Recap of last week

Horrendous week for bulls, including us. Got clapped. All I can say is what’s done is done and the worst thing you can do right now is carry that negativity into the new week. If you have been in this game long enough you have experienced the hottest of winning streaks, and the coldest of losing streaks. The key is don’t get too high when you're winning and don’t get too low when you’re losing. It’s simply variance.

Next move for markets

Up. The perfect bearish storm landed in April. CPI came in hotter across the board, yields exploded, Iran-Israel headlines, CTA selling, vol control selling, tax day selling, buyback blackout, ASML/TSM/NFLX. As of Friday the SPX closed red 6 days in a row. The last time that happened was in early October, 2022. That was 557 days ago. That was the most volatile month in a vicious bear market.

I see alot of people freaking out in the chat. We have witnessed a very rare move. There is nothing wrong with our system. We took good trades last week, I am very confident in that and they just didn’t work. Everything that could have gone wrong in April, went wrong. What if I told you I just went into my living room and flipped a quarter and it landed on heads 10 times in a row? Are you going to tell me the chances of flipping a coin and landing on heads is now greater than 50%? No because that’s completely retarded. Its variance. You need to understand that and internalize that if you want to be successful long term in trading. If you start to overreact and question everything because of a losing streak, you are going to go on tilt and cause yourself a devastating loss that you cannot recover from.

Bad result does not equal bad trade, and good result does not equal good trade. So so important to remember that.

I would say my mistake the past couple of weeks is being too aggressive in buying dips and being too bullish. But then again, it has worked for the past 6 months. So after making money hand over fist for 6 months in a row, am I concerned over a two week losing streak? Not in the slightest. Yes you totally could have avoided this drawdown and catching the falling knife if you played more cautiously and avoided buying with leverage. 100%. But you also would have avoided alot of profit the last 6 months too. You can’t have it both ways. If you are making it rain when the market is going up, which is most of the time, you can easily eat the losses when the market sells off in a vicious way like it has the past couple of weeks.

My first year trading options/futures was in 2018. So I have been blessed to see some very large selloffs in my relatively short trading career. The Winter 2018 bear market, the COVID crash in 2020, the bond bear in 2022, the SVB collapse in 2023 and the 10% correction in October of 2023. They were all completely different situations, and yet they were all exactly the same. Each and every time we bottomed, the sentiment was exactly like it was now.

If I asked you right now what would you have done differently during December 2018, March 2020, October 2022, October 2023, what would you say?

I will start by saying I would go back and buy more. I bought alot in all those situations, and I regret not buying even more.

And so we arrive back to the present day. It’s April 2024, and I have invented a Time Machine. You have the rare opportunity to buy the SPX at a major discount.

But 50ptMAE, this time is different you might say. The Fed is hawkish again, inflation is unchecked, the 1970s are back, yields are ripping, AI is dead. Etc etc. Let me ask you something again, you don’t think things looked bleak in March 2023 when we had multiple banks literally collapsing? You don’t think things looked bleak in March 2020 when we literally were not allowed to leave our homes for months? You don’t think things looked bleak when CPI was 9%?

The market bottoms on bad news. When things start to look rosy again, we will already be hundreds of points off the lows.

This has been an extremely fast and vicious sell off with no reprieve for bulls. We closed out Friday with our 6th day in a row red. Last time that happened was October 12, 2022. The multi-year bear market low was October 13, 2022. We closed out Friday far below the bottom Keltner channel. Last time that happened was October 27, 2023. The multi-month bottom was October 27, 2023 before we rallied 1200 points in the SPX. Pure anecdotes, however it kind of illustrates how extreme this selloff has been.

The low made during the Asian session on Thursday was 4963, that is a 7% correction off the ES1 highs made in early April. Three weeks. For some perspective, the July 19 2023 - October 27 2023 10% correction transpired over 3 months and 1 week. We have traversed 70% of that move in a mere fraction of the time. That tells you something about the velocity.

Now Friday was actually a win for bulls in my opinion. The ES1 session (beginning Thursday 6pm) brought a nice low on the Israel strike news that was kind of cathartic for markets. A nice puke move on the strike gets all those last sellers out of the system. I do not foresee Iran/Israel being much of a market mover moving forward. Although you might look at the SPX down 88bps and be thinking bearishly, RSP (equal weighted SPX) was actually up 0.38%. Breadth bottomed late last week. I think SPX either bottomed Thursday on the Israel strike news or will on Monday.

