Recap of last week

Last week we started with a bang.

We were on the lookout for a look below and fail and then squeeze using the gamma from the JPM collar puts that were 0DTE. The market reversed on Monday undercutting the lows and ending the day green after a almost 100 point gap down. From Monday’s lows to Wednesday afternoon, we got a 240 point rally.

Then Liberation Day happened. The market crashed. I was not expecting that. I missed that. I think everyone did. I dont want to waste time talking about Trump we all know who he is. Basically the market puked because his tariff policies are just so insane and if they actually get implemented will cause a steep global worldwide recession. That’s why it wasn’t priced in, because its just so insane and stupid, that in a perfectly fine economy and world Trump dropped an economic nuclear bomb for no reason.

I think the mistake people make here is overreacting. Markets crash sometimes. 1929, 1987, 2000, 2020, 2025. And they continue to make new all time highs after that without fail. Don’t let a crash live rent free in your head. That’s how a perma bear is created. They obsess about a market crash they missed and then every single pullback they see for the rest of their life is another crash waiting to happen. This can cause irreparable damage to your psyche. You without a doubt will lose more money playing for a crash every time than you actually lose when it finally does happen.

Here’s my advice. Laugh about it, and move on. Markets crash like once or twice a DECADE. On like 0.01% of days. Focus on making money on the 99.9% of days. Don’t obsess about things you will never predict. Unless you are withdrawing every week to pay for living expenses, you are barely affected by this. By the time you need to access funds from your stocks the SPX could be double or triple. Take solace in the fact that any rich person you will ever meet, the large majority of them took the same paper loss as you. If everyone is the room is down 20%, its like no one is. Wealth is all relative anyways. The real danger, and real fuck-up is if you are down while everyone else is up big. That’s what happens to the perma-bears.

Next move for markets

The SPX just dropped -11% in two days, the last two times that happened were the Financial Crisis and the COVID crash. This is such an extreme outlier event, I honestly recommend not obsessing about it. You can’t predict market crashes, or if you do, its likely because you predicted 1000 crashes that didnt materialize before you finally get it right. If you can, then you’d be living in a mansion on Indian Creek besides Jeff Bezos. Don’t waste your time planning or overfitting your strategy to these once in a decade type events. If your goal is making a career as a trader, you need to focus on the day to day, and not the extreme standard deviation events that happen once in a blue moon. Last week is just a reminder that anything can happen in markets, and its why you always size your options contracts in a manner that you can handle them going to 0.

When you trade, each and every time you trade you ALWAYS get paid. Sometimes its money, and sometimes its experience and knowledge. This year we’re getting paid in the latter. I was unprepared for the market crash this year. I am not going to lie and say I get it right every time like some of the frauds out there. So we must examine where I went wrong.

I have to say, looking back on late 2024, I failed to predict that we would have a POTUS who would do everything he could to crash the stock market. That was not on my bingo card. But I also I am not upset about that, and I dont hold anything against myself for not foreseeing that. Its just so ridiculous that I didnt consider it as a possibility. Theres no precedent for this. Trump is truly one of a kind. I mean, we knew in January/February he was selling calls. That is one thing. Right now he is not selling calls. He is buying 5 delta puts and going full margin short the market right now. The damage he has done, we dont know the extent of it.

You literally cannot overstate how ridiculous his tariff policy is. In a world where a 1% beat/miss on revenue moves the stock 5%, Trump’s new tariff plan on a bellwether economic export the US makes takes the price of an iphone up ~54% according to estimates from the WSJ. No one was ready for Liberation Day, because frankly no one thought he could be this stupid. In a world where a 0.1% beat/miss on CPI moves the market 100 points, the POTUS wants to increase the price of some goods 50% or more. Its hard to wrap your head around. This is max uncertainty.

These tariffs, if unchanged will be absolutely devastating. The only reason the market isnt already sub 4000, is Trump has a reputation for changing his mind quickly. We all know he can send the market up or down with a simple tweet from the toilet. This is just a nightmare for businesses. Imagine the logistics of moving manufacturing to a new country. It would take years minimum. But to even start that you would need assurances that the policy would stick. Lets say you are 100% sure Trump will not budge, do you make significant changes to your supply chain, knowing in 3 years 7 months we will be having another election? If you are super fast and move all your production somewhere, you might finish in 3 years and then by the time you do we have a new president and he repeals everything Trump did. This is an absolute nightmare for businesses as you can see.

