Hopefully this helps some of my newer readers understand more about my trading processes, terminology I use, and preferred brokerages.

Important terms

IB - Initial Balance. 9:30-10:30 AM New York Time. This is the 2nd highest volume period of the trading session (behind the close) but crucial because it comes after the European and Asian sessions. So price during this session confirms or denies what transpired in the other sessions generally. Waiting for price to be accepted or rejected in this time frame allows you to have a better grasp of what the market is deeming to be fair prices, and to avoid being shaken out by liquidity grabs and stop runs.

NY close - 3-4PM NY time.

Euro open - 3AM NY time.

ES - S&P e mini futures contracts. You can use MES interchangeably. I think generally most brokers have too LOW of a margin requirement. This gets you to overtrade/oversize/overleverage and blow your account. I personally recommend ~30% of the CME required margin. So I would recommend at least $4000 USD to trade one ES. $400 to trade one MES. I think if you fail to maintain that amount of margin, the daily meaningless gyrations of the market will stop you out of otherwise winning positions.

My preferred brokers

Futures - I use AMP Futures. The commissions are very low, and to be honest not much else matters. To buy/sell 1 MES the fee is 0.60. For ES it is 2.00. Round trip is 1.20/4.00 respectively. For the data I use Rithmic which is 25.00 USD/month.

https://www.ampfutures.com

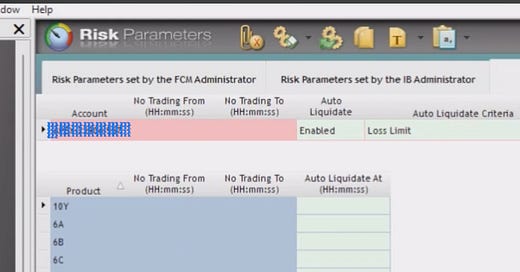

Trading Software - I use Rithmic R trader Pro. I will not use anything but this as I consider this the only option. The reason is simple, you can implement a server side daily stop loss. Discovering this platform was one of the best days of my life. No exaggeration. You can set your Auto Liquidate threshold to whatever amount you want, in $ or in % terms. I personally use 2%. Obviously if you are starting with a lower amount of capital, that is not a realistic number. I would recommend 2% if your account is greater than $100,000 USD. If its smaller, then use a larger % loss or use a flat dollar amount.

No matter what happens, you can never lose more than X% of your account in one day. It completely eliminates the left tail in your futures trading. That is priceless. If you hit your daily max loss of 2% 5 days in a row, you would be down 9.61%. Then the weekend hits. So your worst loss in a 7 day week would be 9.61%. I have found the main ingredient in recovering from a bad trading stretch is time. If the worst damage you can do to yourself is 9.61% over a week, that dramatically increases your chance of succeeding, in my humble opinion. Rtrader pro also has many very handy parameters such as No trading from X time to Y time. So if you break down your trading performance, say you discover that from 11:30AM to 1:00PM your win rate is 22%. Now you can completely prevent yourself from trading those times by entering it into the risk parameters. I cannot emphasize enough how much this platform has helped me. It took some of my major weaknesses (overtrading, over leveraging, and trading during off-peak hours) completely out of the equation. Don’t rely on solely will power, it will fail you when you need it the most. There are so many things that can go wrong in trading, mostly its user error and bad decisions. But I have taken huge losses fat fingering (entering 50 ES lots when I wanted to do 5), trading while ill, and technical disruptions. Imagine the internet going out, or you spill a cup of coffee over your laptop while you are badly positioned. You must have a safeguard. You can be profitable every single day of the year, then on the last day lose everything with one fat finger. Even if the risk is 0.00001% of something like that happening, it is too high for me.

In live trade alerts that I give out, I will frequently use stops predicated on price upon IB or NY close. For example, I may say long 5001 ES, stop a close below 5000 IB/NY close. That does not mean if the market drops 100 pts intraday I am taking all that heat. If I hit my daily 2% stop loss, I get stopped out. I generally size my futures trades so that I can take a 20pt drawdown intraday without hitting my 2% stop. 20 points on MES is only $100, so if you can’t take 20 points of heat you are likely way over leveraged.

Lastly, the 2% daily stop is a MAXIMUM LOSS. I frequently take small losses well before that limit is hit and I often go many weeks without hitting it even once. It’s there to protect you in the worst case scenario. On the flip side, there is no limit to the upside gains. On a good day, I will gain 5-10% on my futures account. Once the day rolls over, you would have to get hit on your daily max loss for multiple days/weeks in a row to give back those winnings. Remember many traders hit big winners, just to give it all back and more. Often on the exact same day or shortly after! This stop loss curtails small losses before they become big, but still allow for large gains. It also makes it much more difficult to give back gains. Say I have a $100,000 account and I have a huge day and make $10,000. My balance is now $110,000. It would take 5 days, or 120 hours to lose that $10,000 you just made assuming a 2% daily loss limit. That’s alot of time I think, to pull yourself out of a potential rut. It slows down the game when you are struggling. You can make 5%-10% in a day quite easily, you can only lose 2% max. Asymmetry to the upside.

Options/FX/Stocks - I use Interactive Brokers. First off, I love the interface, especially the spread builder which I use frequently for SPX options.