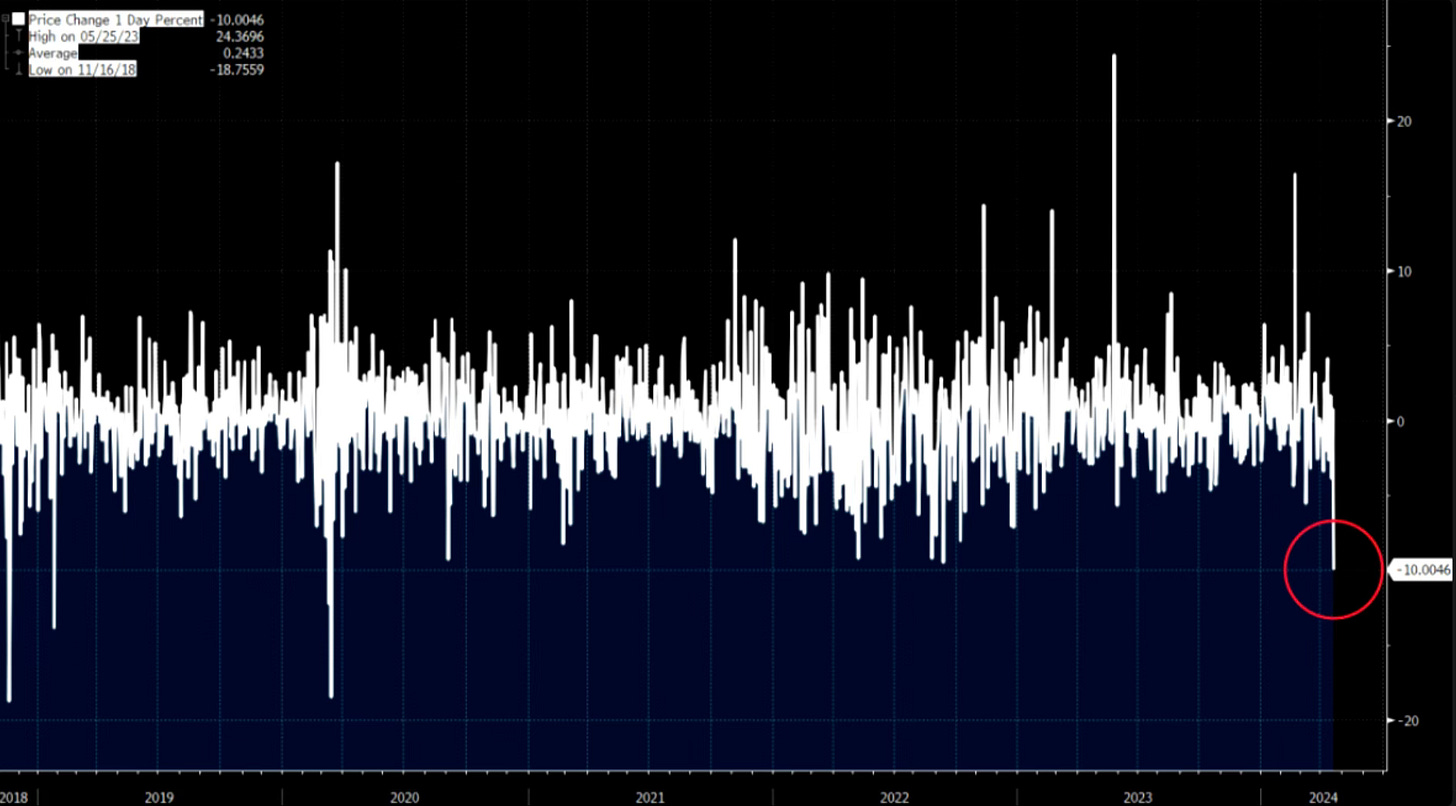

The down day in the SPX can mainly be attributed to NVDA. The massive 10% sell off was the worst since March 2020. Rhetorical question coming, was that a good time to be buying stocks? If we reduce the filter for the selloff to just 9%, we see similar pukes in late 2022. When NVDA was about $110-$130. Was that a good time to be buying? This is what you would call blood on the streets. If you removed NVDA from the SPX and it was the S&P 499, the index would have barely closed red.