The main market movers (Citadel, Susquehanna, hedge funds, pension funds) are all run by super smart guys. I am talking about top of the class, MIT, Harvard, Stanford quants and the like. I think everyone was blindsided by this because no one could have predicted how retarded this policy would be. Truly. When the market makers have Liberation day as a ~2% move, and the SPX realizes 5%, everyone is fucked. The market makers provide liquidity and when they have trouble hedging they withdraw their bids and it creates a vortex. Everyone is continuously marked-to-market and this creates a cascade of margin calls and further liquidations and then just outright fear grips the market.

This is just the worst case scenario for businesses, traders, investors. The proposed policies are an outright disaster. And now the market will move according to whatever his latest tweet is. Its a horrible environment for traders. It all hinges on his next tweet or news appearance. I unfortunately can’t help much, no one can. Only his inner circle knows his next move, maybe not even that.

Well thats mostly the bad news, I think the good news is the Trump put is still alive. Its just delayed or at a lower strike. I dont think Trump has anything to gain by crashing the market to oblivion and mainly this is a temporary motive for a variety of reasons. It could be to get yields down to refinance. It could be about his legacy as a president. It could be able stomping inflation into dust. It could be just revenge for the people who screwed with him. It could be to strong arm Powell. Ultimately, though, I think this is temporary.

I think he will be back to pumping the market, but from which price? Could it be 4800, 4400, 3500? No one knows. However I believe thats the wrong way to think about it. If you have a job, and you dont need to sell your stocks to pay living expenses, it shouldnt concern you. Stop thinking about drawdown in terms of dollars, and think in terms of time. I believe, as a worst case scenario you are in a drawdown for maybe one year max.

They key here is the Fed. Powell’s term is up May 2026, and by then at the latest but most likely before that the market will start to front run his handpicked Fed chair. He will pick someone who will succumb to his every whim, likely a Fed chair who will cut rates to 0 and reignite another round of QE. I think this will take SPX to 7000-8000 by 2027/2028. That is my long term view of things. So in the short term could we trade in the 4000s? Absolutely yes. I would consider that a gift, and you should say “Thank you President Trump!”. Because we could potentially double from those levels in just a few short years. Part of the reason the market crashed on Friday is Powell is playing hard ball. But he doesn’t have the card. He is out May 2026, at the LATEST, if not earlier. The market will front run the new Fed chair far before that. So try and think of the drawdown from that perspective. It may be a couple months more of pain, but I fully expect an almost double if we start trading into the low-mid 4000s. You really want to take the long term view here.

Thats my high level view of things, hope that helps assuage some fears and put some things into perspective. Things seem really bleak right now, you may have had a bad week (I know I did). But I am in my mid 30s right now and guys my age or older know how fucking short 1 year feels. I think this Trump short on the market lasts 1 year AT THE MAX, and then we will likely see a crazy market boom similar to the 2020-2021 years. You should start preparing for those days NOW. It could be one of those periods where growth stocks go 5x-10x baggers across the board and the index rips 20-30% in back to back years. The best time to prepare for that is now. Embrace the drawdown. Play the longer time game here. A common theme in life as I am sure we all know very well, is short term pain = long term gains. That absolutely applies now. In 2022, META could have been had for 80 bucks. NFLX could have been had for 120 bucks. Look where they are now. The really BIG MONEY is made by buying in bear markets. We are in one now. Seize that opportunity.

For a shorter term look, all signals point to volatility both ways but especially a bounce. But again, Trump is the X factors and he is live and actively responding to market movements (think of it as a gigantic short rolling down his strikes) so any moves could stop/start/reverse at any time. It is an extremely difficult environment to trade, no two ways about it. Some may say stay in cash and do nothing. I am of the view that every day you trade in the market you get better, and you will become a better trader for having traded this market. You will be forced to manage risk more tightly than ever before. I say continue to trade everyday, but use smaller size than typical and keep DCAing on SPY.

My favorite sentiment indicator from GS has hit levels BEYOND what was seen in 2020, and 2020, on par with December 2018. There are no superlatives to describe this selloff.

Typically we see very strong forward returns, with a huge right tail skew (gray bar) and very high hit rate as well.

