Week of August 19

Jackson Hole.

Recap of last week

It’s been an extremely difficult time to trade and most people have taken serious debilitating losses as they got whipsawed by a historical selloff and equally as fast of a recovery. We were not faked out and navigated this entire move expertly.

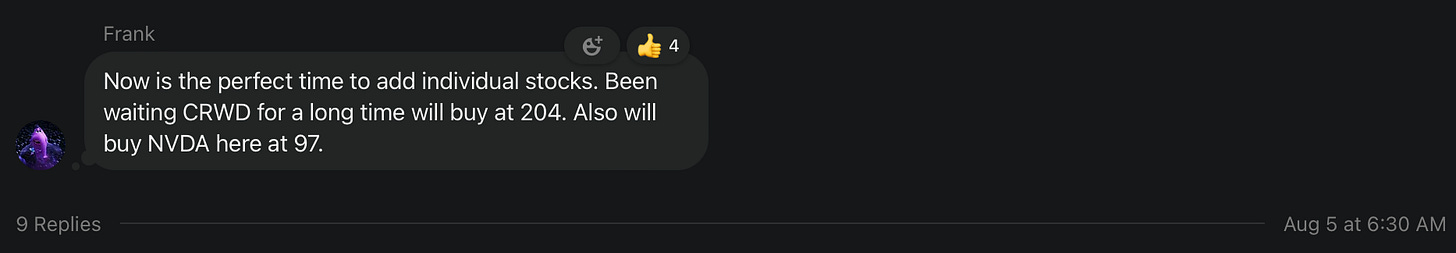

On August 5, the day the market bottomed at sub 5100 SPX, I sent out an update that not only is it time to buy. I said it was the PERFECT time to buy. No wavering, no “maybe it goes up, maybe it goes down”, no waiting for confirmation, none of that bullshit.

The only way I can be of more help is to take control over your body and press the buy button for you.

In times of extreme volatility, the ones who succeed are those with a systematic approach.

A bunch of my systematic reversal signals fired on August 5, the day we bottomed and I sent out multiple frequent updates to reassure anyone on the fence that it was time to buy. I did not consider additional downside as a likely scenario at all. I did not screw anyone over by telling them to sell the rip or to wait for a retest of lows.

The last time my reversal signals fired was on the week of April 19, the last major SPX low at ~4950 SPX. This is an excerpt below from my “Week of April 22” post when I urged buyers that they would regret not buying more. That was before an 800 point rally in 3 months in the SPX.

This last rally is already 400 points in 2 weeks.

There is very little luck in a systematic approach. We have been big buyers at the bottom/close to the bottom on both major SPX corrections. When the next one rolls around we will again be there to size the opportunity.

Next move for markets

Keep reading with a 7-day free trial

Subscribe to Systematic Approach to $ES Futures to keep reading this post and get 7 days of free access to the full post archives.