Recap of last week

Last week was another great week. We called for a blow off top, and we definitely got that with the OVN high during Thursday of 6468 being a new ATH, point of max euphoria before a vicious selloff of 200 pts less than 48 hours later.

On the execution side of things, we took 3 ES trades, and hit all 3. We also put on a long term collar hedge a couple of weeks back, that also ended up well in the green this week. So overall, we were engaged in 4 trades, and every one of them was a winner.

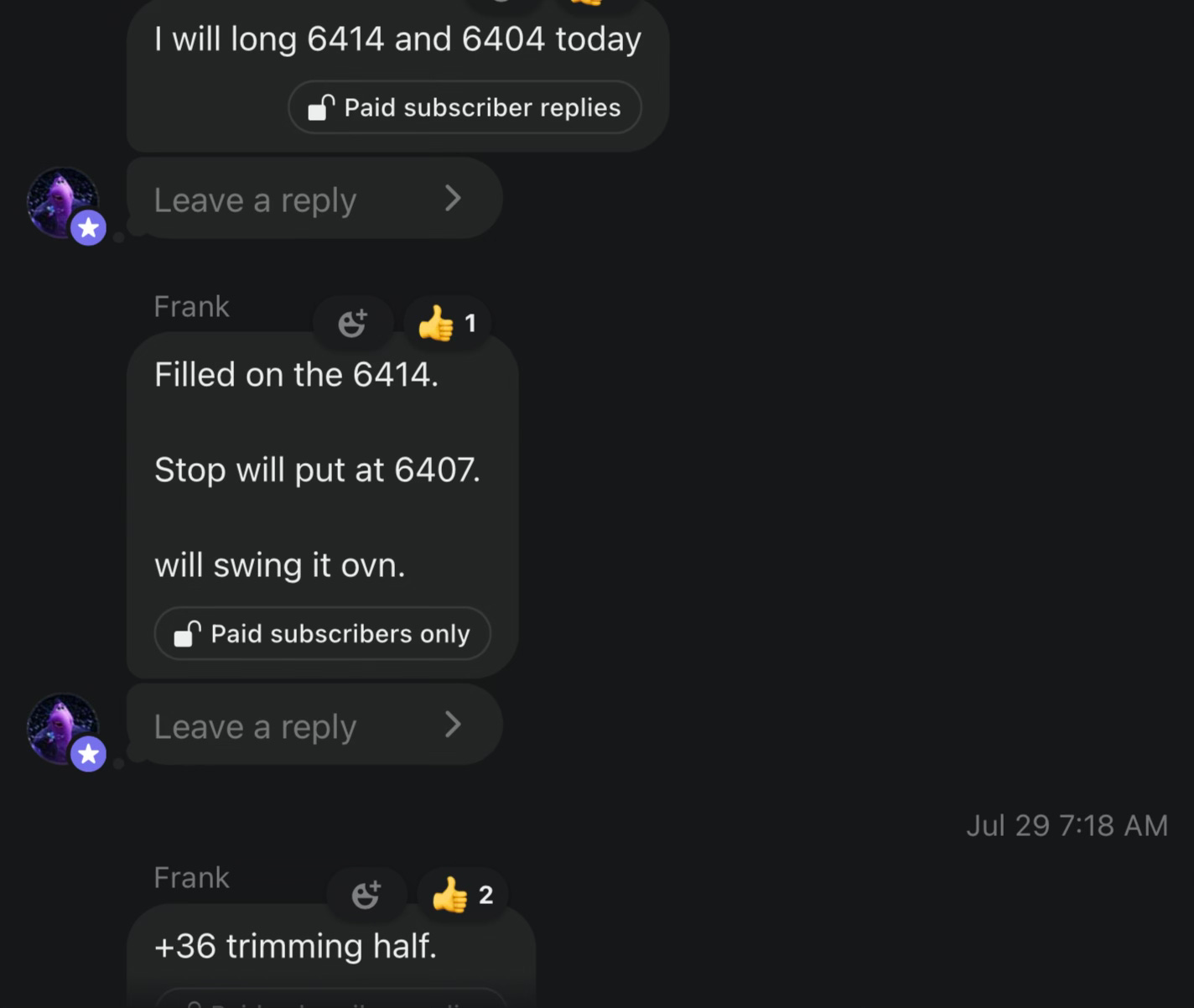

We went long early on in the week at 6414 for the Monday/Tuesday gap up and sold near the top that day.