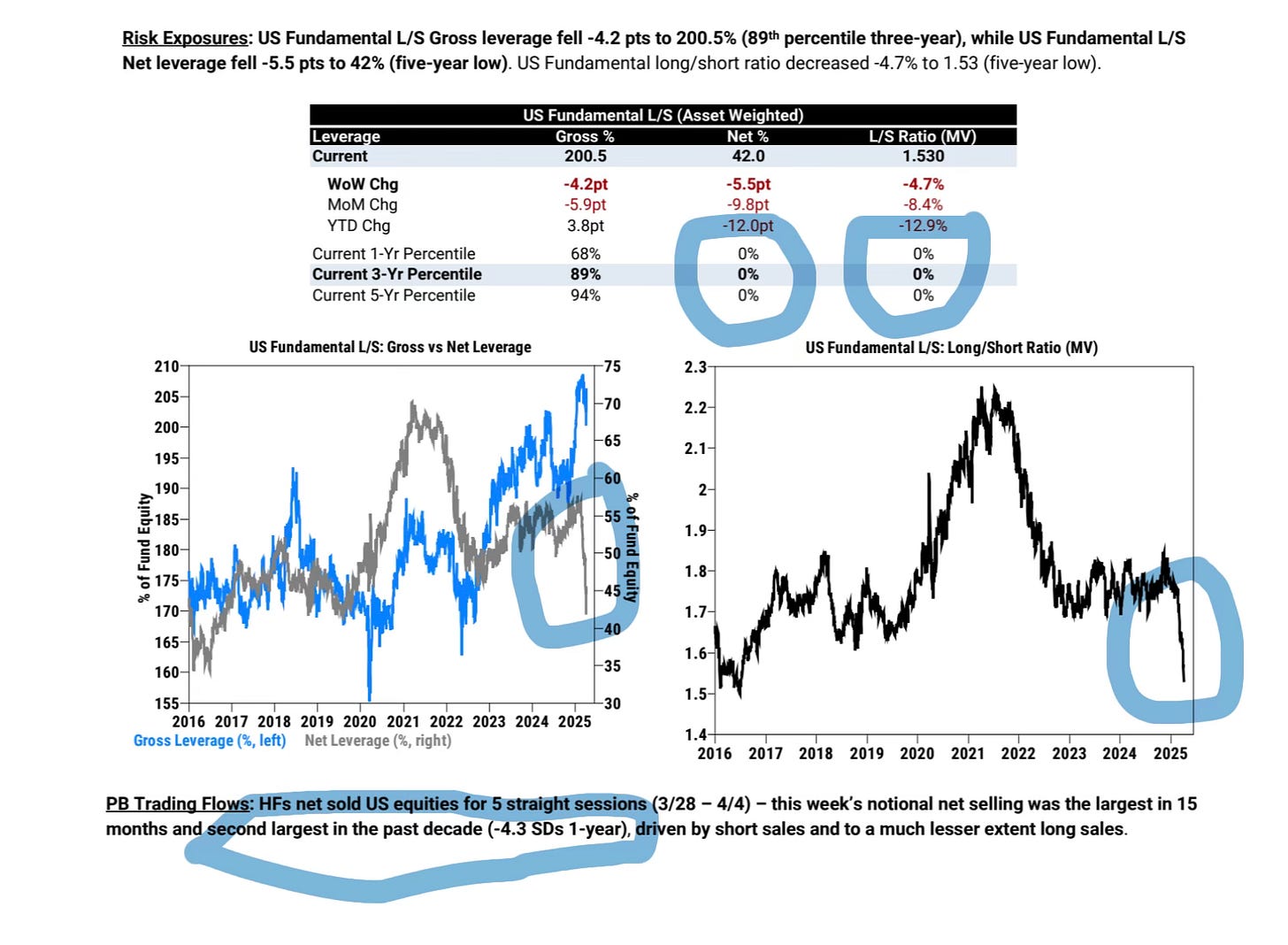

A look at hedge funds. I have literally never seen this in my life. L/S ratio and net exposure is at the 0th percentile. On a 1, 3, and 5 year lookback. We don’t know when they will start to re-gross, but that is a huge potential buyer on the market and its a matter of when, not if.

US net trading flow for US equities was -4.3SDs. That implies a probability of around 0.0003%. Yes you read that right. The events of the last week are extreme outliers, dont panic and overreact to these once in a decade type moves.

