Week of April 8

CPI week.

Recap of last week

We went 2/2 last week.

We went long near the lows on Tuesday at 11am.

As always we take profit consistently along the way. When the Thursday mega-reversal came we were down to a just a couple contracts after a nice winner.

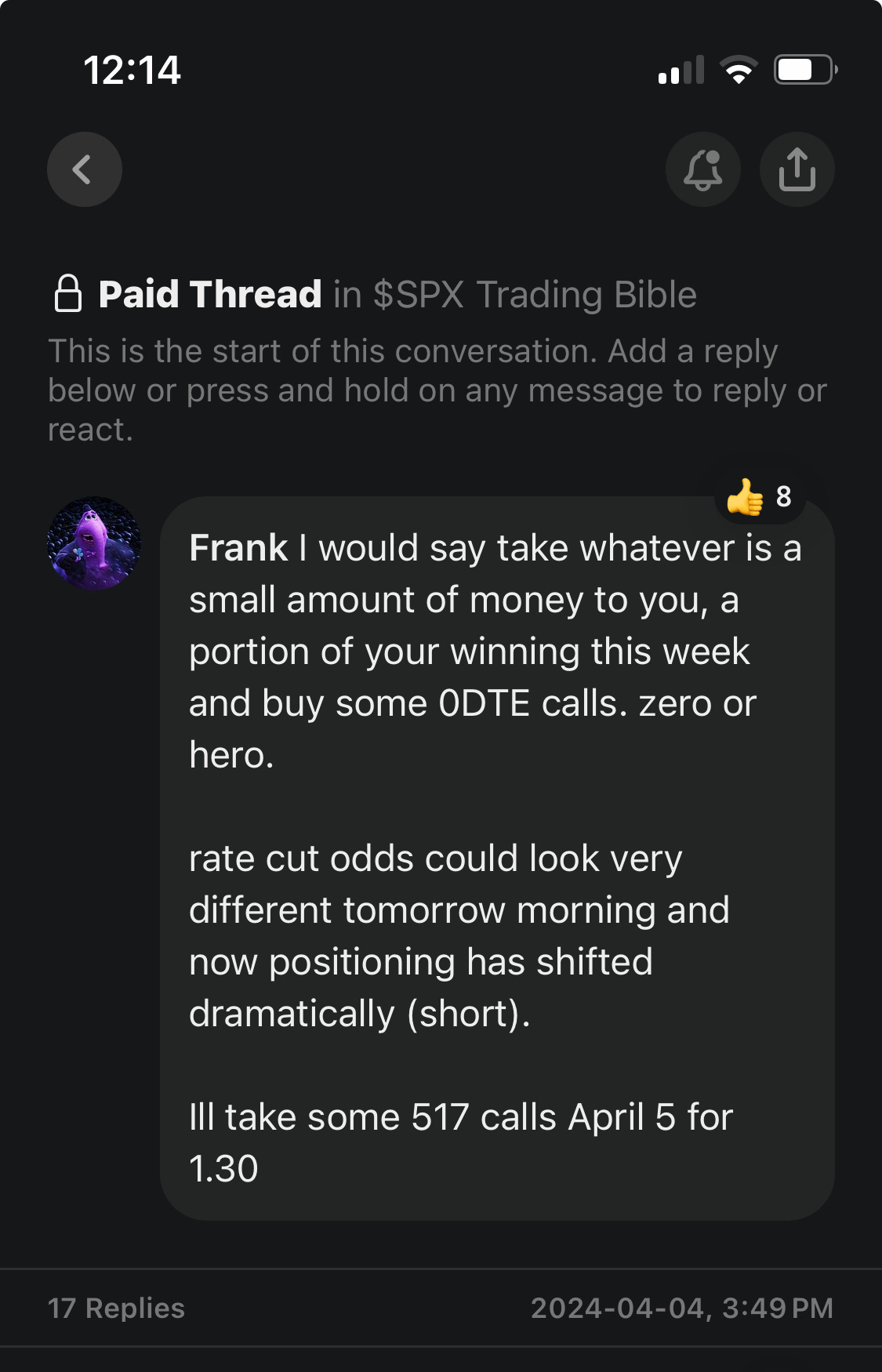

On Thursday after a huge 2% intraday drop, everyone and their mother turned bearish. We stayed even keeled, kept our composure and went long EOD because of the massive shift in positioning. Our Friday calls went 2.5x the next day while shorts got squeezed.

Every week we review market aggregate positioning, detailed granular seasonal flows, fund flows and it kept us from getting too bearish last week. VIX is officially back above 15 so this new volatility is likely here to stay awhile. Big week upcoming with CPI and FOMC minutes.

Next move for markets

Keep reading with a 7-day free trial

Subscribe to Systematic Approach to $ES Futures to keep reading this post and get 7 days of free access to the full post archives.