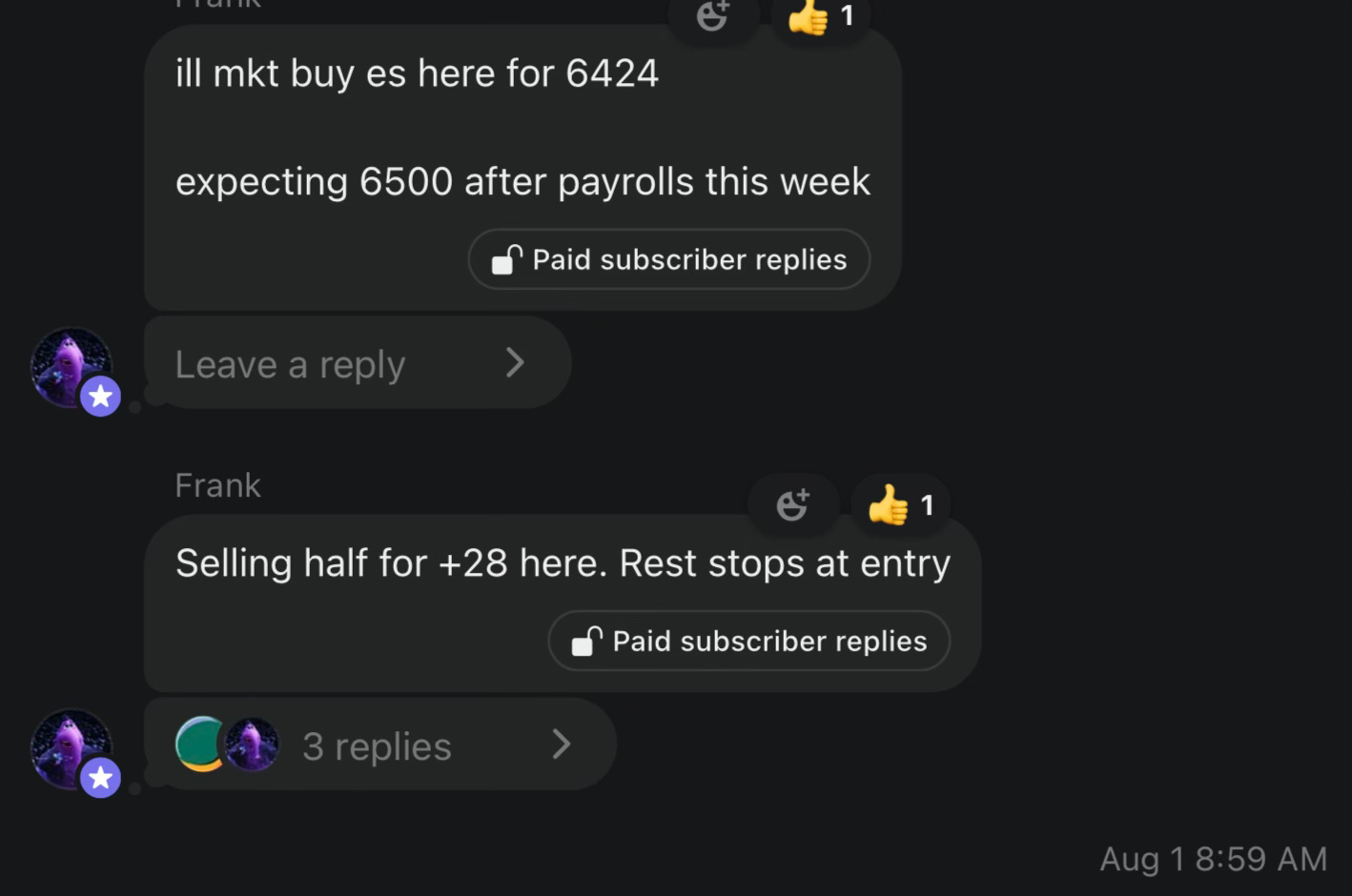

We also were very confident in a gap up on Wednesday evening and we went long ES there for another winner. Although market was down -2.4% this week, we did not lose on a single trade even though we took all longs.