Breadth bottomed and is up quite a lot from the lows. I believe this is leading the index by 1-2 days.

Price has dipped below the Yearly VWAP which I believe is unfair. As in the market is cheap here. I believe long term bulls are buying here. As you can see in mid January price dipped below the AVWAP for a couple days before rocketing back up.

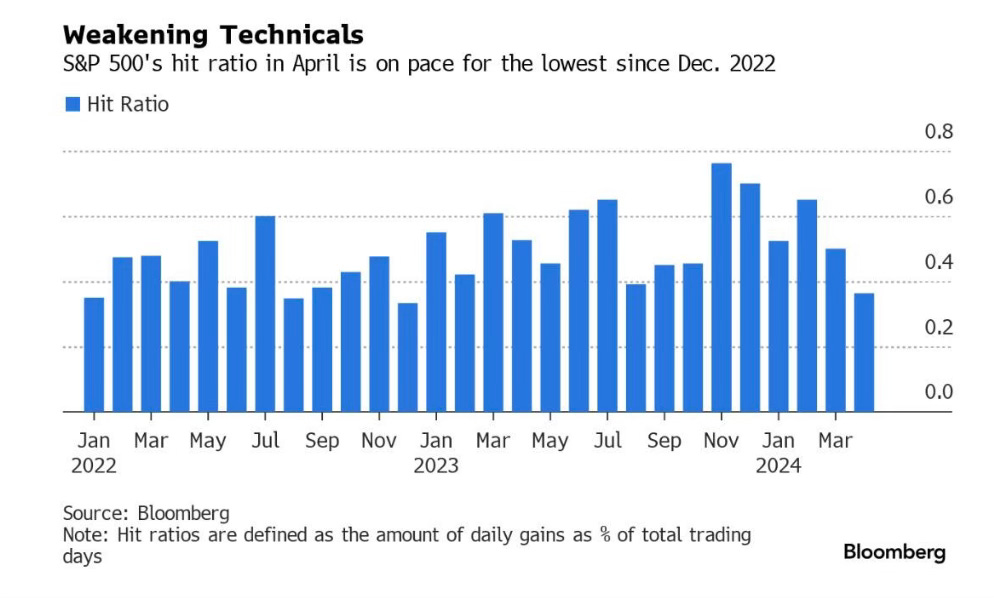

Nomura has made a nice chart here showing how severe the selling pressure has been in April. The worst average down move since October 2023, and before that March 2023. Were those good times to buy?

Bloomberg has April 2024’s hit ratio as the worst since December 2022. Was that a good time to buy?