Second, the FX trader is great for both spot FX and currency conversion. You can hold currency in USD, CAD, EUR, GBP whatever you like. There is no fee for converting FX other than a small transaction cost, many brokers charge 1.5%+. You can also buy treasuries on IBKR and use them as collateral which is very useful. This is also my preferred platform for FX trades, and it uses a standard 20:1 leverage. There are alot of platforms that offer 50x or 100x leverage in FX, and that is precisely why you should not use them. Small meaningless moves in the market will completely wipe you out. Especially in FX when big trades occur from price-indiscriminate market participants who need to transact purely because of business needs. For example an exporter in China needs to sell USD to pay domestic workers in CNH. They are selling XXX amount because they need to, not as a trade.

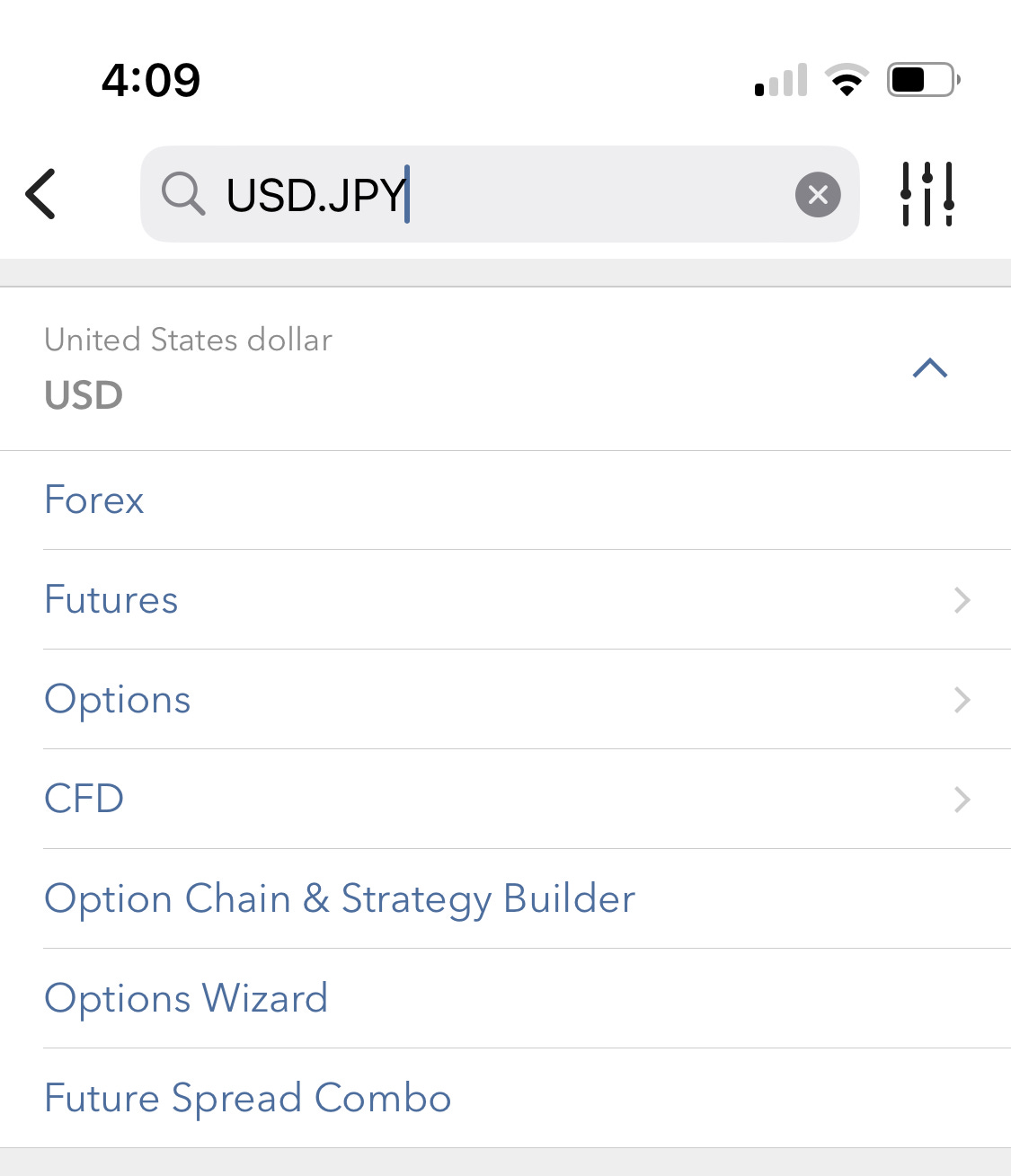

To find the right “ticker” for FX, you type it in like this. For USDJPY, type in USD.JPY and IBKR will pull up the right ticker. You would then click the 1st option, named “Forex”.

In FX, there alot of shady brokers offering insane leverage, platforms with horrible spreads, CFDs that dont track the real price well and things of that nature. There also is no centralized market so for transparency and to make it easier to follow my trades, this is what I use specifically.

Shameless plug: If you are planning to use this after doing your research on different brokers, here is my referral link. We both get some free money out of it (Up to $1000 depending on how much you deposit).

https://ibkr.com/referral/frank166