Let’s start with a slight recap of last week. All quotes are ESH23.

Markets continued their 3 week balance between 3800 and 3920. We started off the week with FOMC minutes on Wednesday. Unlikely to surprise many as Powell’s hawkish stance hasn’t changed since Jackson Hole, with the main takeaway being the Fed’s dependency on the data. FOMC is usually well hedged and because of that rarely causes big market moves. No surprises there, and the market continued its 3 week balance. Then came the low unemployment claims and big JOLT number, which caused the market to sell down from 3890 area post FOMC-minutes, down to 3820 pre-NFP. 3820 has been strong support the past couple of weeks, but ultimately you might as well treat big data releases like a random number generator. As a big enough number would have caused the market to fall, and you have no predictive power or edge in knowing what it will be. The big binary events like CPI/NFP you should NOT have a position on. That’s gambling. There’s no edge. But it doesn’t mean you have to miss the big move. ES still traded a full 100 points AFTER the NFP print. When there are that many points available it’s foolish to gambling on the slot machine number that drops 8:30AM. In the end the market showed no interest in auctioning below 3800/3820 and we squeezed up as all the put hedges decayed and dealers had to buy back their delta 1 short futures hedges once their sold options decayed to 0 over the day.

Image A: Mid December onwards the S&P has been building a base at around 3800.

I use some very basic technical indicators to provide a big picture view of the markets, with 8EMA and 21EMA has short term signals of strength in the market. We are trading in the middle of the range here with, keltner channels singling spots where I would take profit, not necessarily take a counter trend position but be extra cautious. I think we have room up to 4000 ES this week, and I am going with a bullish bias. I think there is about an 80% chance we end the week green here but not necessarily in a straight line.

Monday: Markets like to balance before big events. Powell is speaking at a conference hosted by Riksbank in Stockholm.

Image B: Federal Reserve schedule with Powell on 9am Tuesday.

Powell can move markets like no one else. Big money and experienced traders know this. So as always watch for a slight risk off an hedging take place. 3918.75 was the big high on Dec 22, before the hot GDP print (which signaled to markets the FED was nowhere close to pausing rate hikes) that was just broken in Friday RTH. We just touched 3930 in ETH during the Asia session Sunday January 9. I think bulls need to close the IB (initial balance 930-1030AM in NY session) above this 3920 level to test 3950/3960. Failure to to do means we likely retrace to 3850ish to find more buyers. I would avoid taking big bets before Powell speaks unless the price was just too appealing to do so. I would take longs around that 3850 but would not chase here at 3920 as I believe the risk of sentiment with Powell on in 1 day will cap the potential upside. Remember this is a game of probabilities and the risk/reward needs to make sense to take a trade.

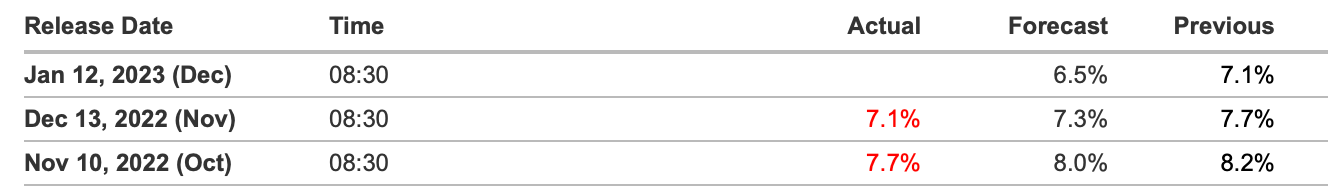

Thursday: The always anticipated CPI report. Last 2 prints came in below expectations causing huge moves in ES both times.

Image C: CPI results of the last 2 months.

On both occasions SPX moved 200+ pts in the days leading up to the print and including on the day itself. Absolutely massive moves that made/lost some people lots of money. Which is why it’s so important to position properly for it. I have a definite BULLISH bias heading into the print as the front runners want to get in front of another declining print. As mentioned earlier the 3850 area pre Powell would be a great spot to initiate a long if you aren’t long already, and I would hold it all the way through pre CPI. Ideally long calls or call spreads as there is likely a chance VIX creeps up heading into the event.

Image D: Vix gains 12.16% in the 3 days leading up to the Dec CPI print.

A call option here would appreciate in price through the spot moving up here, as well as increased volatility. I like Feb 17 SPX 4000 calls here.

If you have been paying attention, I highly recommended not holding ANY positions through what the random number generator decides to provide us. The print is impossible to guess. Trading is about developing a PROCESS and SYSTEM. It’s not about guessing which number the BLS pulls out of its hat on the particular day of CPI. So I recommend going flat at 8:29.

If 4000 ES is reached before the CPI print, I would close up shop on all longs and take the entire weekend off. Just like you get tilted after a big loss, a big win does the same. A 3-4 day weekend allows you to “digest” the win and recalibrate for the next week without getting too euphoric over a win, which can be as damaging as major tilt.

4000 is also major resistance with a confluence of major resistances. The 200DMA is around this price, as well as the 38.2% Fib retracement of the Jan 2022 highs to the Oct 2022 lows, as well as the top of the Keltner channel. You don’t need to squeeze every last bit of juice out of every move, in fact chasing the last points of each swing likely will murder your account in the long run.

To recap im looking for a long around 3850 with SPX 4000 calls and to TP around 4000. I recommend no CPI position. The easy points will be in the front run. As well as 1/20/23 quarterly OPEX having a large amount of expiring puts, which as time decays contribute to the bullish flows supporting the market.

That sums up this week. Drop me a comment about anything below or Twitter and good luck trading!