-Jackson Hole. That said, I am a buyer in the low 4300s if we happen to get there this week, as that would be extreme emotional selling that I would want to take advantage of.

Trade ideas:

I want to long anything sub 4350 on SPX if we get there this week.