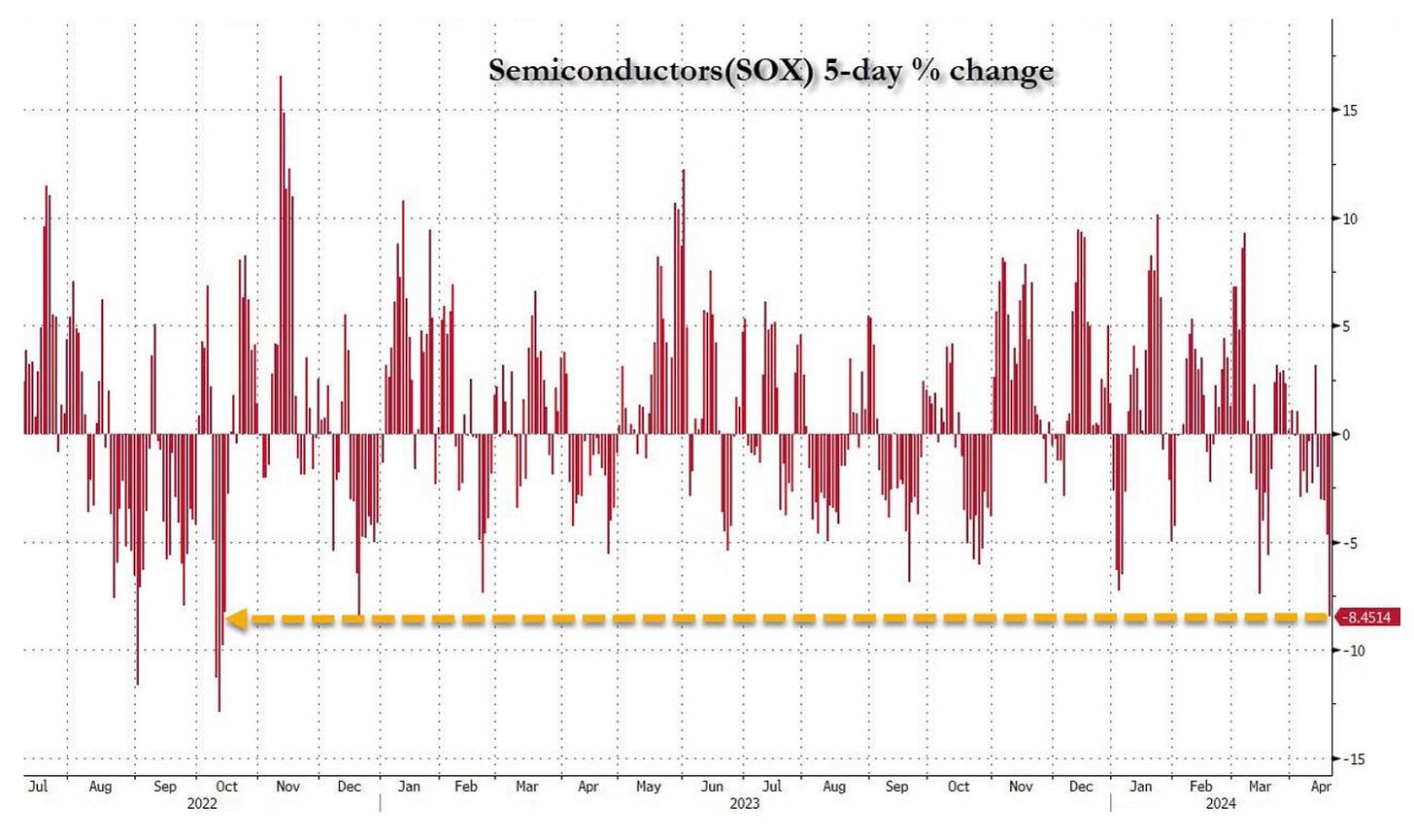

Semis got rocked this week like it was October 2022, again. These moves are bear market bottom type moves. The NVDA move was March 2020 like, the SOX move was October 2022 like.

