I wanted to do a broad overview of 2025 in terms of how one might structure his/her portfolio. Most of my posts are focused on short term swing trades, really mainly in options/futures. This post is for your retirement portfolio, your 401, your TFSA, your Roth etc.

For a long time I just held 80%+ of SPY/SPXL/QQQ/TQQQ plus some fixed income. I do not believe that is necessarily the best approach moving forward and I will try and explain why. That being said, it is a fact that holding SPY you are virtually guaranteed to make money over the long run (10+ years) so keep that in mind as well. This is for those of us who take a more active approach to portfolio management, if you are more comfortable and want a set it and forget it, you really can’t go wrong with all SPY.

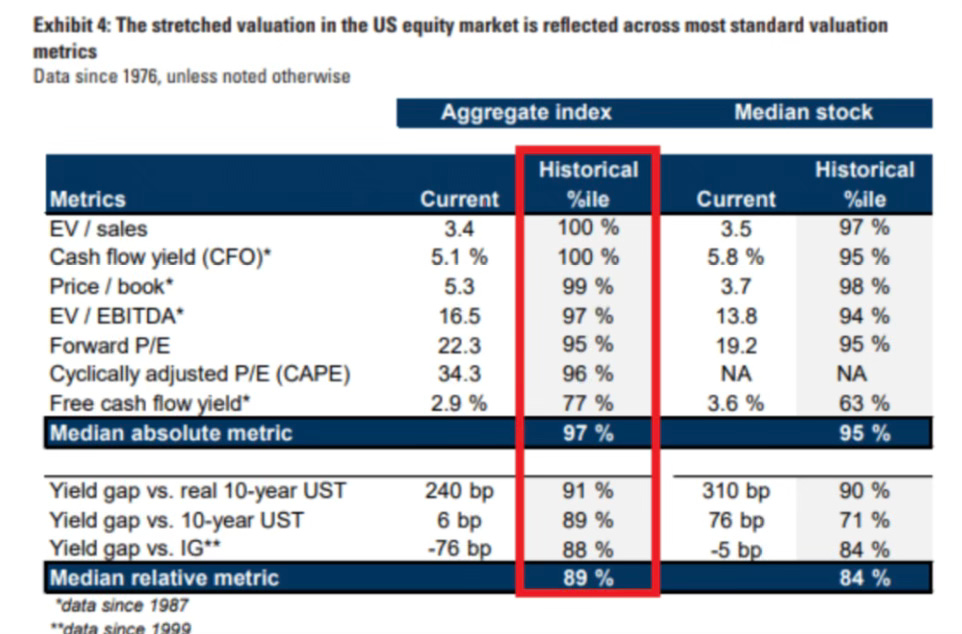

Let me begin with the most important thing. The genesis for this article. Valuations. This ain’t your grandfathers stock market. When historical valuations are this high, it does offer the motive and incentive to be a little more creative. History has shown that buying at rich valuations have led to poor returns in the medium and long term unequivocally. If for example, historically valuations were <20% across the board, I would say just buy the index with leverage because everything will go up together indiscriminately. I think in today’s case you aren’t afforded that easy way out. Things are fragile.

GS forecasts a pitiful 3%/yearly baseline return for the next 10 years. It’s basically 0 when accounting for inflation. While this is only a forecast, there are many historical precedents for this, and it is an evidence based thesis. We only need to look at a couple decades ago where SPY was roughly flat for 10 years post the dot-com bubble collapse. This time might be different, genuinely, but most likely not.