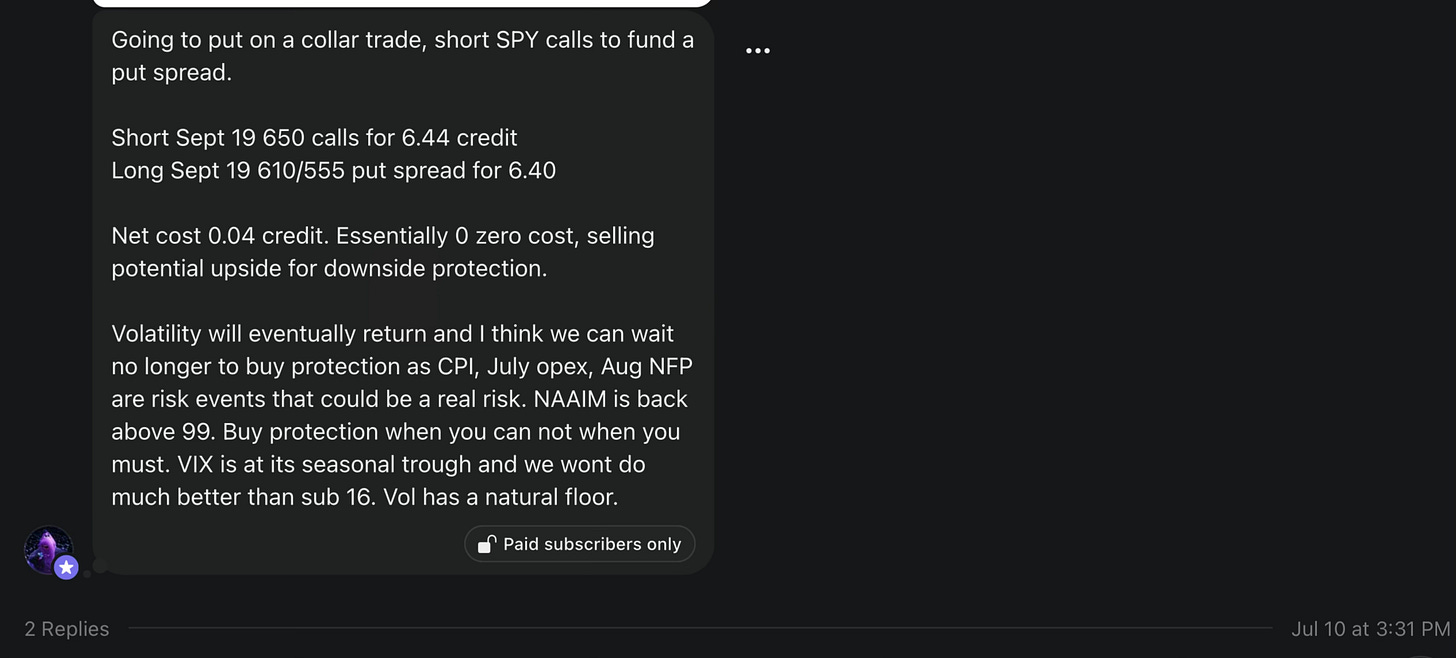

Friday was another green day for us, but not with ES. We put on a collar on July 10th when we identified an idea time to harvest overpriced call vol and use it to fund a put spread, completely cost free.

We put on these collars for -0.04 and they last traded at 3.74. With still about 45 days till expiration.

Last Friday was an ugly day for bulls, and I think the end of an uptrend. I do think there is another buy the dip moment on the horizon. I dont think the bottom is in yet though.

Next move for markets

Keep reading with a 7-day free trial

Subscribe to $SPX Trading Bible to keep reading this post and get 7 days of free access to the full post archives.