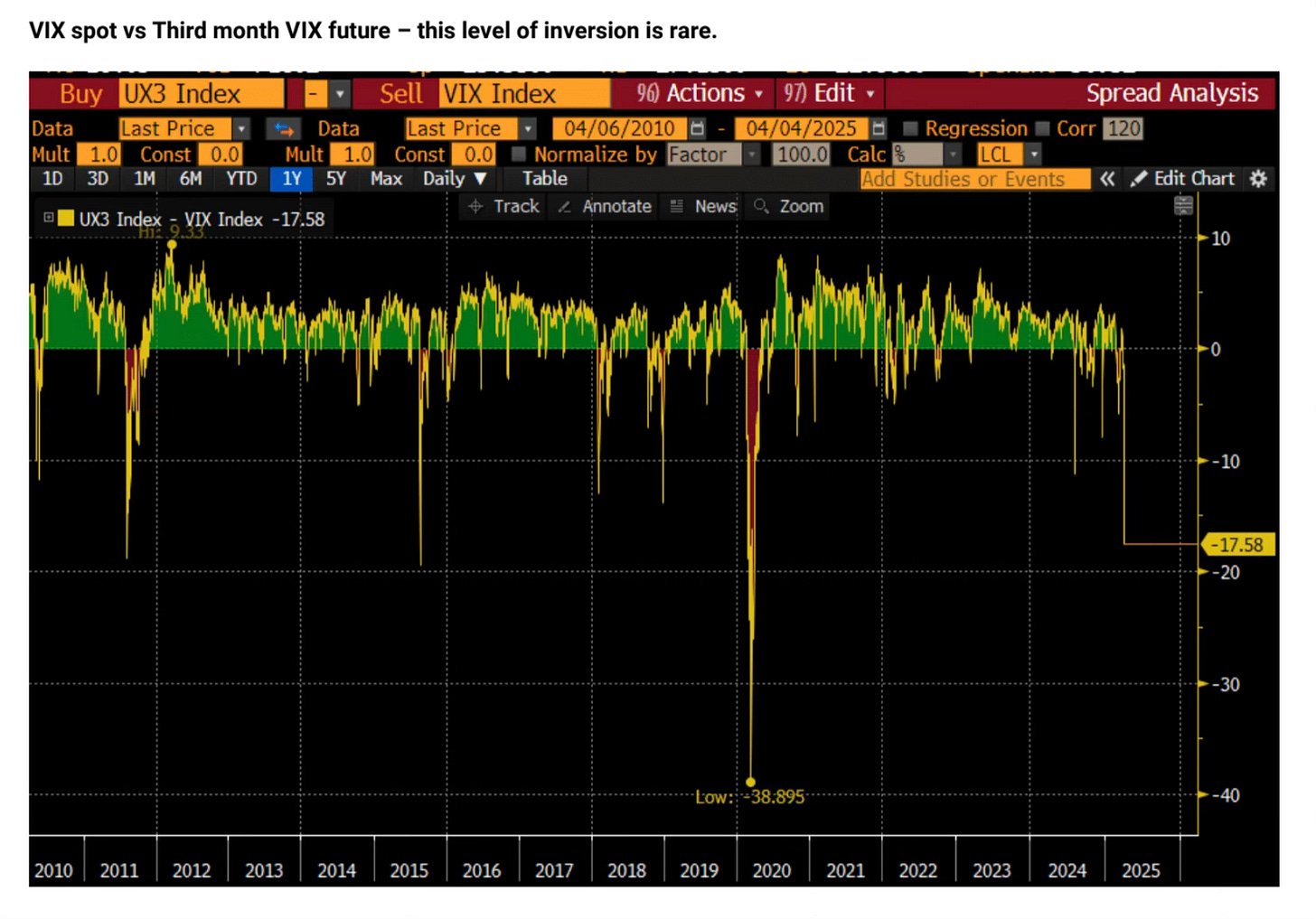

The GS vol panic index just hit a 10/10. We are at March 2020 levels, when everyone was forced to lock themselves into their home and entire industries shut down.

We only saw this level of panic in volatility futures 3 other times in the past 15 years.