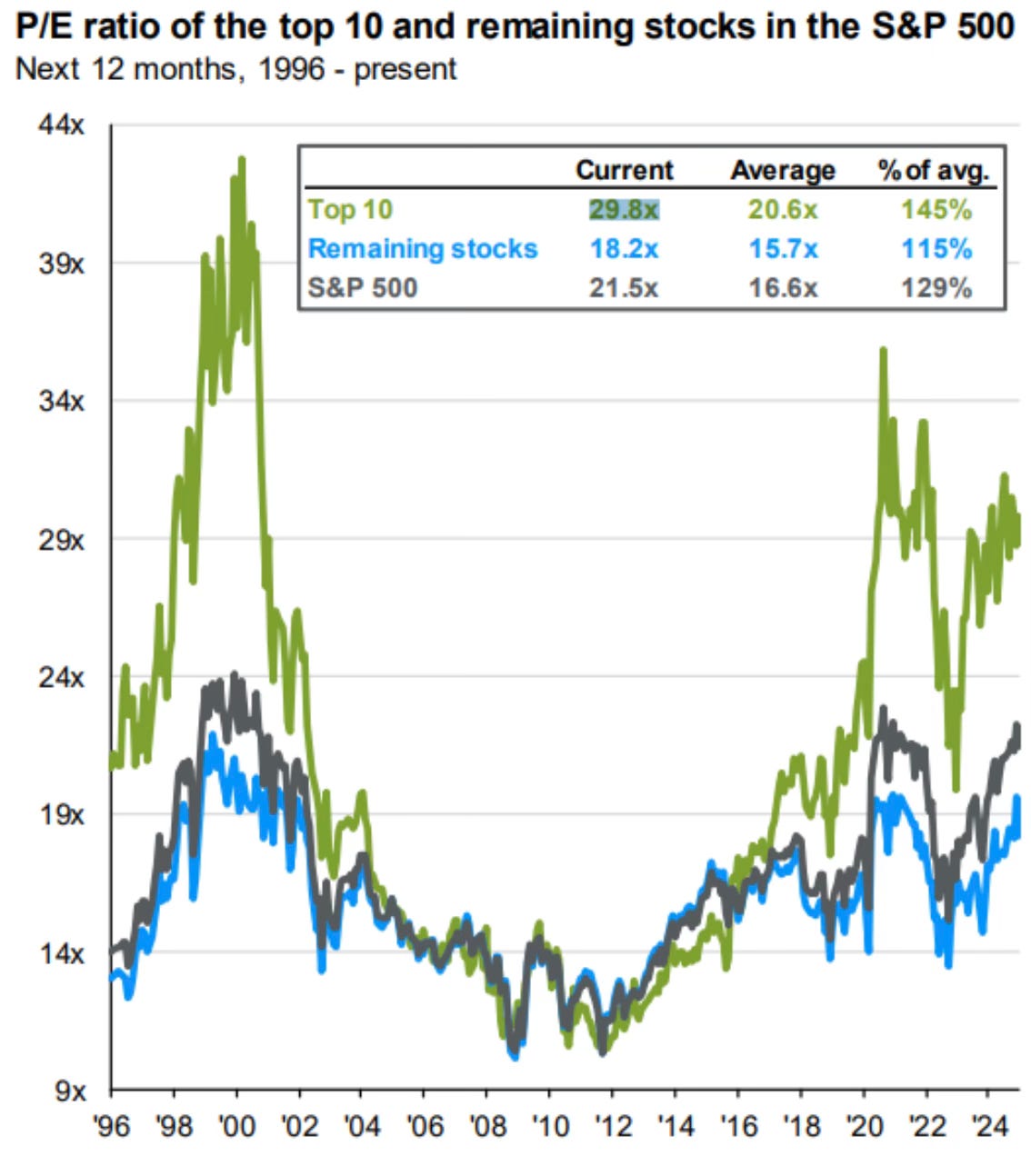

Here’s where it gets interesting though. The 22x PE of the SPX is extremely rich. But if you look beneath the surface, it’s only a handful of stocks that are touching 30x that are dragging up the overall average. The remaining stocks, although still rich in P/E terms, is quite reasonable. When accounting for macro factors, US exceptionalism, TINA and other factors. PE’s have also trended higher since the GFC. Something to keep in mind.

We also know that historically Mid-caps have actually outperformed the S&P. I was surprised to learn this. You are actually better off buying the S&P 400 than the S&P 500. It’s been that way for decades. Why does everyone buy the 500? I have no clue.

I think these charts really illustrate two things.

Stocks are extremely expensive

Stocks are reasonably priced

It’s a tale of two stock markets. Put simply, there are two halves of the SPX. The top 10 and everyone else. The top 10 trades at a rich valuation, and the 490 is rather reasonable. I think if you own the 500 or just the top 10, you are whistling by the graveyard. To be clear I am not bearish. I do think you are on borrowed time however. The top 10 stocks can go on for another year, two years and scream higher, absolutely. Long term however because of the insane valuations they will eventually experience a horrible prolonger period of margin compression, similar to 2001.

I am not recommending your SPY or your Mag 7, just wanted to share what I know and what I am thinking of. I know what you guys are thinking, “50ptMAE, are you stupid? there is no way anyone will stop using Google, or Instagram, or NVDA chips. These companies are not going anywhere”

To that I would just say, the only constant is change.

Everything people are now saying about Mag 7, they said about General Electric, Exxon Mobil, Pfizer etc. You get the picture.

At the end of the day, after all these charts and information I shared I wanted to end with some actionable ideas. Not just bore you with a bunch of text. I think you have 2 options here.

Remain invested in SPY/QQQ/Mag 7 names. This is the very familiar high risk/high reward choice. Gun to my head this bubble blows a bit bigger and we do 7200-7400 SPX by the end of the year.

The more conservative option here, especially targeted towards folks who have already built a bit of wealth. Is be one of the first ones to exit. I almost never recommend people selling their stocks. I wont do that here. I think there is a very solid case to be made to sell out of large caps however and buy the madcaps (MDY or IJH). I think the stage is set for continued CAGR of around 10% over the next decade, while on the large cap side I am not as optimistic. However that is not a forecast for next year, you could see the S&P 500 do another 20% next year, than a -30% year after that. It wont be so smoothed out. Whereas Mid-caps I believe are much less susceptible to such volatility.