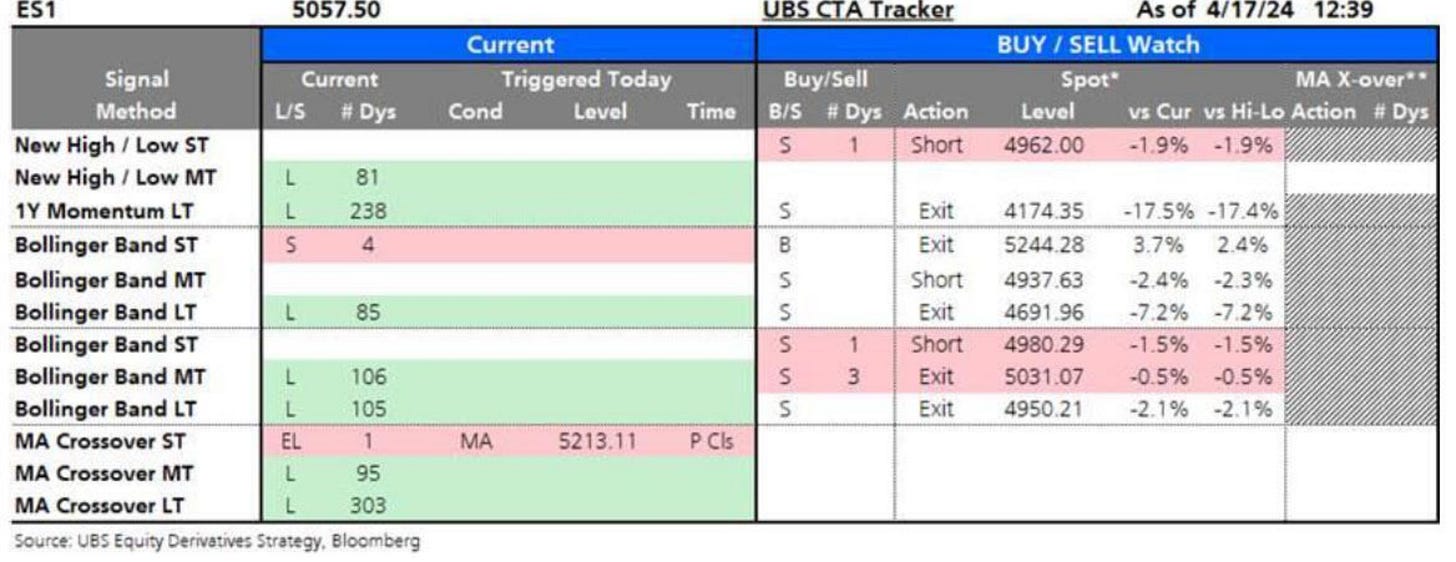

A key factor pressuring risk right now is the exploding USD. I think that will be key in supporting a large rally once this reverses. The main poster child for strong dollar in FX land is of course USDJPY. It is around 154 right now. The MOF has been dropping cute little hints lately that they do not like this move. Dollar bulls are on the clock, when the Japanese officials intervene it will be big and fast. Nomura astutely points out that when the dollar is strong going into notable IMF meetings, it tends to portend significant weakness in the coming weeks. A strong dollar is horrible for global trade, and in the past policymakers have shown a strong tendency and preference for intervention. Essentially you have some major worldwide central bankers/policymakers short calls in the USD. They have the will, and they have the way.

People always acknowledge and joke about the Fed put and how powerful it is. Well in FX-land there is no need for messaging or guidance. They will straight up sell or buy whatever they need to in currency markets to achieve their desired outcome. There is no hinting. I believe the dollar rally is on borrowed time and can spur a very large rally in risk assets on the back of easing financial conditions.

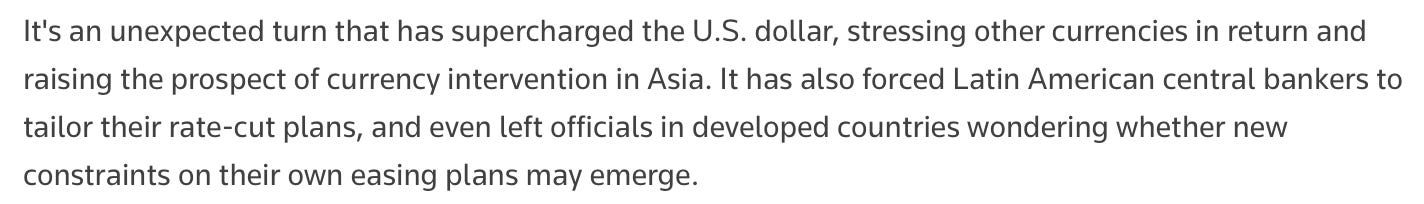

Here we have yet another chart showing the severity and velocity of last week’s selloff. Worst since, March 2023. Once again. If you look at each and everyone of these large selloffs, you will find that it is almost always a great time to buy, and to buy with leverage. When people are puking.