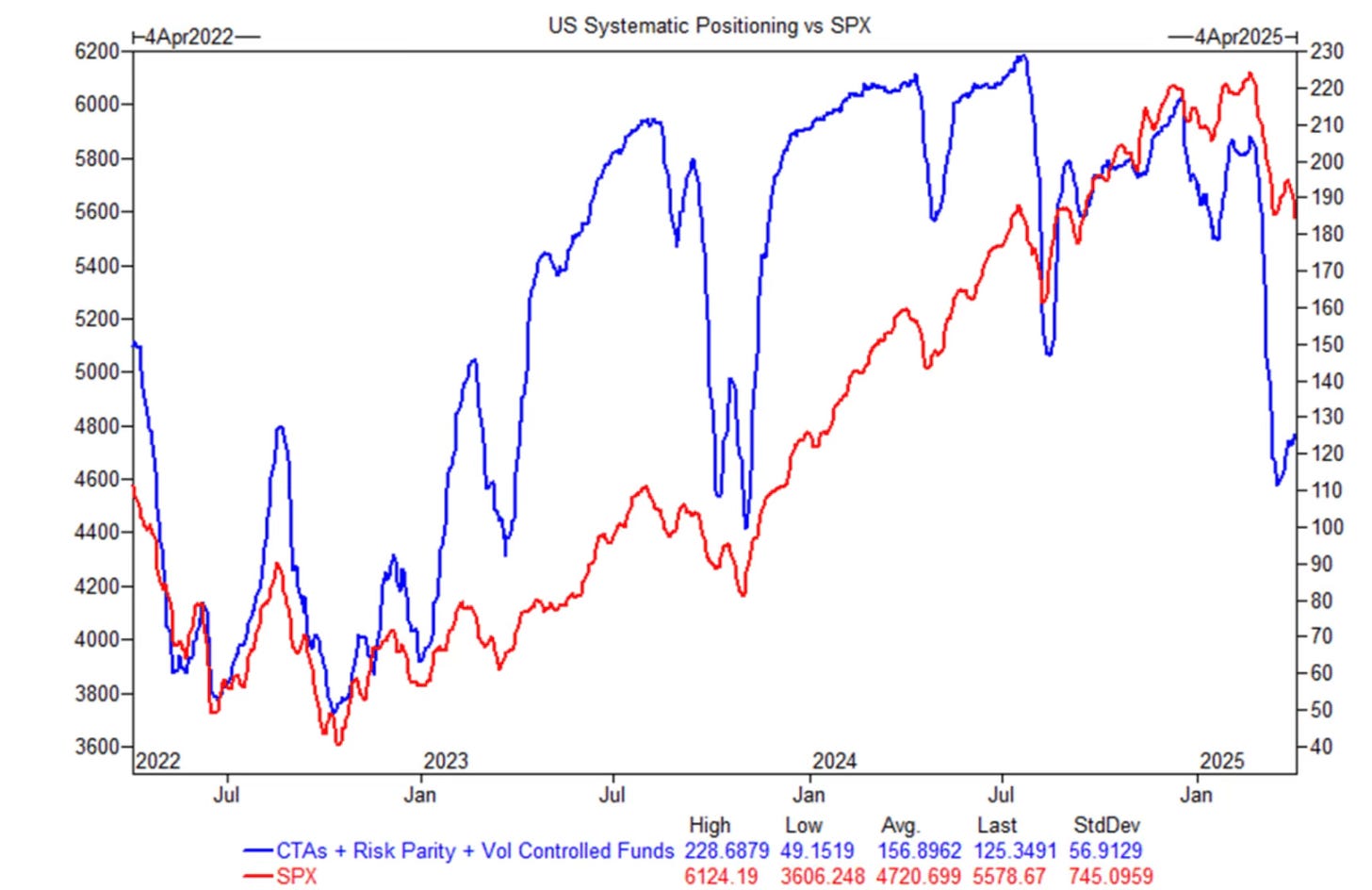

Systematic players have degrossed so heavily already, at multi year lows, but it can go lower. The main risk is to the upside, but they will not be buying much right here, but will rather be adding fuel to the upside once SPX gets traction. But worth noting, not really a factor until the trend changes or reverses.

However global CTAs are different story. We know Europe has had a relatively great year especially compared to the US. I continue to think if you want to play for a bad gets worse tariff situation, Europe has alot more meat on the bone to sell or short from here. No one escapes this tariff mess if it goes forward as planned. CTAs can fuel a fast downside move for Eurostoxx (FEZ) and vols are cheaper than in the US.

To sum up, the market crashed. It does so once or twice every decade, and invariably recovers. As traders we have to focus on making money in most environments but not all environments. I would be wary of overfitting or adjusting my strategy to account for these extremely rare events and that is not conducive to being consistently profitable. Everything screams for a large bounce, except we know Trump is actively shorting the market every chance he gets and we are unable to quantify or prepare for that adequately. I believe the most important thing to know right here and right now is this will not last and I think worst scenario is we could see this volatile market for another year at most until Trump installs his Fed chair who will likely bring back QE and zero rates - at which point you will be thankful you had the opportunity to buy stocks in the 4000s. Try not to think about this manufactured drawdown in $ or %, but rather in time. 1 year is not a long period of time unfortunately, and goes by faster than you think. When Trump finally changes his tune, and no one ones when that will happen, it will be like a starting gun was fired and its off to the races. We could be at 8000 SPX in a couple of years, so try and accept this current market environment for what it is. A gift.

Trade ideas

With the straddle being 5.6% for the week on SPX expect insane rallies and dumps. I recommend do not stop trading, as these volatile times are rare and can offer a rare learning experience.

I think ES or likely MES or SPXL is the ideal tool for this. Options are decaying fast at 45 VIX obviously. I think 4800 SPX could be an the first support if we gap down on Monday, which was the 2021 high.