Recap of last weeks action:

Next move for markets?

Up. Im seeing a lot of signals and confluence line up for yet another bear market rally. Maybe one of the last ones. We still haven’t really exited the regional bank credit event that plagued markets during march. Positioning got very one sided during this credit crisis and will need to be flushed out.

I had very high conviction that we were going to rally this week. We did about 130 points in 5 days with little to no drawdown. Needless to say if you read my plan and executed with me you made a lot of money. Now lets go over my 3 trade ideas.

Trade Ideas:

Buy dips towards 3900 on $SPX to target 4100 and beyond.

I like IWM here for my long term portfolio. I will be selling naked puts. In a risk reversal trade such as this, I like both outcomes. Either I get to own IWM for an effective 163.55 cost basis which I love, or I get paid on my call spreads. Use the proceeds from the short put to fund the call spread.

Sell: 166 strike for April 14 (now 2.45)

Buy:175/180 call spread (now 1.75).

I also like KRE here for my long term portfolio.

Sell the 40 April 14 puts (Now 1.40)

buy the 46/49 call spreads (Now 0.82).

Until next week, happy trading!

Massive winner. Hit and even exceeded my 4100 target on Friday. You’ll notice I don’t recommend any shorts, but to only buy dips. If you get the general trend of the market right, you can be less than perfect in execution and still be very profitable. 80/20 rule applies here. Don’t worry too much yet about theta/Vega/strikes/slippage/etc because that small stuff only amounts to about 20% of your profitability. If you get the general trend right like we do most weeks you will make money while you you may still be figuring out the finer details of trading.

Massive winner.

Short puts went from 2.45 to 0.39. +84%

Long call spread went from 1.75 to 3.08. +76%

Small winner. This one is taking longer to play out than I had expected. It closed the week as a small win. But I am still holding this trade. At one point in the week both the short puts and long calls were green. So not a home run trade but a small winner (so far) that I want to hold. Sometimes you cut your trades and sometimes you hold them. I still like this play.

Short puts went from 1.40 to 0.42. +70%

Long call spread went from 0.82 to 0.47. -43%

So all in all I recommended 6 trades this week, 5 of them wins with 1 loser. And that loser was green at many points in the week too so if you managed that one well there would have been no losers. You all got my email in your inbox from last Sunday and you can verify this was all given ahead of time. Unlike Twitter where everyone just deletes their bad trades everything I write here goes down in history unedited.

Also, as I touched on earlier with my KRE position, some trades take a bit longer to play out. To truly become a great trader you need to be able to exercise patients when necessary. Some really big winners will come to you if you are able to size appropriately, keep a level head and let your trade thesis play out. Here’s an example. These two trades I recommended two weeks ago, didn’t do much the first week but this past week they blew up and became big winners. I recommended these two trades in this very same Sunday post “Week of March 20”.

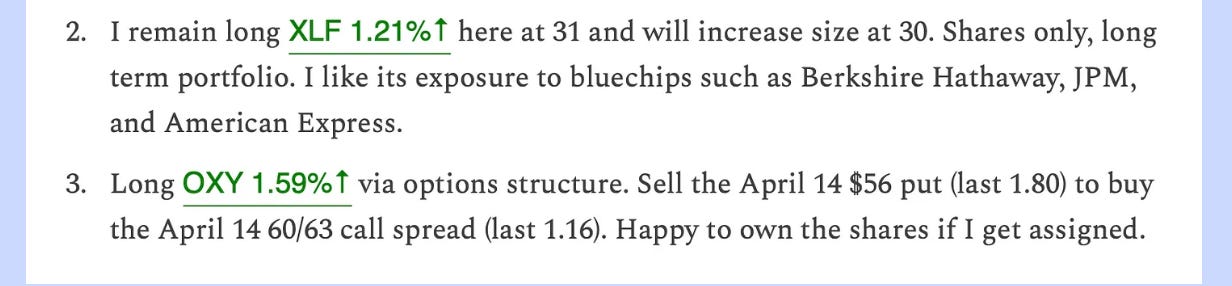

XLF was a solid win, now trading at 32.15, up about 4% from our main entry point. Now this is a financials sector ETF, it aint Gamestop! This is an ETF filled with dinosaur banks and big financial firms with massive market caps. So 4% is a rather large move, and you’ll notice that if you take a detailed look at the options greeks, the implied volatility for this ETF is quite low. Which is to say if you took some calls they paid quite handsomely.

OXY was another massive winner. Oil is going to open with a huge gap up so likely maximum profit on both legs for this trade. So +100% on the short put and +159% on the call spread.

Now I like to give out a couple trade ideas when I have good ones in mind as a nice bonus to my followers and so you can make back your subscription fee a couple times over. But I really want to encourage you guys to take your own trades, get creative and find ways to extract money out of the market. If I am bullish energy for example, like I was a couple weeks ago, I might express it 3-5 different ways. I will often start with a short put, such as on OXY, then use the premium to buy call spreads, long XLE stock, and long /CL oil futures. That way I am getting paid in many different ways if my thesis is correct, as well as less exposed to idiosyncratic risk that taking only 1 position exposes you to. So many ways to make money from a trade idea. So I always recommend a couple but you can really get creative and branch out and do different things. I often utilize just straight shares on most of my long trades to begin my starter position, fully expecting to take a little drawdown. But I am able to hold the trade until it is profitable because of my conviction, which is born out of my detailed weekly analysis that is shared with you all here. Then I will use a leveraged derivative such as futures or options when I can nail down my entry/exit to be more precise as there is less margin for error. There are times to bust out the hammers, and times to bring out those dainty little tweezers. So many ways to skin a cat, so many tools you need to have in your toolbox to really excel at trading and extracting money out of the market. Highly recommend you get very comfortable with trading shares, leveraged ETFs, futures, and both short and long options for this reason.

We also got long oil a couple weeks ago as part of my long bonds thesis. That trade is turning out to be one of the biggest of the year with still tons of room to run.

OPEC cutting just announced they are rolling out voluntary production cuts to further boost price. And then as if that wasn’t enough CTAs have extreme upside convexity in this WTI tape as positioning got completely flushed out, right before I turned bullish. Not only were we bullish, we sold puts AND bought calls.

Next move for markets?