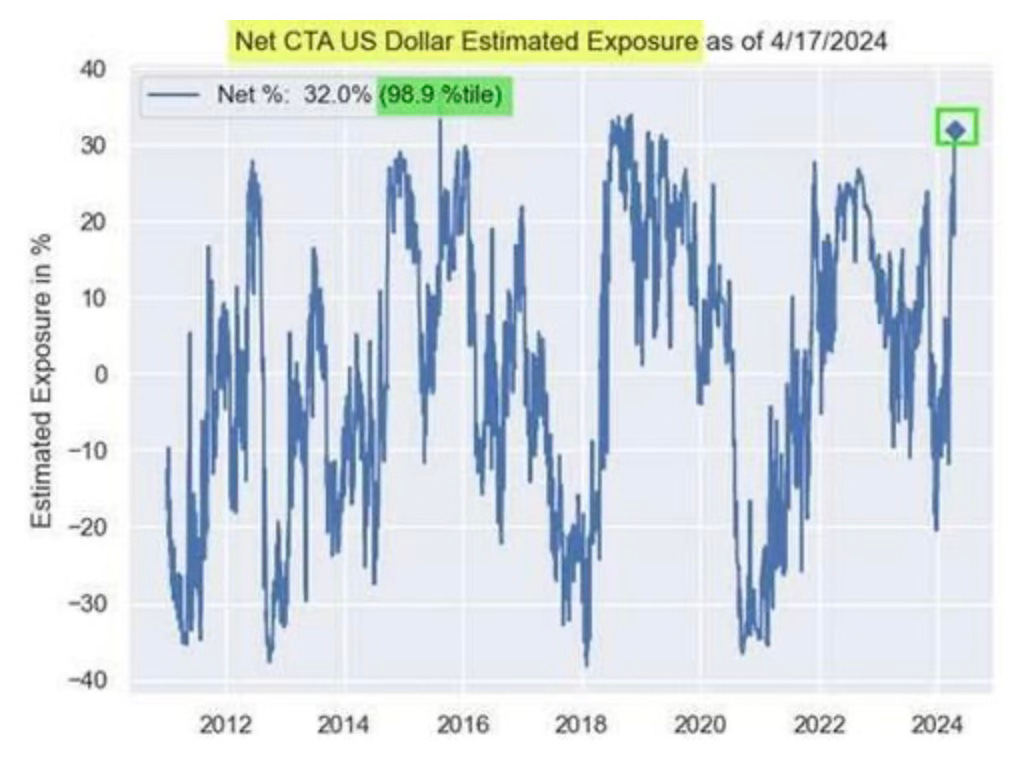

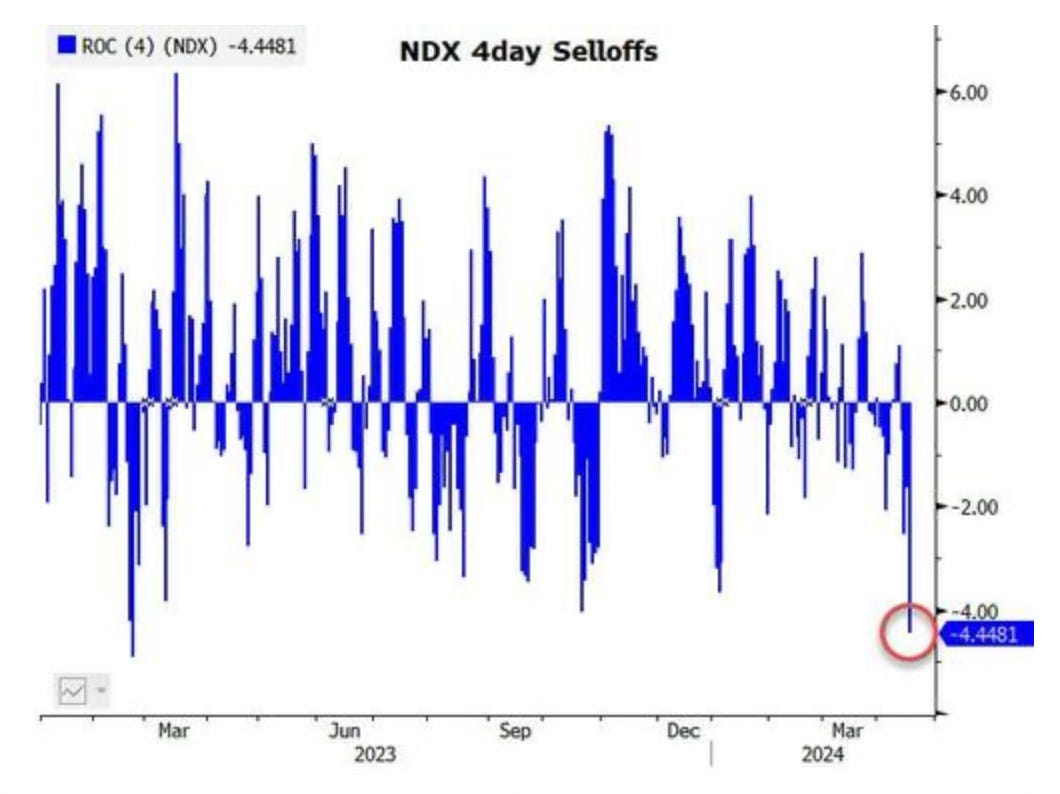

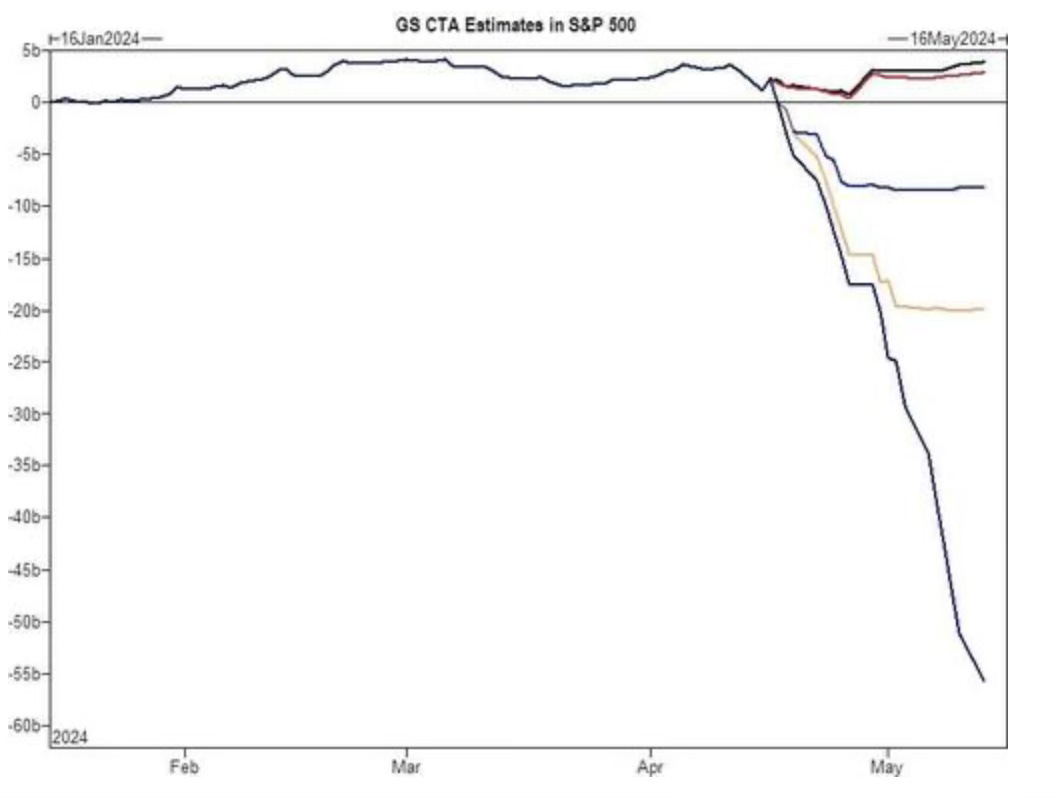

CTAs are officially back in the ring. I think that’s the biggest bearish flow right now to be honest. The main risk is the MT trigger which UBS has around 4937. That is about 4900 SPX. That also coincides with major support from early January this year.

I am hoping for one final sweep of the lows on Monday. First target is of course the Thursday lows of ES 4963, I would like to load more longs in that 4930-4970 range. If we close below 4900 SPX, that would be the point where I stop buying calls/futures and switch to just DCA shares..

When you’re buying these big scary down moves, and buying major bottoms, it is not supposed to feel good. You’re not supposed to enjoy it. You’re supposed to feel frustration, anger, all these negative things. The joy, euphoria and loads of money come at a later date. Now it’s time to get your hands dirty.

To sum up, when it is time to buy you won’t want to. It hurts, it feels like shit, it’s painful, it’s humiliating and it’s also going to make you alot of money. Pain is weakness leaving the body. You want to hold all your longs, and I think gather the courage and the stomach to load more calls on Monday.

A Picture is worth a thousand words here.

Trade ideas

I will update in the chat on Sunday/Monday. I will try another ES long, and I will be loading a large options bet for May.