Option 1 could be a very simple/classic 100% SPY portfolio. I think its setup for more boom or bust action where you might see another +30% or -30% year in the near future, although I think it more likely to see another +30% for 2025.

Option 2 I think you will see 5-15% yearly pretty consistently without any big down years. CAGR smoothed out in the next decade I expect to be in line with the historical 11%.

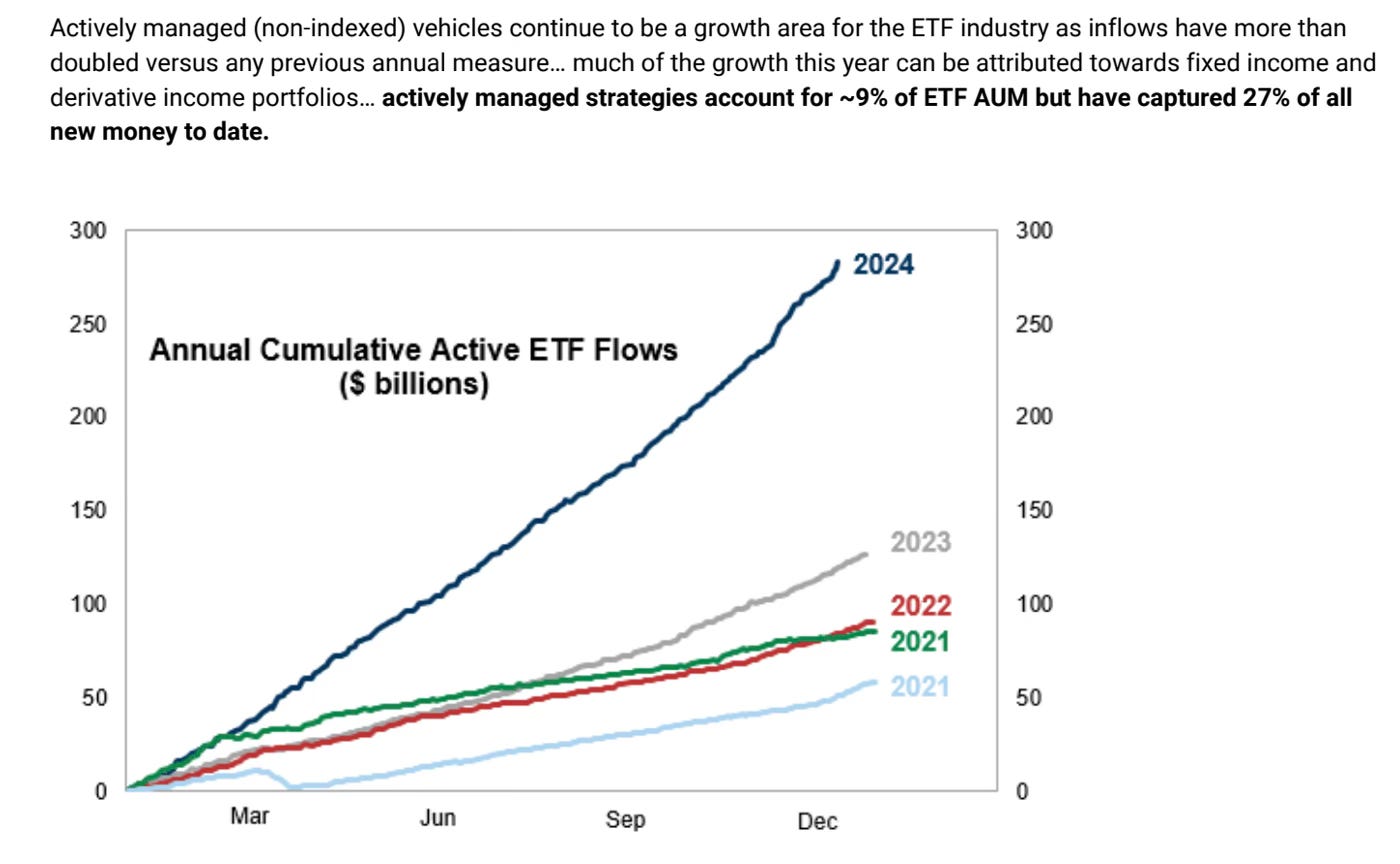

I also really like bonds/fixed income here, particularly non rate sensitive products like floating rate instruments, or inflation protected bonds (TIPS). I generally like BofAs prudent yield strategy which is a blend of different bond products that diversify your risks and mitigates exposure to Fed rate cycles.

That’s all for me folks, I thought I would share my thoughts on the elephant in the room, the absurd valuations of the S&P 500 and how one might navigate that without selling your stocks. You have options. You can choose to reduce your exposure to risk (and equally the reward) if you so choose. Lastly, there are many parts of the market that are quite fairly priced.

"madcaps" :- ) thanks for extra write-up, very helpful insights